Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1d and 2b (could not find the account title, please check list of accounts) On May 1, 2017, Sheridan Ltd. issued a series of bonds

1d and 2b (could not find the account title, please check list of accounts)

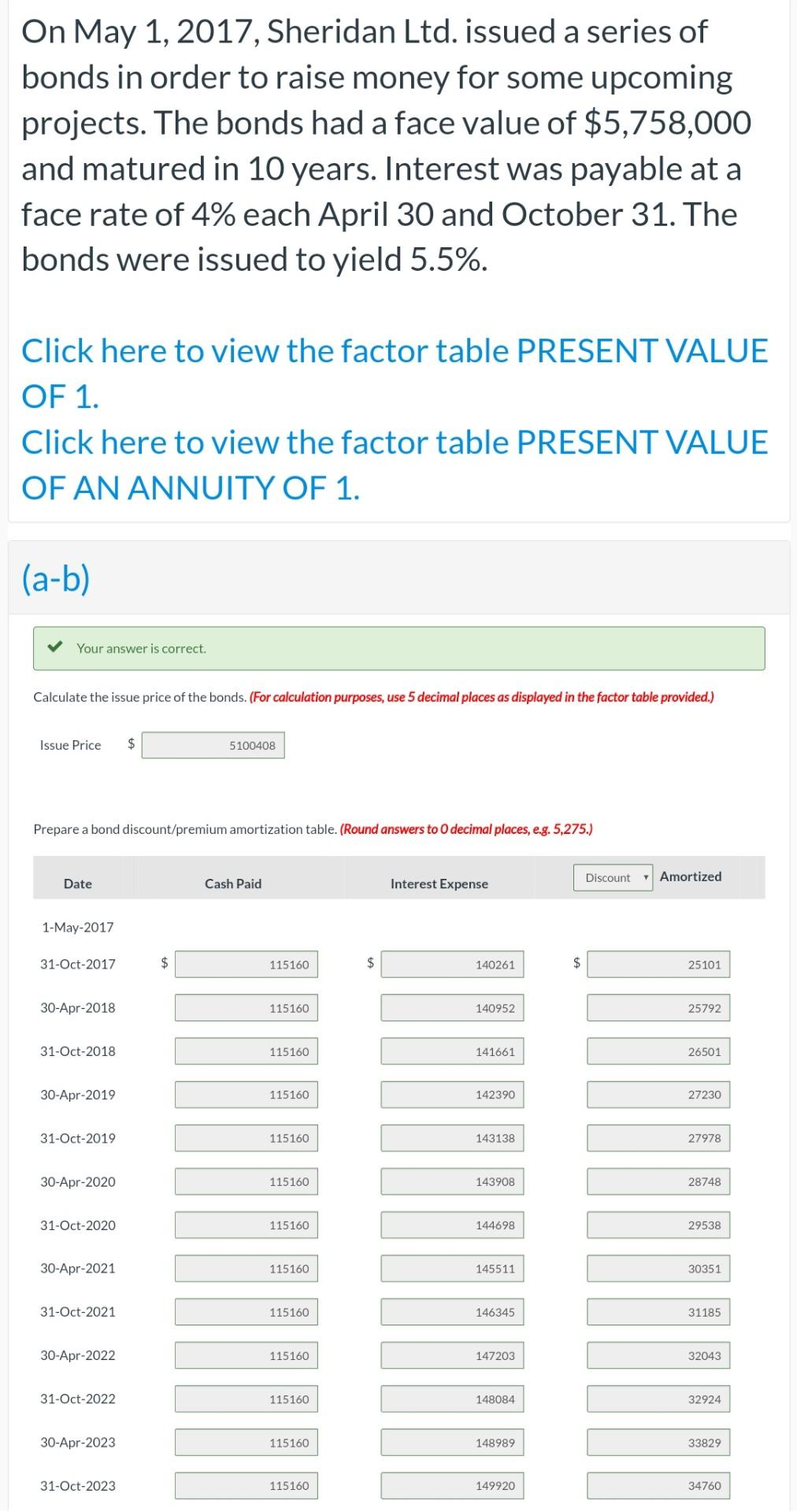

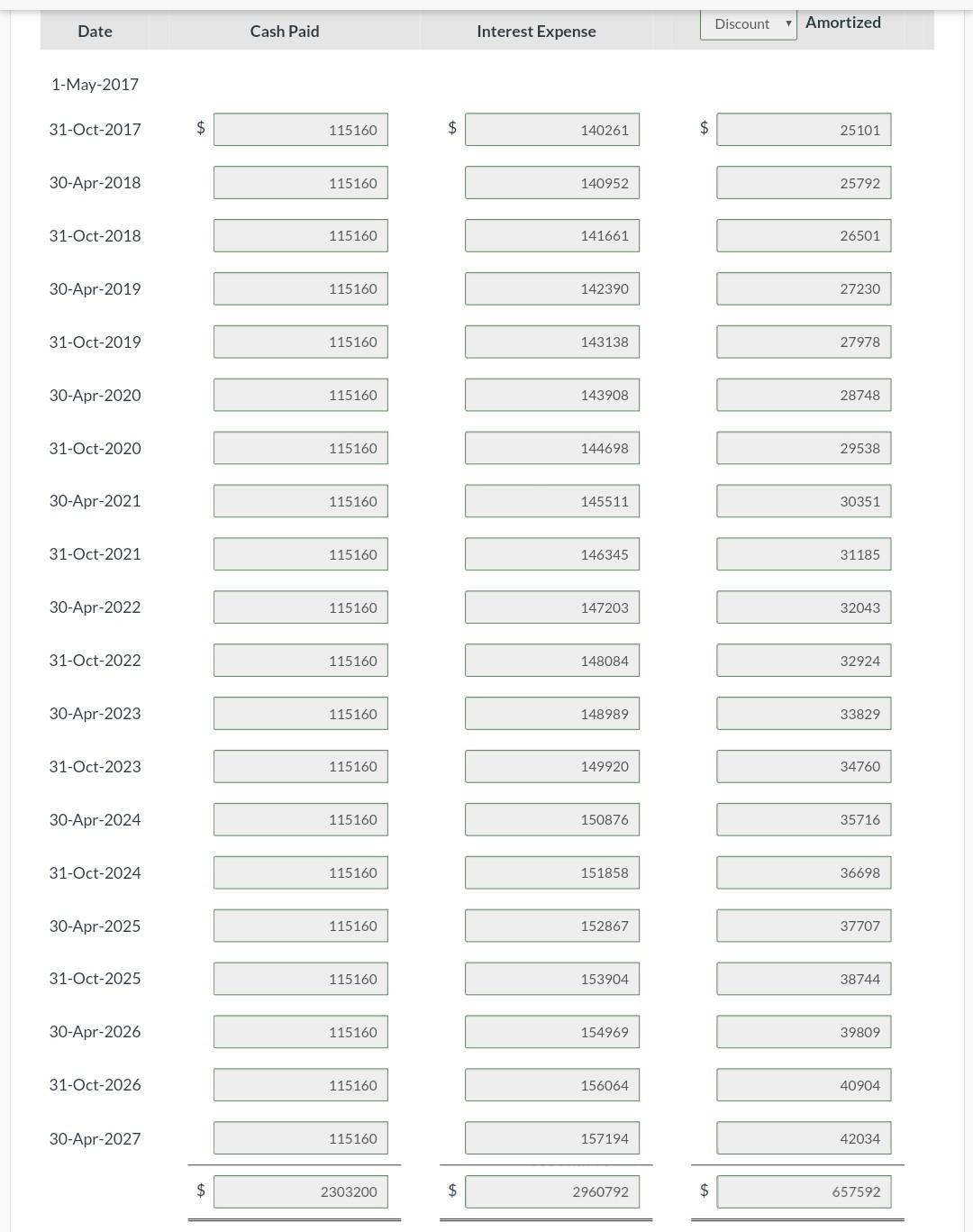

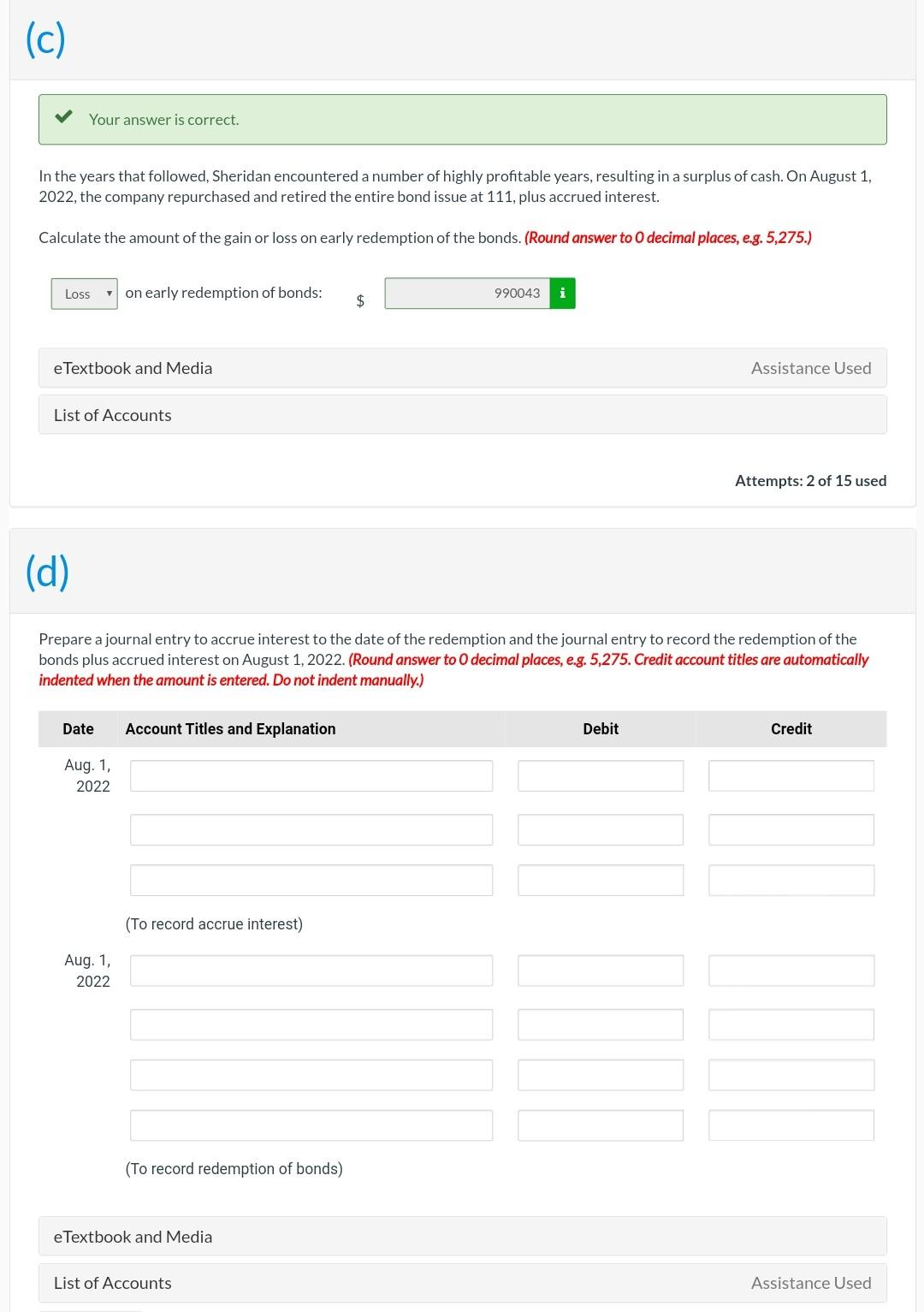

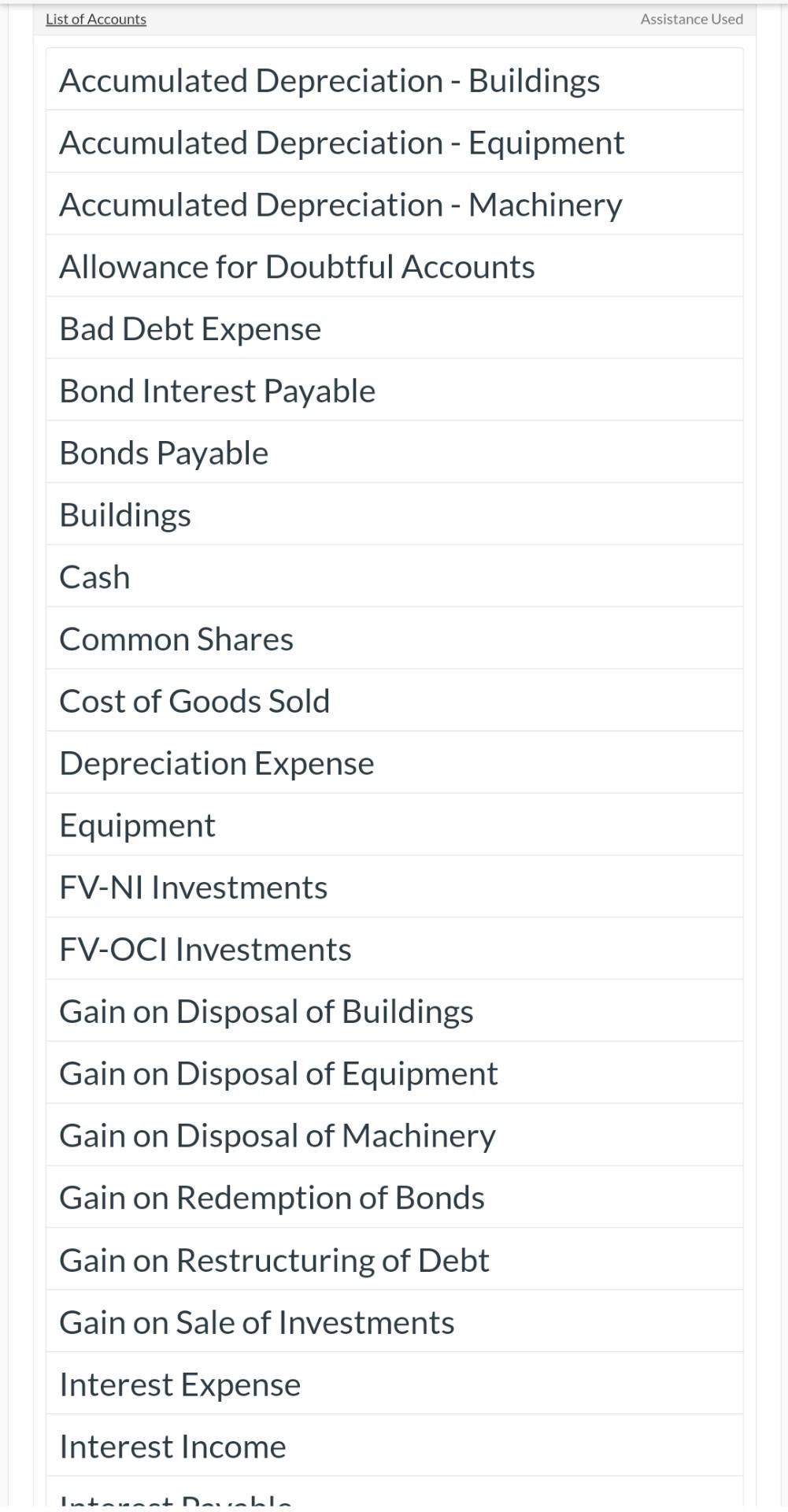

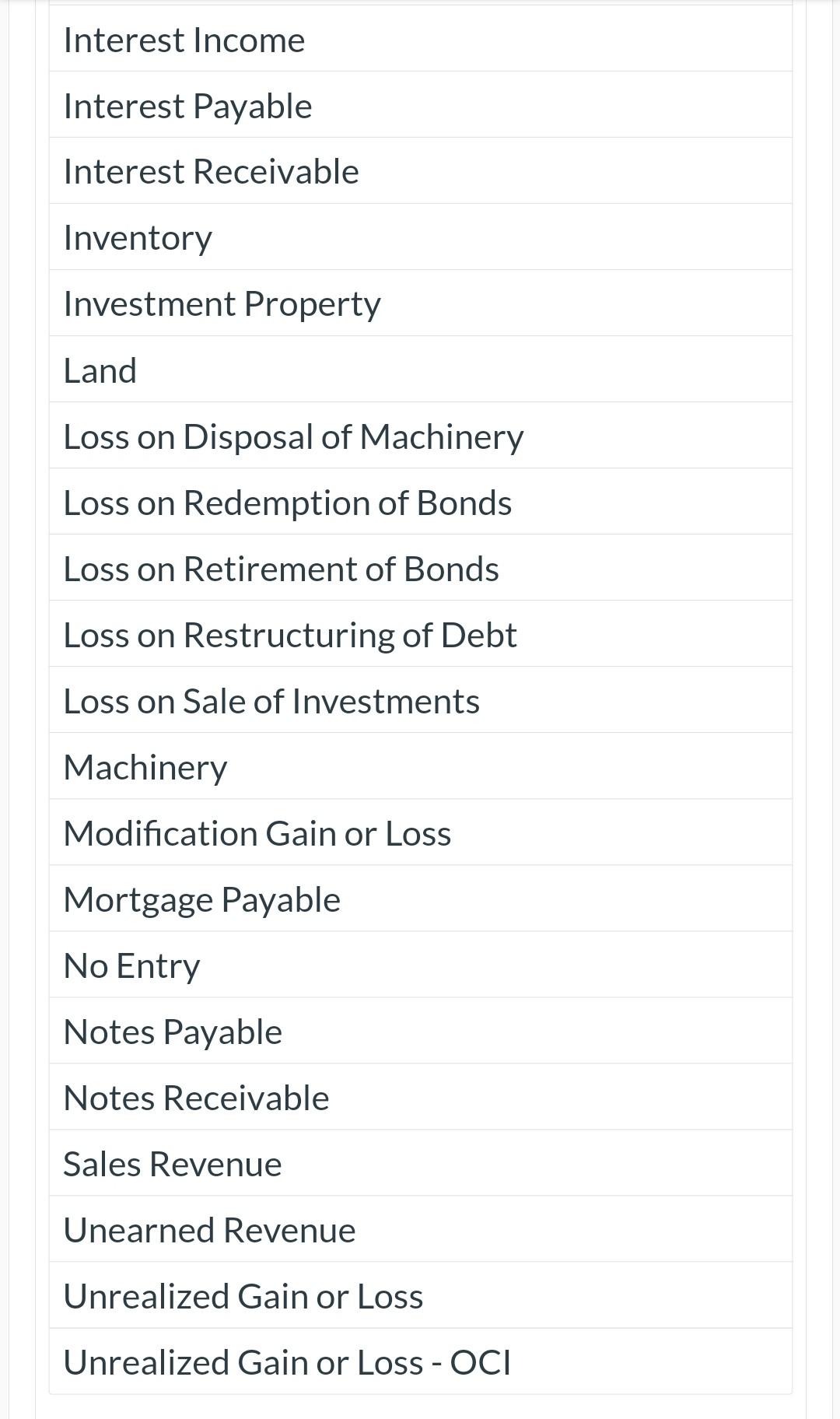

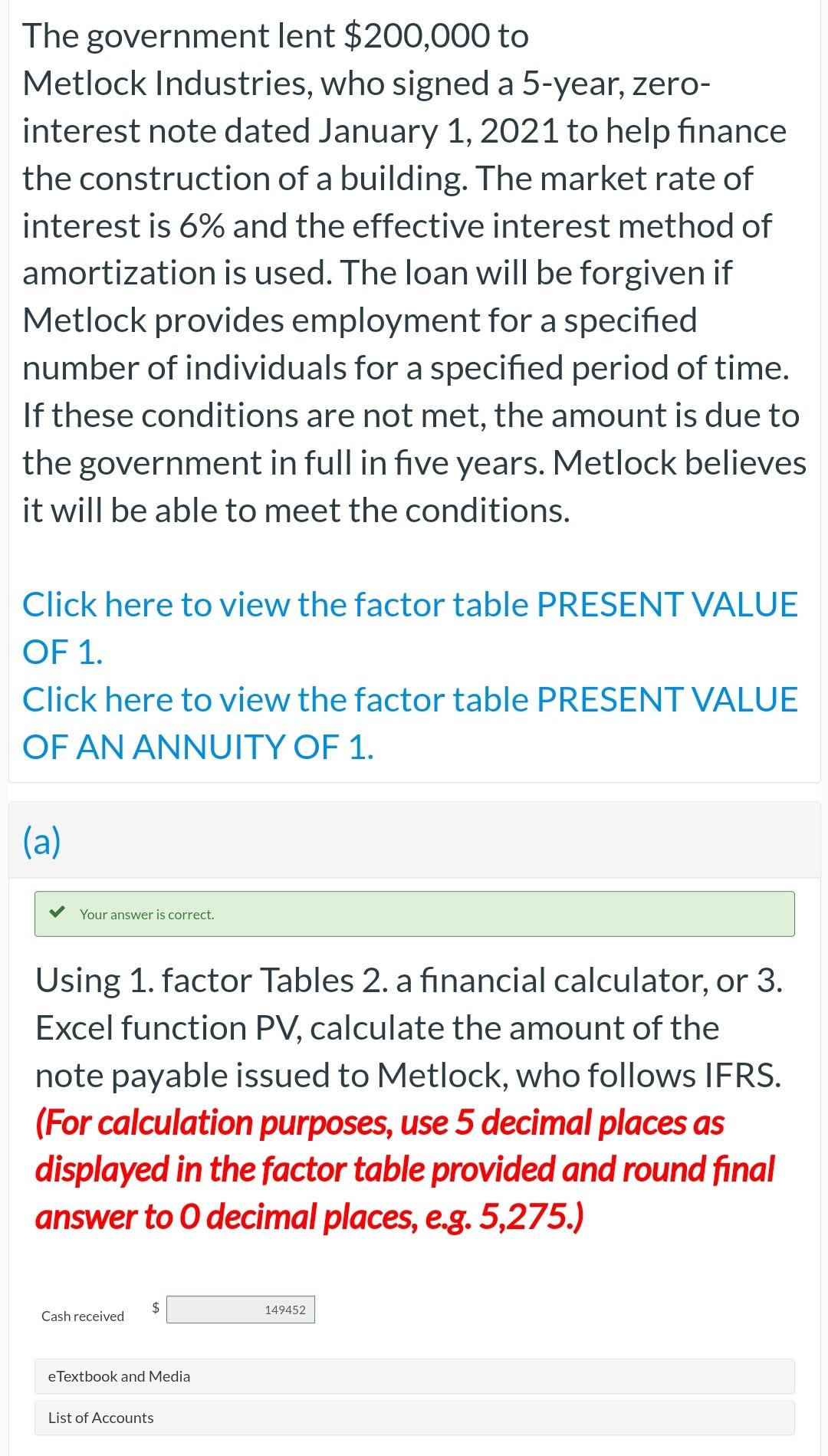

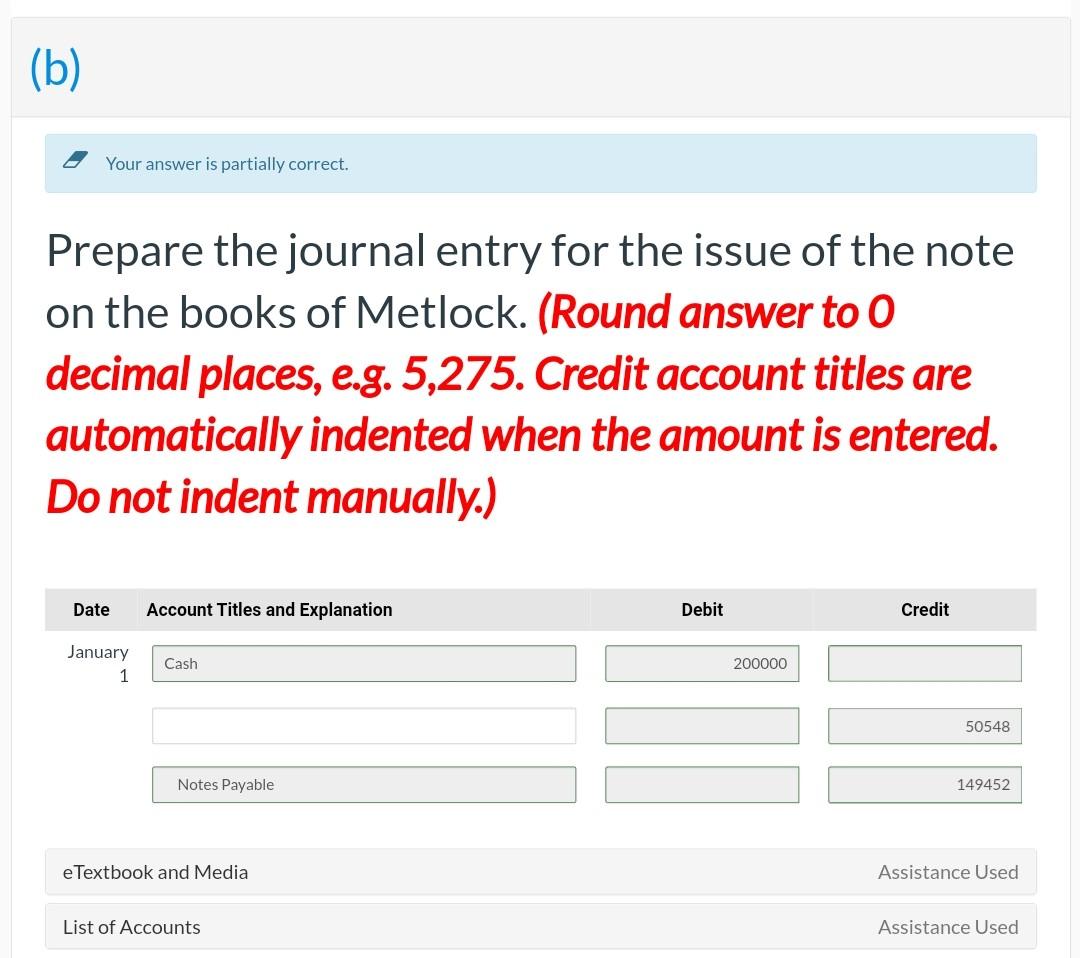

On May 1, 2017, Sheridan Ltd. issued a series of bonds in order to raise money for some upcoming projects. The bonds had a face value of $5,758,000 and matured in 10 years. Interest was payable at a face rate of 4% each April 30 and October 31. The bonds were issued to yield 5.5%. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (a-b) Your answer is correct. Calculate the issue price of the bonds. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Issue Price $ 5100408 Prepare a bond discount/premium amortization table. (Round answers to 0 decimal places, e.g. 5,275.) Date Cash Paid Interest Expense Discount Amortized 1-May-2017 31-Oct-2017 $ 115160 $ 140261 $ 25101 30-Apr-2018 115160 140952 25792 31-Oct-2018 115160 141661 26501 30-Apr-2019 115160 142390 27230 31-Oct-2019 115160 143138 27978 30-Apr-2020 115160 143908 28748 31-Oct-2020 115160 144698 29538 30-Apr-2021 115160 145511 30351 31-Oct-2021 115160 146345 31185 30-Apr-2022 115160 147203 32043 31-Oct-2022 115160 148084 32924 30-Apr-2023 115160 148989 33829 31-Oct-2023 115160 149920 34760 Discount Amortized Date Cash Paid Interest Expense 1-May-2017 31-Oct-2017 $ 115160 $ 140261 $ 25101 30-Apr-2018 115160 140952 25792 31-Oct-2018 115160 141661 26501 30-Apr-2019 115160 142390 27230 31-Oct-2019 115160 143138 27978 30-Apr-2020 115160 143908 28748 31-Oct-2020 115160 144698 29538 30-Apr-2021 115160 145511 30351 31-Oct-2021 115160 146345 31185 30-Apr-2022 115160 147203 32043 31-Oct-2022 115160 148084 32924 30-Apr-2023 115160 148989 33829 31-Oct-2023 115160 149920 34760 30-Apr-2024 115160 150876 35716 31-Oct-2024 115160 151858 36698 30-Apr-2025 115160 152867 37707 31-Oct-2025 115160 153904 38744 30-Apr-2026 115160 154969 39809 31-Oct-2026 115160 156064 40904 30-Apr-2027 115160 157194 42034 $ 2303200 $ 2960792 $ 657592 (c) Your answer is correct. In the years that followed, Sheridan encountered a number of highly profitable years, resulting in a surplus of cash. On August 1, 2022, the company repurchased and retired the entire bond issue at 111, plus accrued interest. Calculate the amount of the gain or loss on early redemption of the bonds. (Round answer to O decimal places, e.g. 5,275.) Loss on early redemption of bonds: 990043 i $ e Textbook and Media Assistance Used List of Accounts Attempts: 2 of 15 used (d) Prepare a journal entry to accrue interest to the date of the redemption and the journal entry to record the redemption of the bonds plus accrued interest on August 1, 2022. (Round answer to 0 decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 1, 2022 (To record accrue interest) Aug. 1, 2022 (To record redemption of bonds) e Textbook and Media List of Accounts Assistance Used List of Accounts Assistance Used Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Machinery Allowance for Doubtful Accounts Bad Debt Expense Bond Interest Payable Bonds Payable Buildings Cash Common Shares Cost of Goods Sold Depreciation Expense Equipment FV-NI Investments FV-OCI Investments Gain on Disposal of Buildings Gain on Disposal of Equipment Gain on Disposal of Machinery Gain on Redemption of Bonds Gain on Restructuring of Debt Gain on Sale of Investments Interest Expense Interest Income Intauantaina Interest Income Interest Payable Interest Receivable Inventory Investment Property Land Loss on Disposal of Machinery Loss on Redemption of Bonds Loss on Retirement of Bonds Loss on Restructuring of Debt Loss on Sale of Investments Machinery Modification Gain or Loss Mortgage Payable No Entry Notes Payable Notes Receivable Sales Revenue Unearned Revenue Unrealized Gain or Loss Unrealized Gain or Loss - OCI The government lent $200,000 to Metlock Industries, who signed a 5-year, zero- interest note dated January 1, 2021 to help finance the construction of a building. The market rate of interest is 6% and the effective interest method of amortization is used. The loan will be forgiven if Metlock provides employment for a specified number of individuals for a specified period of time. If these conditions are not met, the amount is due to the government in full in five years. Metlock believes it will be able to meet the conditions. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. (a) Your answer is correct. Using 1. factor Tables 2. a financial calculator, or 3. Excel function PV, calculate the amount of the note payable issued to Metlock, who follows IFRS. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to O decimal places, e.g. 5,275.) $ Cash received 149452 e Textbook and Media List of Accounts (b) Your answer is partially correct. Prepare the journal entry for the issue of the note on the books of Metlock. (Round answer to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit January 1 Cash 200000 50548 Notes Payable 149452 e Textbook and Media Assistance Used List of Accounts Assistance UsedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started