Answered step by step

Verified Expert Solution

Question

1 Approved Answer

19-1,2,3,4,5 BE 19-1 High-low method Obj. 1 The manufacturing costs of Ackerman Industries for the first three months of the year follow: SHOW ME ROW

19-1,2,3,4,5

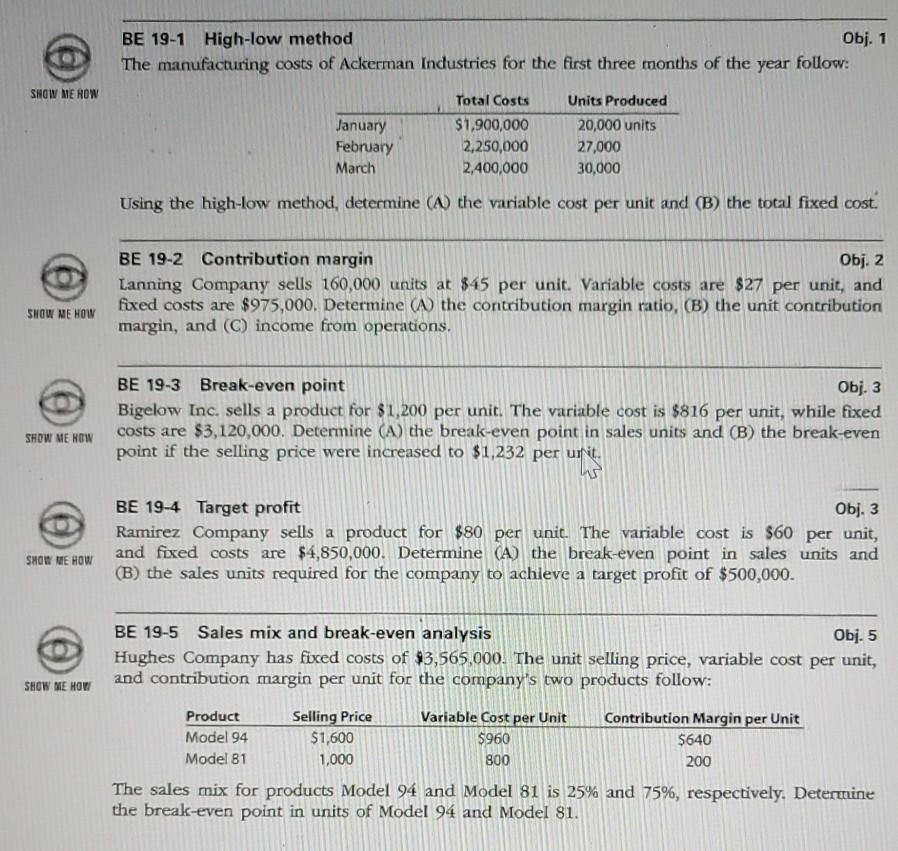

BE 19-1 High-low method Obj. 1 The manufacturing costs of Ackerman Industries for the first three months of the year follow: SHOW ME ROW January February March Total Costs $1,900,000 2,250,000 2,400,000 Units Produced 20,000 units 27,000 30,000 Using the high-low method, determine (A) the variable cost per unit and (B) the total fixed cost. BE 19-2 Contribution margin Obj. 2 Lanning Company sells 160,000 units at $45 per unit. Variable costs are $27 per unit, and fixed costs are $975,000. Determine (A) the contribution margin ratio, (B) the unit contribution margin, and (C) income from operations. SHOW ME HOW BE 19-3 Break-even point Obj. 3 Bigelow Inc. sells a product for $1,200 per unit. The variable cost is $816 per unit, while fixed costs are $3,120,000. Determine (A) the break-even point in sales units and (B) the break-even point if the selling price were increased to $1,232 per urit. SHOW ME HOW BE 19-4 Target profit Obj. 3 Ramirez Company sells a product for $80 per unit. The variable cost is $60 per unit, and fixed costs are $4,850,000. Determine (A) the break-even point in sales units and (B) the sales units required for the company to achieve a target profit of $500,000. SHOW ME HOW BE 19-5 Sales mix and break-even analysis Obj. 5 Hughes Company has fixed costs of $3,565,000. The unit selling price, variable cost per unit, SHOW ME How and contribution margin per unit for the company's two products follow: Product Selling Price Variable Cost per Unit Contribution Margin per Unit Model 94 $1,600 $960 $640 Model 81 1,000 800 200 The sales mix for products Model 94 and Model 81 is 25% and 75%, respectively. Determine the break-even point in units of Model 94 and Model 81Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started