Answered step by step

Verified Expert Solution

Question

1 Approved Answer

18.) In 2022 Jenna (age 15 ) received $3,000 of interest income from a corporate bond that she owns. In addition, she has earned income

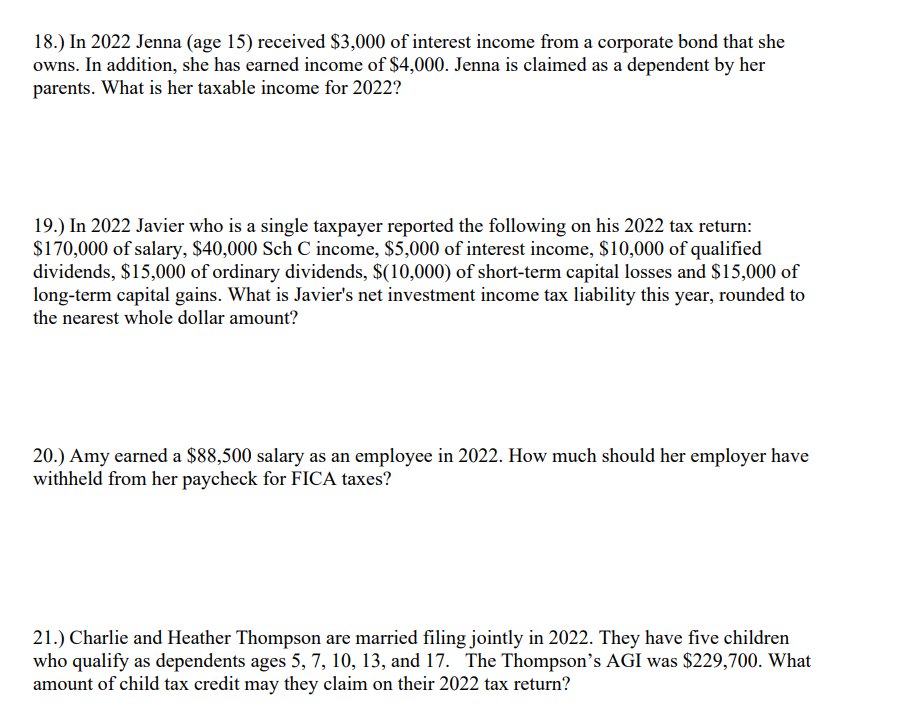

18.) In 2022 Jenna (age 15 ) received $3,000 of interest income from a corporate bond that she owns. In addition, she has earned income of $4,000. Jenna is claimed as a dependent by her parents. What is her taxable income for 2022 ? 19.) In 2022 Javier who is a single taxpayer reported the following on his 2022 tax return: $170,000 of salary, $40,000SchC income, $5,000 of interest income, $10,000 of qualified dividends, $15,000 of ordinary dividends, $(10,000) of short-term capital losses and $15,000 of long-term capital gains. What is Javier's net investment income tax liability this year, rounded to the nearest whole dollar amount? 20.) Amy earned a $88,500 salary as an employee in 2022 . How much should her employer have withheld from her paycheck for FICA taxes? 21.) Charlie and Heather Thompson are married filing jointly in 2022. They have five children who qualify as dependents ages 5,7,10,13, and 17 . The Thompson's AGI was $229,700. What amount of child tax credit may they claim on their 2022 tax return

18.) In 2022 Jenna (age 15 ) received $3,000 of interest income from a corporate bond that she owns. In addition, she has earned income of $4,000. Jenna is claimed as a dependent by her parents. What is her taxable income for 2022 ? 19.) In 2022 Javier who is a single taxpayer reported the following on his 2022 tax return: $170,000 of salary, $40,000SchC income, $5,000 of interest income, $10,000 of qualified dividends, $15,000 of ordinary dividends, $(10,000) of short-term capital losses and $15,000 of long-term capital gains. What is Javier's net investment income tax liability this year, rounded to the nearest whole dollar amount? 20.) Amy earned a $88,500 salary as an employee in 2022 . How much should her employer have withheld from her paycheck for FICA taxes? 21.) Charlie and Heather Thompson are married filing jointly in 2022. They have five children who qualify as dependents ages 5,7,10,13, and 17 . The Thompson's AGI was $229,700. What amount of child tax credit may they claim on their 2022 tax return Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started