Answered step by step

Verified Expert Solution

Question

1 Approved Answer

18 9 points 8 02:16:39 After planning to build a new plant, Kallisto Backpack Manufacturing purchased a large lot on which a small building was

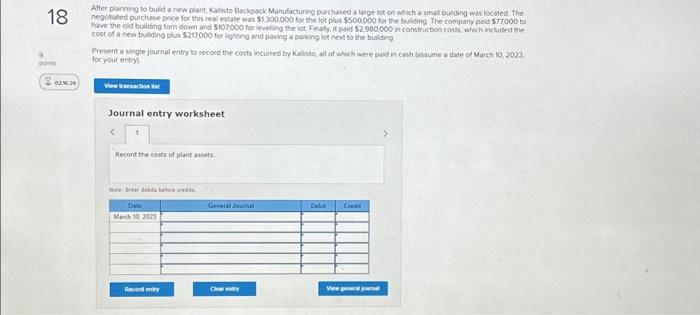

18 9 points 8 02:16:39 After planning to build a new plant, Kallisto Backpack Manufacturing purchased a large lot on which a small building was located. The negotiated purchase price for this real estate was $1,300,000 for the lot plus $500,000 for the building. The company paid $77,000 to have the old building torn down and $107,000 for levelling the lot. Finally, it paid $2,980,000 in construction costs, which included the cost of a new building plus $217,000 for lighting and paving a parking lot next to the building. Present a single journal entry to record the costs incurred by Kallisto, all of which were paid in cash (assume a date of March 10, 2023, for your entry) View transaction list Journal entry worksheet 1 Record the costs of plant assets. Note: Enter debits before credits. Date March 10, 2023 Record entry General Journal Clear entry Debit Credit View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started