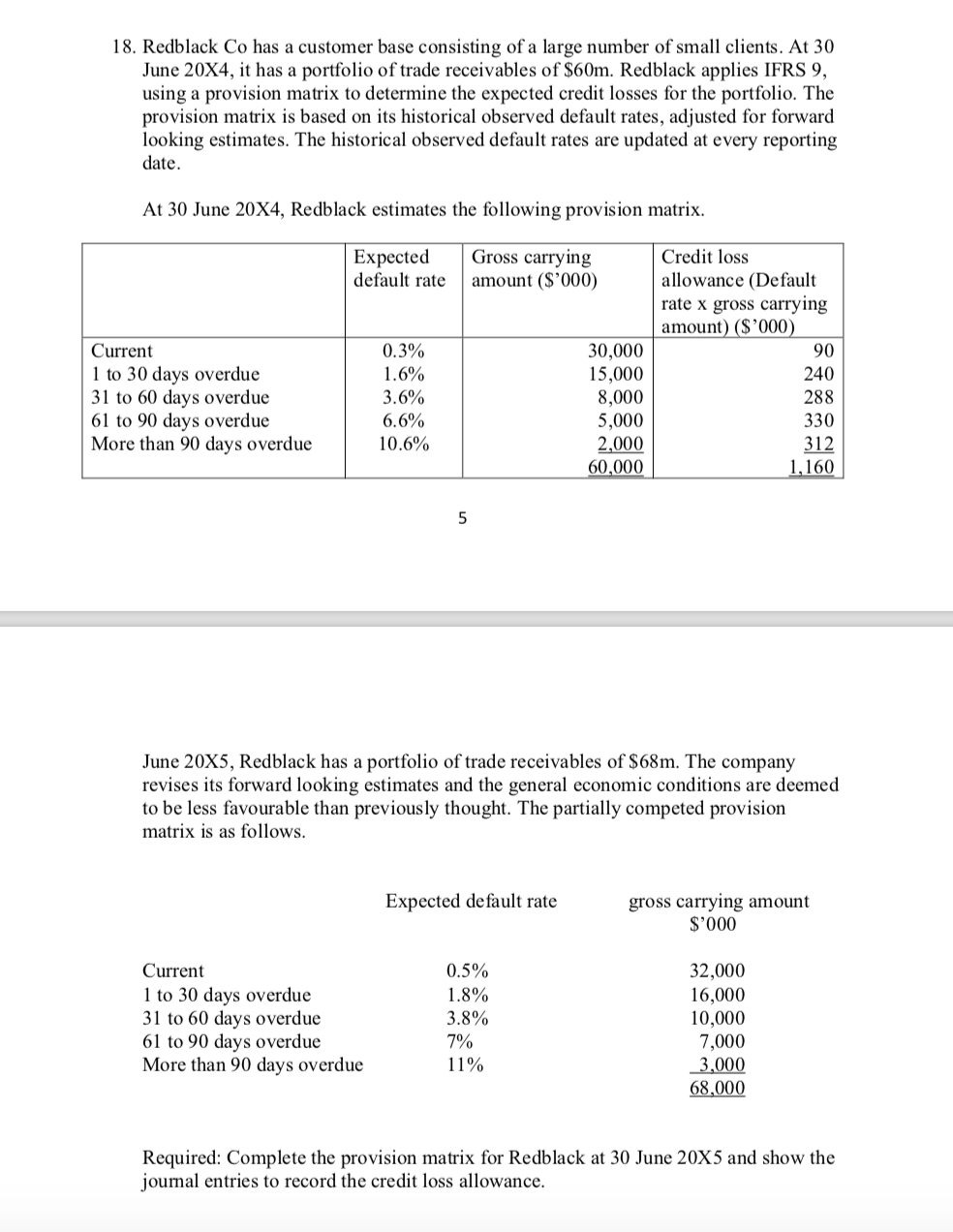

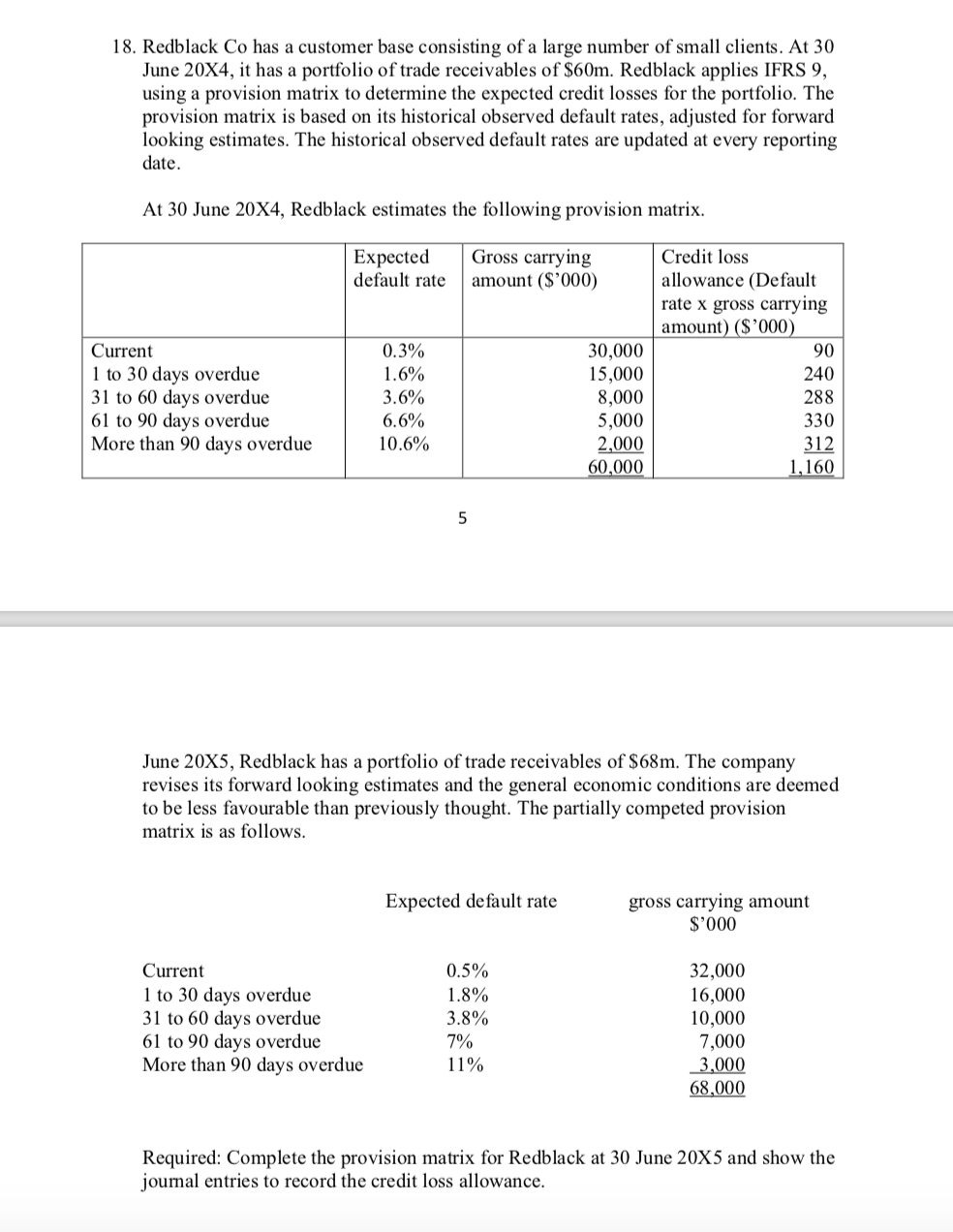

18. Redblack Co has a customer base consisting of a large number of small clients. At 30 June 20X4, it has a portfolio of trade receivables of $60m. Redblack applies IFRS 9, using a provision matrix to determine the expected credit losses for the portfolio. The provision matrix is based on its historical observed default rates, adjusted for forward looking estimates. The historical observed default rates are updated at every reporting date. At 30 June 20X4, Redblack estimates the following provision matrix. Expected default rate Gross carrying amount ($'000) Current 1 to 30 days overdue 31 to 60 days overdue 61 to 90 days overdue More than 90 days overdue 0.3% 1.6% 3.6% 6.6% 10.6% 30,000 15,000 8,000 5,000 2,000 60,000 Credit loss allowance (Default rate x gross carrying amount) ($'000) 90 240 288 330 312 1,160 5 June 20X5, Redblack has a portfolio of trade receivables of $68m. The company revises its forward looking estimates and the general economic conditions are deemed to be less favourable than previously thought. The partially competed provision matrix is as follows. Expected default rate gross carrying amount $'000 Current 1 to 30 days overdue 31 to 60 days overdue 61 to 90 days overdue More than 90 days overdue 0.5% 1.8% 3.8% 7% 11% 32,000 16,000 10,000 7,000 3,000 68,000 Required: Complete the provision matrix for Redblack at 30 June 20X5 and show the journal entries to record the credit loss allowance. 18. Redblack Co has a customer base consisting of a large number of small clients. At 30 June 20X4, it has a portfolio of trade receivables of $60m. Redblack applies IFRS 9, using a provision matrix to determine the expected credit losses for the portfolio. The provision matrix is based on its historical observed default rates, adjusted for forward looking estimates. The historical observed default rates are updated at every reporting date. At 30 June 20X4, Redblack estimates the following provision matrix. Expected default rate Gross carrying amount ($'000) Current 1 to 30 days overdue 31 to 60 days overdue 61 to 90 days overdue More than 90 days overdue 0.3% 1.6% 3.6% 6.6% 10.6% 30,000 15,000 8,000 5,000 2,000 60,000 Credit loss allowance (Default rate x gross carrying amount) ($'000) 90 240 288 330 312 1,160 5 June 20X5, Redblack has a portfolio of trade receivables of $68m. The company revises its forward looking estimates and the general economic conditions are deemed to be less favourable than previously thought. The partially competed provision matrix is as follows. Expected default rate gross carrying amount $'000 Current 1 to 30 days overdue 31 to 60 days overdue 61 to 90 days overdue More than 90 days overdue 0.5% 1.8% 3.8% 7% 11% 32,000 16,000 10,000 7,000 3,000 68,000 Required: Complete the provision matrix for Redblack at 30 June 20X5 and show the journal entries to record the credit loss allowance