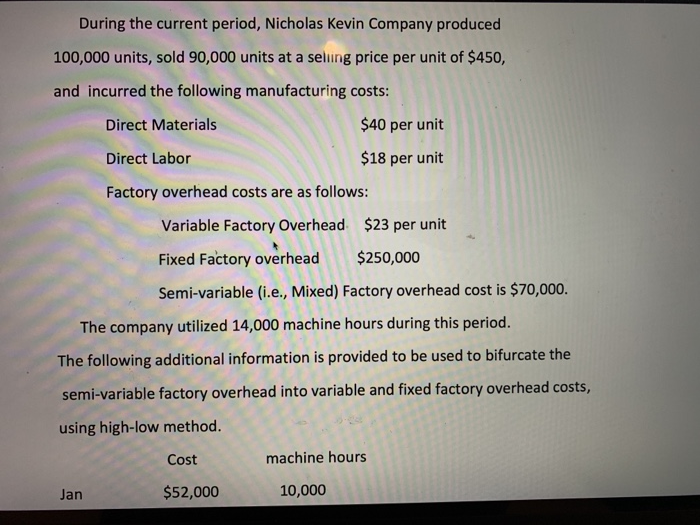

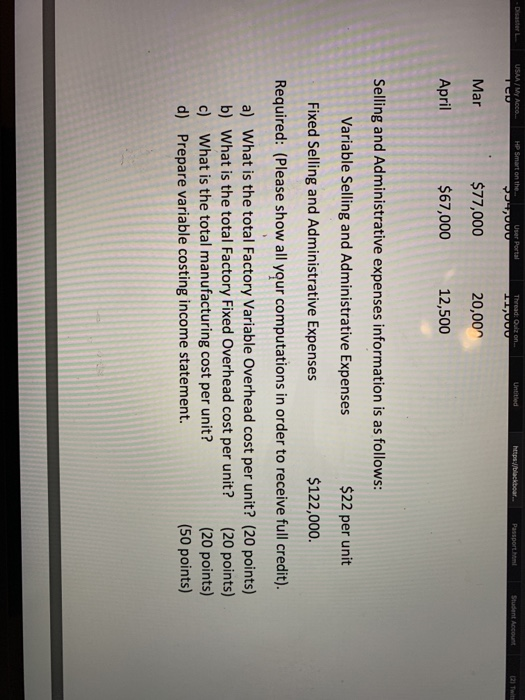

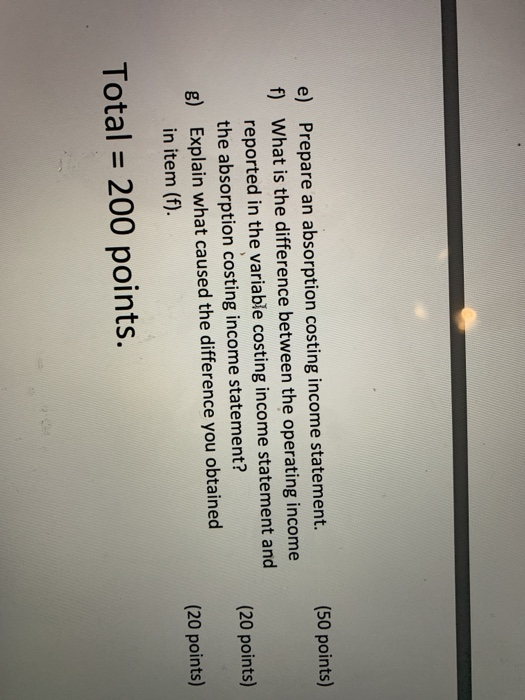

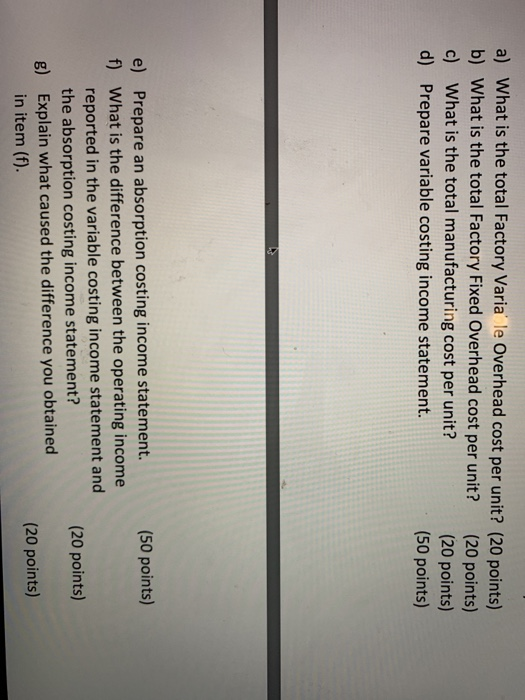

During the current period, Nicholas Kevin Company produced 100,000 units, sold 90,000 units at a selling price per unit of $450, and incurred the following manufacturing costs: Direct Materials $40 per unit Direct Labor $18 per unit Factory overhead costs are as follows: Variable Factory Overhead $23 per unit Fixed Factory overhead $250,000 Semi-variable (i.e., Mixed) Factory overhead cost is $70,000. The company utilized 14,000 machine hours during this period. The following additional information is provided to be used to bifurcate the semi-variable factory overhead into variable and fixed factory overhead costs, using high-low method. Cost machine hours Jan $52,000 10,000 HP Smart on the USA / MY ACCO TE User Portal Thread: Odeon https://blackboar.. Passport.html Student Account 21 Twitt Mar $77,000 20,00 April $67,000 12,500 Selling and Administrative expenses information is as follows: Variable Selling and Administrative Expenses $22 per unit Fixed Selling and Administrative Expenses $122,000 Required: (Please show all your computations in order to receive full credit). a) What is the total Factory Variable Overhead cost per unit? (20 points) b) What is the total Factory Fixed Overhead cost per unit? (20 points) c) What is the total manufacturing cost per unit? (20 points) d) Prepare variable costing income statement. (50 points) (50 points) e) Prepare an absorption costing income statement. f) What is the difference between the operating income reported in the variable costing income statement and the absorption costing income statement? g) Explain what caused the difference you obtained in item (f). (20 points) (20 points) Total = 200 points. a) What is the total Factory Varia' le Overhead cost per unit? (20 points) b) What is the total Factory Fixed Overhead cost per unit? (20 points) c) What is the total manufacturing cost per unit? (20 points) d) Prepare variable costing income statement. (50 points) (50 points) e) Prepare an absorption costing income statement. f) What is the difference between the operating income reported in the variable costing income statement and the absorption costing income statement? g) Explain what caused the difference you obtained in item (f) (20 points) (20 points)