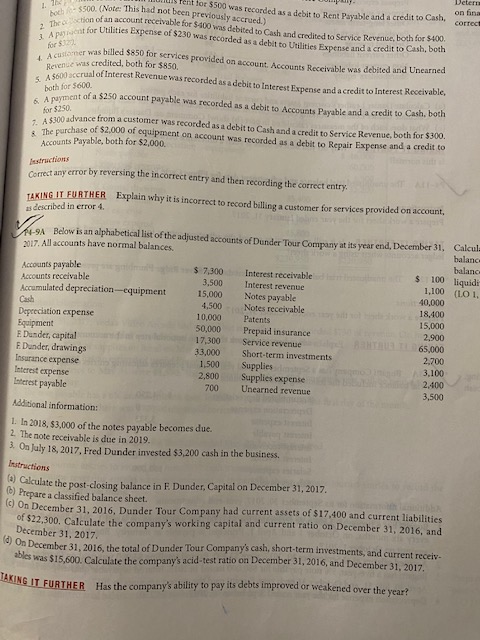

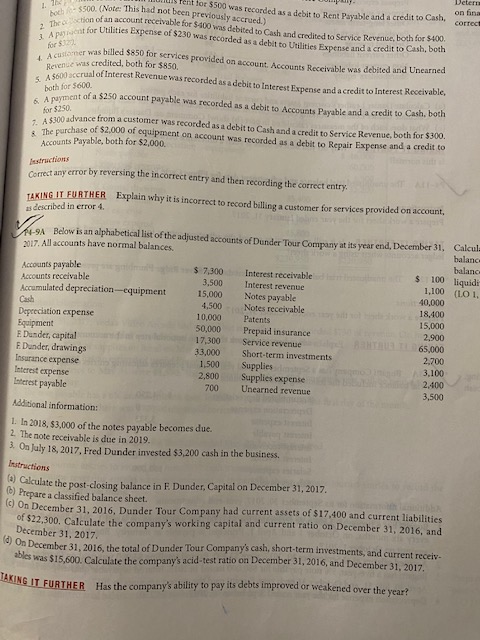

16 Stent for $500 was recorded as a debit to Bent Payable and a credit to Cash, 00. (Note: This has not been previously accrue) n ofan account receivable for $400 was dcbited to cash and died Service Revenue, both for $100 for Utilities Expense of $230 was recorded as a debito Utilities Expense and a credit to cash, both Detern on fina bo correst Theo Scion of an acca Apart for Utilities En 22 Acasamer was billed SRS was billed $850 for services provided on account Accounts Receivable was debited and Uncarnea Devenue was credited, both for $850 crual of Interest Revenue was recorded as a dcbit to interest T ense anda credit to Interest Receivable, both for $600 6 A payment of a $250. for $250. wment of a $250 account payable was recorded as a dcbit to Accounts Payable and a credit to Cash, both advance from a customer was recorded as a dcbit to Cash anda credit to Service Revenue, both for $300. the surchase of $2,000 ot equipment on account was recorded as a dehit to Repair Fxpense and a credit to Accounts Payable, both for $2.000 Instructions any error by reversing the incorrect entry and then recording the correct entry VING IT FURTHER Explain why it is incorrect to record billine a customer for services provided on account, is described in error 4. 1-94 Below is an alphabetical list of the adjusted accounts of Dunder Tour Company at its year end, December 31. Calcul 2017. All accounts have normal balances balanc Accounts payable balanc $ 7,300 Interest receivable $ 100 liquidi Accounts receivable 3.500 Interest revenue Accumulated depreciation-equipment 1,100 (1.01. 15.000 Notes payable 40,000 Cash 4,500 Notes receivable 18.400 Depreciation expense 10.000 Patents 15,000 Equipment 50,000 Prepaid insurance 2.900 E Dunder capital 17,300 Service revenue 65.000 33,000 Short-term investments 2.700 Insurance expense 1,500 Supplies 3.100 Teterest expense 2,800 Supplies expense 2,400 Laterest payable 700 Unearned revenue 3,500 Additional information: 1. In 2018, $3.000 of the notes payable becomes due. 2. The note receivable is due in 2019. 3. On July 18, 2017, Fred Dunder invested $3,200 cash in the business. Instructions a) Calculate the post-closing balance in E Dunder, Capital on December 31, 2017 6) Prepare a classified balance sheet. On December 31, 2016, Dunder Tour Company had current assets of $17,400 and current liabilities of $22,300. Calculate the company's working capital and current ratio on December 31, 2016. and December 31, 2017 On December 31 2016 the total of Dunder Tour Company's cash, short-term investments, and current receive les was $15.00 Calculate the company's acid-test ratio on December 31, 2016, and December 21 2017 NING IT FURTHER Has the commany's ability to pay its debts improved or weakened over the years