Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with computation plss Problem: Hanna and Becky entered into a partnership on March 1, 2017, investing P125,000.00 and P75,000.00 respectively. It was agreed that Hanna,

with computation plss

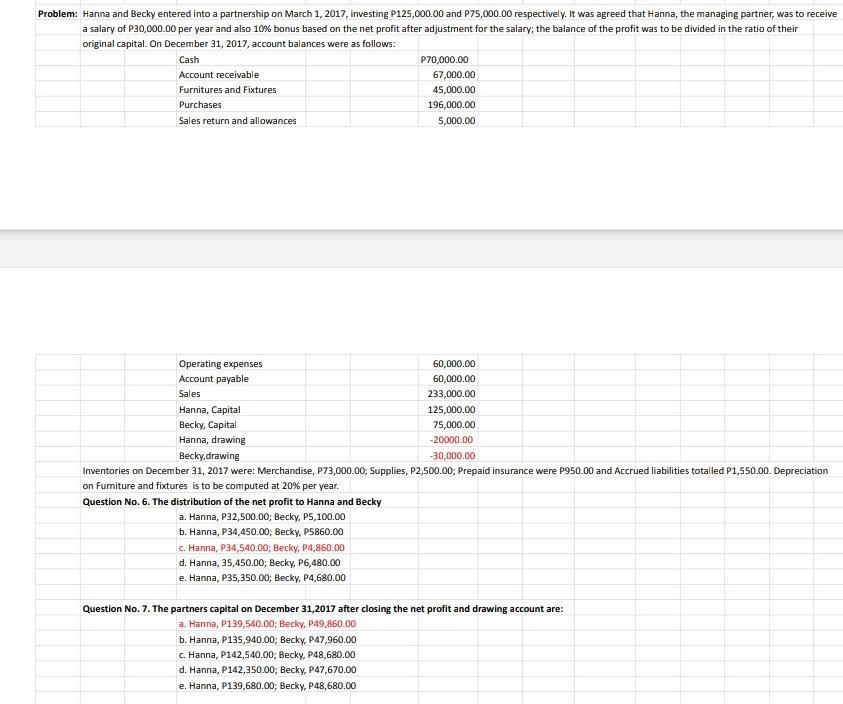

Problem: Hanna and Becky entered into a partnership on March 1, 2017, investing P125,000.00 and P75,000.00 respectively. It was agreed that Hanna, the managing partner, was to receive a salary of P30,000.00 per year and also 10% bonus based on the net profit after adjustment for the salary; the balance of the profit was to be divided in the ratio of their original capital. On December 31, 2017, account balances were as follows: Cash P70,000.00 Account receivable 67,000.00 Furnitures and Fixtures 45,000.00 Purchases 196,000.00 Sales return and allowances 5,000.00 Operating expenses 60,000.00 Account payable 60,000.00 Sales 233,000.00 Hanna, Capital 125,000.00 Becky, Capital 75,000.00 Hanna, drawing -20000.00 Becky,drawing -30,000.00 Inventories on December 31, 2017 were: Merchandise, P73,000.00; Supplies, P2,500.00; Prepaid insurance were P950.00 and Accrued liabilities totalled P1,550.00. Depreciation on Furniture and fixtures is to be computed at 20% per year. Question No. 6. The distribution of the net profit to Hanna and Becky a. Hanna, P32,500.00; Becky, PS,100.00 b. Hanna, P34,450.00; Becky, P5860.00 c. Hanna, P34,540.00; Becky, P4,860.00 d. Hanna, 35,450.00; Becky, P6,480.00 e. Hanna, P35,350.00; Becky, P4,680.00 Question No. 7. The partners capital on December 31, 2017 after closing the net profit and drawing account are: a. Hanna, P139,540.00; Becky, P49,860.00 b. Hanna, P135,940.00; Becky, P47,960.00 C. Hanna, P142,540.00; Becky, P48,680.00 d. Hanna, P142,350.00; Becky, P47,670.00 e. Hanna, P139,680.00; Becky, P48,680.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started