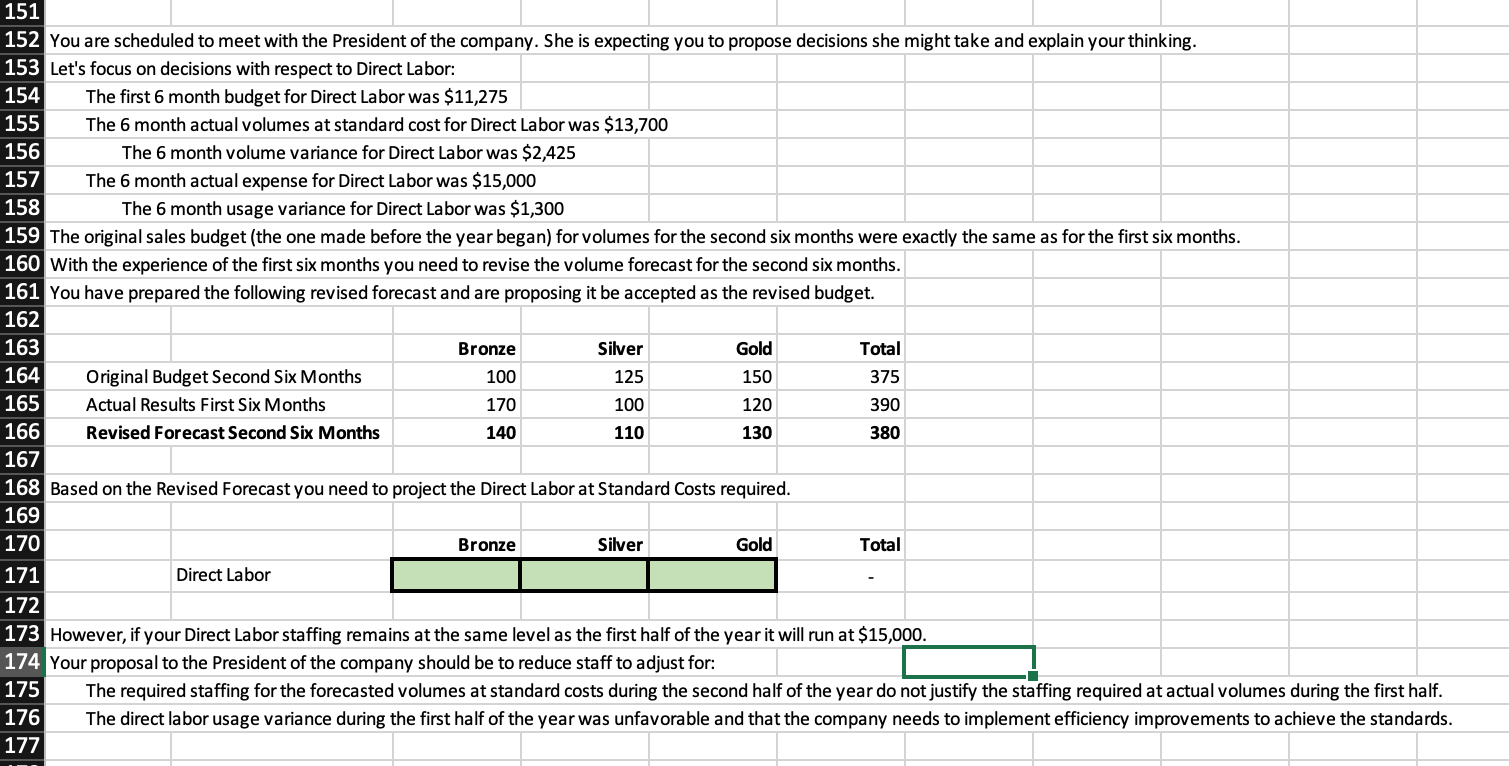

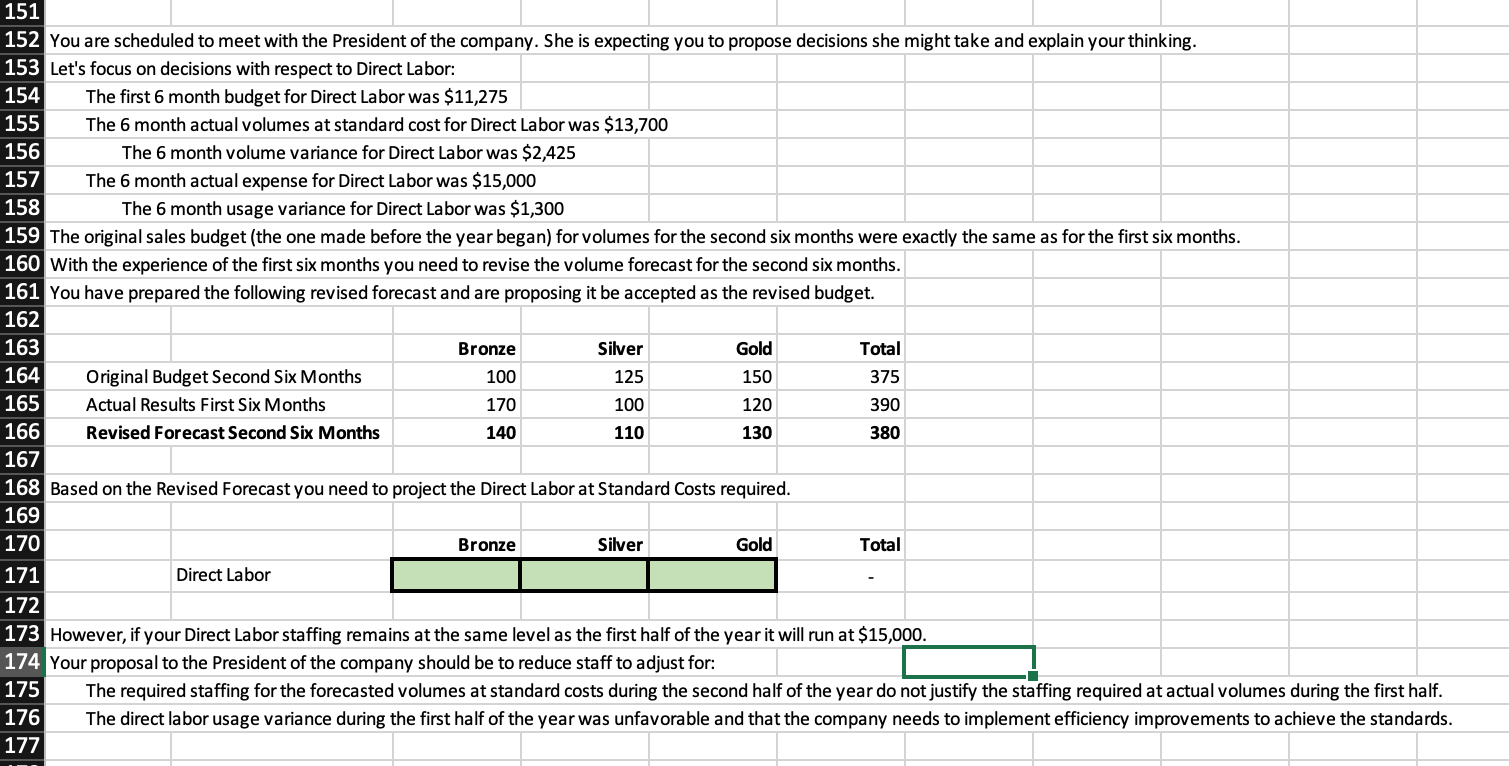

151 152 You are scheduled to meet with the President of the company. She is expecting you to propose decisions she might take and explain your thinking. 153 Let's focus on decisions with respect to Direct Labor: 154 The first 6 month budget for Direct Labor was $11,275 155 The 6 month actual volumes at standard cost for Direct Labor was $13,700 156 The 6 month volume variance for Direct Labor was $2,425 157 The 6 month actual expense for Direct Labor was $15,000 158 The 6 month usage variance for Direct Labor was $1,300 159 The original sales budget (the one made before the year began) for volumes for the second six months were exactly the same as for the first six months. 160 With the experience of the first six months you need to revise the volume forecast for the second six months. 161 You have prepared the following revised forecast and are proposing it be accepted as the revised budget. 162 163 Bronze Silver Gold Total 100 125 150 375 164 Original Budget Second Six Months 165 Actual Results First Six Months 170 100 120 390 166 Revised Forecast Second Six Months 140 110 130 380 167 168 Based on the Revised Forecast you need to project the Direct Labor at Standard Costs required. 169 170 Bronze Silver Gold Total 171 Direct Labor 172 173 However, if your Direct Labor staffing remains at the same level as the first half of the year it will run at $15,000. 174 Your proposal to the President of the company should be to reduce staff to adjust for: 175 The required staffing for the forecasted volumes at standard costs during the second half of the year do not justify the staffing required at actual volumes during the first half. 176 The direct labor usage variance during the first half of the year was unfavorable and that the company needs to implement efficiency improvements to achieve the standards. 177 151 152 You are scheduled to meet with the President of the company. She is expecting you to propose decisions she might take and explain your thinking. 153 Let's focus on decisions with respect to Direct Labor: 154 The first 6 month budget for Direct Labor was $11,275 155 The 6 month actual volumes at standard cost for Direct Labor was $13,700 156 The 6 month volume variance for Direct Labor was $2,425 157 The 6 month actual expense for Direct Labor was $15,000 158 The 6 month usage variance for Direct Labor was $1,300 159 The original sales budget (the one made before the year began) for volumes for the second six months were exactly the same as for the first six months. 160 With the experience of the first six months you need to revise the volume forecast for the second six months. 161 You have prepared the following revised forecast and are proposing it be accepted as the revised budget. 162 163 Bronze Silver Gold Total 100 125 150 375 164 Original Budget Second Six Months 165 Actual Results First Six Months 170 100 120 390 166 Revised Forecast Second Six Months 140 110 130 380 167 168 Based on the Revised Forecast you need to project the Direct Labor at Standard Costs required. 169 170 Bronze Silver Gold Total 171 Direct Labor 172 173 However, if your Direct Labor staffing remains at the same level as the first half of the year it will run at $15,000. 174 Your proposal to the President of the company should be to reduce staff to adjust for: 175 The required staffing for the forecasted volumes at standard costs during the second half of the year do not justify the staffing required at actual volumes during the first half. 176 The direct labor usage variance during the first half of the year was unfavorable and that the company needs to implement efficiency improvements to achieve the standards. 177