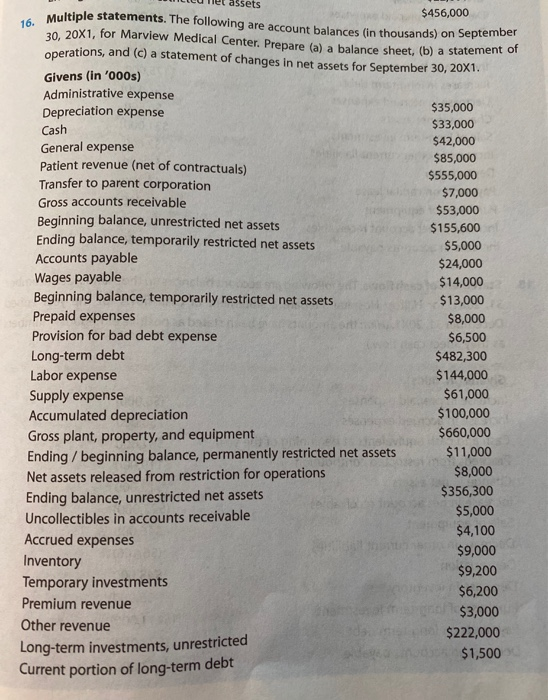

16) The following re account balances ('000) on 09/30. 20X1 for Marview Medical Center. Prepare (a) a balance sheet, (b) a statement of operations, and (c) a statement of changes in net assets for 09 30, 20X1

GIVENs (in '000)

Administrative expense $35,000

Depreciation expense $33,000

Cash $42,000

General expense $85,000

Patient revenues (net of contractual) $555,000

Transfer to parent corporation $7,000

Gross accounts receivable $53,000

Beginning balance, unrestricted net assets $155,600

Ending balance, temporarily restricted net assets $5,000

Accounts payable $24,000

Wages payable $14,000

Beginning balance, temporarily restricted net assets $13,000

Prepaid expenses $8,000

Provision for bad debt expense $6,500

Long-term debt $482,300

Labor expense $144,000

Supply expense $61,000

Accumulated depreciation $100,000

Gross plant, property, and equipment $660,000

Ending / beginning balance, permanently restricted net assets $11,000

Net assets released from restriction for operations $8,000

Ending balance, unrestricted net assets $356,300

Uncollectibles in accounts receivable $5,000

Accrued expense $4,100

Inventory $9,000

Temporary investments $9,200

Premium revenues $6,200

Other revenues $3,000

Long-term investments, unrestricted $222,000

Current portion of long-term debt $1,500

sets 16. Multiple statements. The following are account balances (in thousands) on September $456,000 30, 20X1, for Marview Medical Center. Prepare (a) a balance sheet, (b) a statement of operations, and (c) a statement of changes in net assets for September 30, 20X1. Givens (in '000s) Administrative expense Depreciation expense $35,000 Cash $33,000 General expense $42,000 $85,000 Patient revenue (net of contractuals) $555,000 Transfer to parent corporation $7,000 Gross accounts receivable $53,000 Beginning balance, unrestricted net assets $155,600 Ending balance, temporarily restricted net assets $5,000 Accounts payable $24,000 Wages payable $14,000 Beginning balance, temporarily restricted net assets $13,000 Prepaid expenses $8,000 Provision for bad debt expense $6,500 Long-term debt $482,300 Labor expense $144,000 Supply expense $61,000 Accumulated depreciation $100,000 Gross plant, property, and equipment $660,000 Ending/beginning balance, permanently restricted net assets $11,000 Net assets released from restriction for operations $8,000 $356,300 Ending balance, unrestricted net assets $5,000 Uncollectibles in accounts receivable $4,100 Accrued expenses $9,000 Inventory $9,200 Temporary investments $6,200 Premium revenue $3,000 Other revenue $222,000 Long-term investments, unrestricted $1,500 Current portion of long-term debt sets 16. Multiple statements. The following are account balances (in thousands) on September $456,000 30, 20X1, for Marview Medical Center. Prepare (a) a balance sheet, (b) a statement of operations, and (c) a statement of changes in net assets for September 30, 20X1. Givens (in '000s) Administrative expense Depreciation expense $35,000 Cash $33,000 General expense $42,000 $85,000 Patient revenue (net of contractuals) $555,000 Transfer to parent corporation $7,000 Gross accounts receivable $53,000 Beginning balance, unrestricted net assets $155,600 Ending balance, temporarily restricted net assets $5,000 Accounts payable $24,000 Wages payable $14,000 Beginning balance, temporarily restricted net assets $13,000 Prepaid expenses $8,000 Provision for bad debt expense $6,500 Long-term debt $482,300 Labor expense $144,000 Supply expense $61,000 Accumulated depreciation $100,000 Gross plant, property, and equipment $660,000 Ending/beginning balance, permanently restricted net assets $11,000 Net assets released from restriction for operations $8,000 $356,300 Ending balance, unrestricted net assets $5,000 Uncollectibles in accounts receivable $4,100 Accrued expenses $9,000 Inventory $9,200 Temporary investments $6,200 Premium revenue $3,000 Other revenue $222,000 Long-term investments, unrestricted $1,500 Current portion of long-term debt