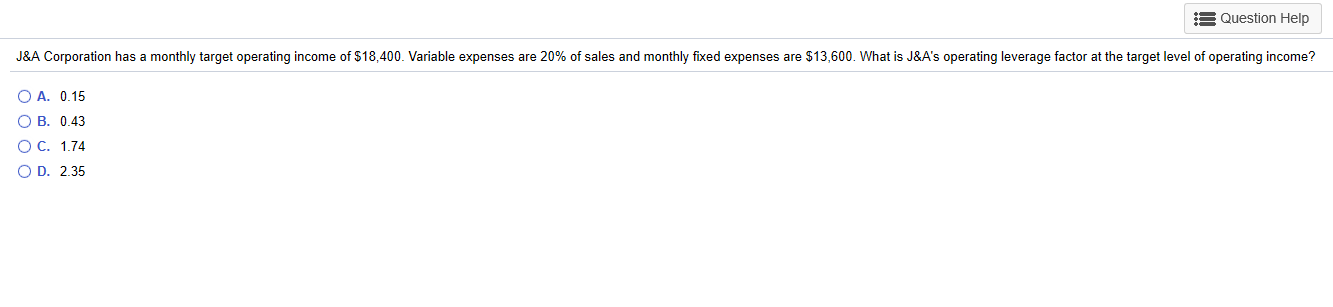

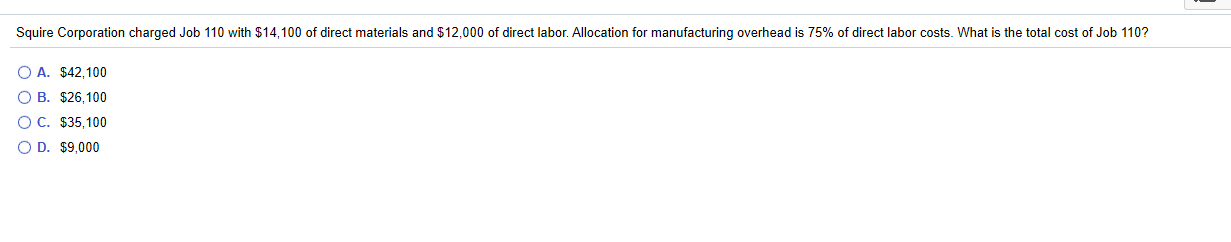

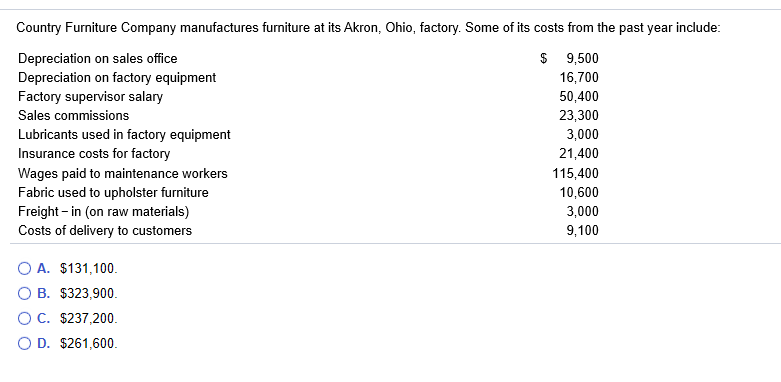

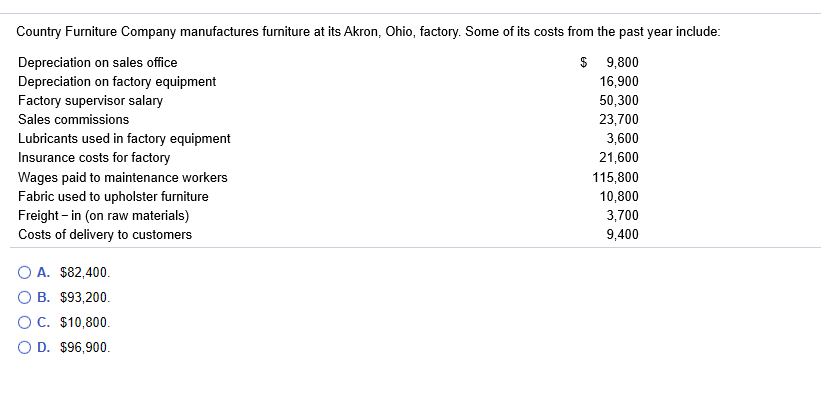

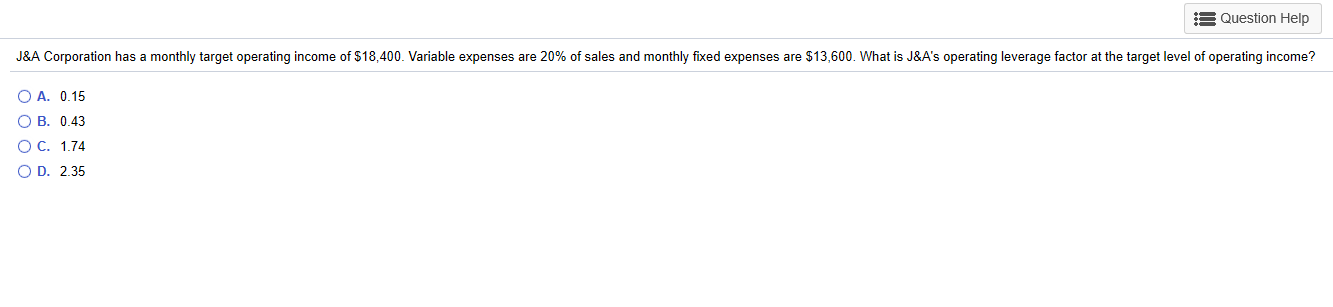

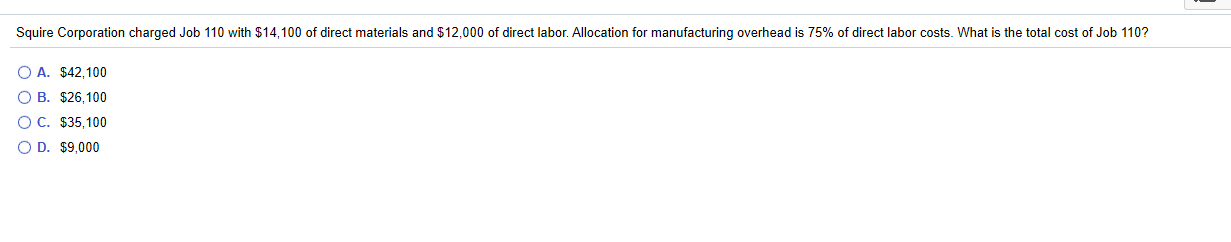

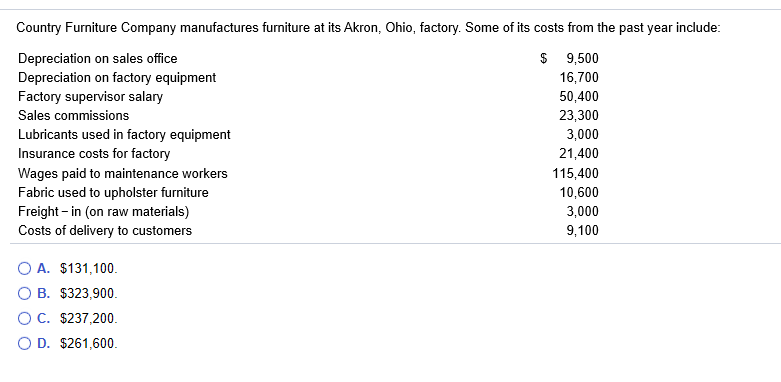

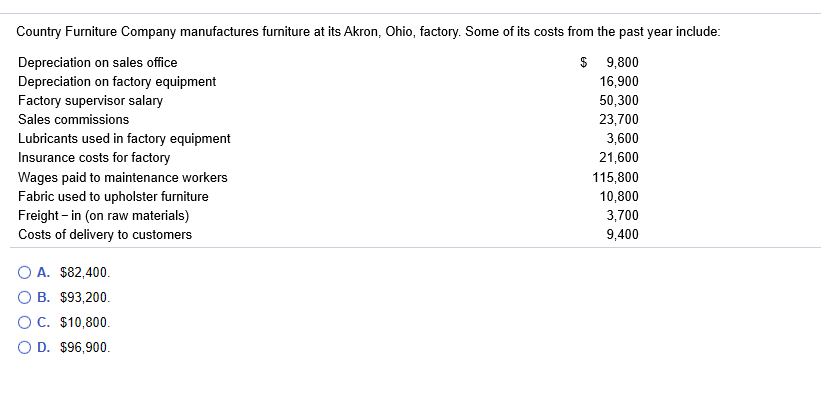

18 Question Help J&A Corporation has a monthly target operating income of $18,400. Variable expenses are 20% of sales and monthly fixed expenses are $13,600. What is J&A's operating leverage factor at the target level of operating income? O A. 0.15 OB. 0.43 O C. 1.74 OD. 2.35 Squire Corporation charged Job 110 with $14,100 of direct materials and $12,000 of direct labor. Allocation for manufacturing overhead is 75% of direct labor costs. What is the total cost of Job 110? O A. $42,100 O B. $26,100 O C. $35,100 OD. $9,000 Country Furniture Company manufactures furniture at its Akron, Ohio, factory. Some of its costs from the past year include: Depreciation on sales office $ 9,500 Depreciation on factory equipment 16,700 Factory supervisor salary 50,400 Sales commissions 23,300 Lubricants used in factory equipment 3,000 Insurance costs for factory 21,400 Wages paid to maintenance workers 115,400 Fabric used to upholster furniture 10,600 Freight - in (on raw materials) 3,000 Costs of delivery to customers 9,100 O A. $131,100. O B. $323,900. O C. $237,200. OD. $261,600 Country Furniture Company manufactures furniture at its Akron, Ohio, factory. Some of its costs from the past year include: Depreciation on sales office $ 9,800 Depreciation on factory equipment 16,900 Factory supervisor salary 50,300 Sales commissions 23,700 Lubricants used in factory equipment 3,600 Insurance costs for factory 21,600 Wages paid to maintenance workers 115,800 Fabric used to upholster furniture 10,800 Freight - in (on raw materials) 3,700 Costs of delivery to customers 9,400 O A. $82,400. O B. $93,200. O C. $10,800. OD. $96,900. 18 Question Help J&A Corporation has a monthly target operating income of $18,400. Variable expenses are 20% of sales and monthly fixed expenses are $13,600. What is J&A's operating leverage factor at the target level of operating income? O A. 0.15 OB. 0.43 O C. 1.74 OD. 2.35 Squire Corporation charged Job 110 with $14,100 of direct materials and $12,000 of direct labor. Allocation for manufacturing overhead is 75% of direct labor costs. What is the total cost of Job 110? O A. $42,100 O B. $26,100 O C. $35,100 OD. $9,000 Country Furniture Company manufactures furniture at its Akron, Ohio, factory. Some of its costs from the past year include: Depreciation on sales office $ 9,500 Depreciation on factory equipment 16,700 Factory supervisor salary 50,400 Sales commissions 23,300 Lubricants used in factory equipment 3,000 Insurance costs for factory 21,400 Wages paid to maintenance workers 115,400 Fabric used to upholster furniture 10,600 Freight - in (on raw materials) 3,000 Costs of delivery to customers 9,100 O A. $131,100. O B. $323,900. O C. $237,200. OD. $261,600 Country Furniture Company manufactures furniture at its Akron, Ohio, factory. Some of its costs from the past year include: Depreciation on sales office $ 9,800 Depreciation on factory equipment 16,900 Factory supervisor salary 50,300 Sales commissions 23,700 Lubricants used in factory equipment 3,600 Insurance costs for factory 21,600 Wages paid to maintenance workers 115,800 Fabric used to upholster furniture 10,800 Freight - in (on raw materials) 3,700 Costs of delivery to customers 9,400 O A. $82,400. O B. $93,200. O C. $10,800. OD. $96,900