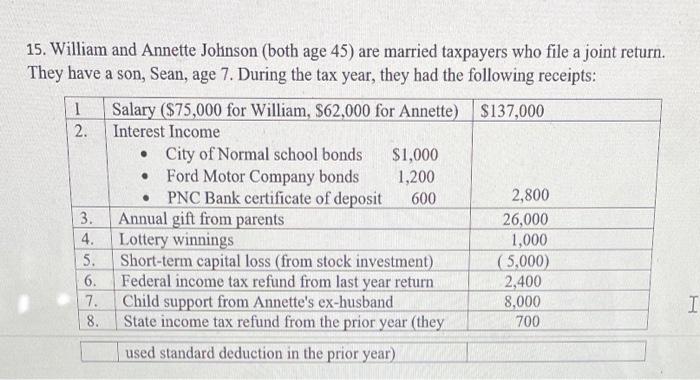

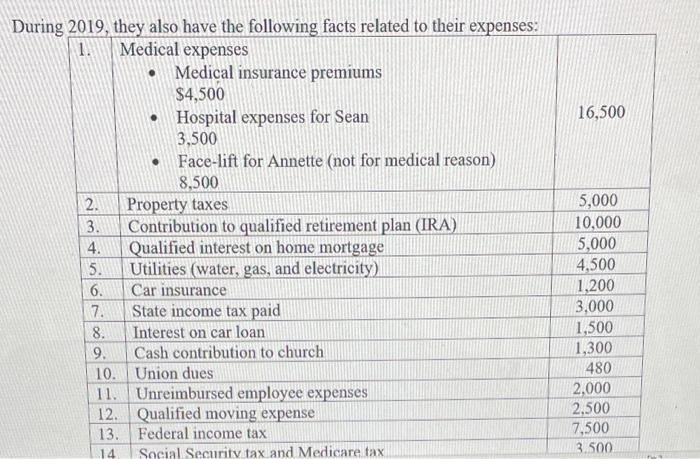

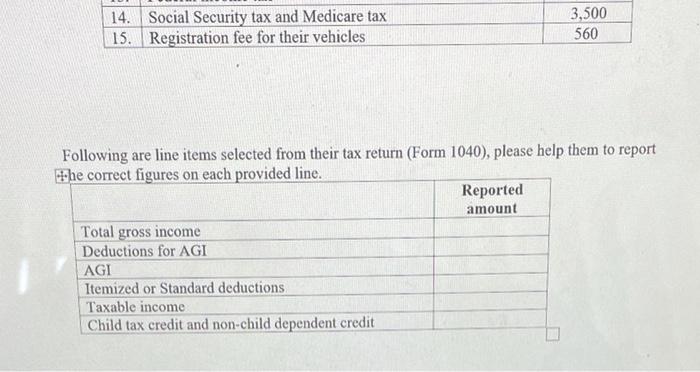

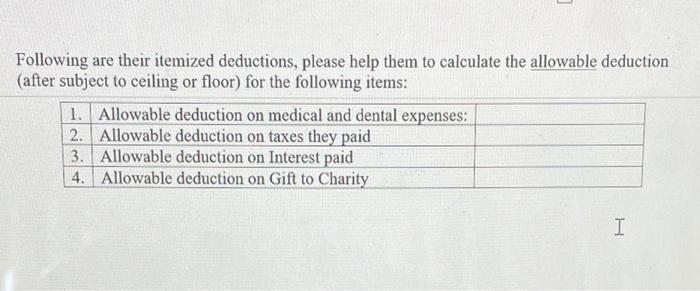

15. William and Annette Johnson (both age 45) are married taxpayers who file a joint return. They have a son, Sean, age 7. During the tax year, they had the following receipts: 1 Salary ($75,000 for William, $62,000 for Annette) $137,000 2. Interest Income City of Normal school bonds $1,000 Ford Motor Company bonds 1,200 PNC Bank certificate of deposit 600 2,800 3. Annual gift from parents 26,000 4. Lottery winnings 1,000 5. Short-term capital loss (from stock investment) (5,000) 6. Federal income tax refund from last year return 2,400 7. Child support from Annette's ex-husband 8,000 8. State income tax refund from the prior year (they 700 used standard deduction in the prior year) I 16,500 During 2019, they also have the following facts related to their expenses: 1. Medical expenses Medical insurance premiums $4,500 Hospital expenses for Sean 3,500 Face-lift for Annette (not for medical reason) 8,500 2. Property taxes 3. Contribution to qualified retirement plan (IRA) 4. Qualified interest on home mortgage 5. Utilities (water, gas, and electricity) 6. Car insurance 7. State income tax paid 8. Interest on car loan 9. Cash contribution to church 10. Union dues 11. Unreimbursed employee expenses 12. Qualified moving expense 13. Federal income tax Social Security tax and Medicare tax 5,000 10,000 5,000 4,500 1,200 3,000 1,500 1,300 480 2,000 2.500 7,500 3.500 14 14. Social Security tax and Medicare tax 15. Registration fee for their vehicles 3,500 560 Following are line items selected from their tax return (Form 1040), please help them to report the correct figures on each provided line. Reported amount Total gross income Deductions for AGI AGI Itemized or Standard deductions Taxable income Child tax credit and non-child dependent credit Following are their itemized deductions, please help them to calculate the allowable deduction (after subject to ceiling or floor) for the following items: 1. Allowable deduction on medical and dental expenses: 2. Allowable deduction on taxes they paid 3. Allowable deduction on Interest paid 4. Allowable deduction on Gift to Charity