Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1.Should companies make rights issues in a bear market? 2.Did CU need the Money? If so why? 3.How did the market react to the news

1.Should companies make rights issues in a bear market? 2.Did CU need the Money? If so why?

3.How did the market react to the news of the issue

Its a case study assignment i hope you can get me the best solution please

i hope its clear now

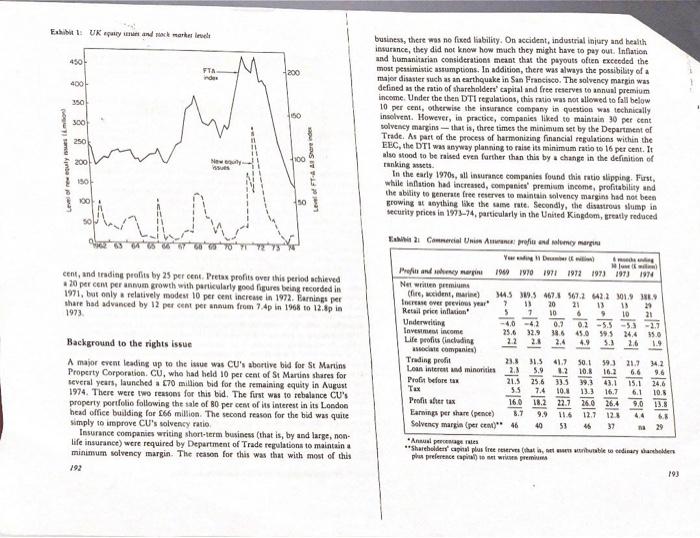

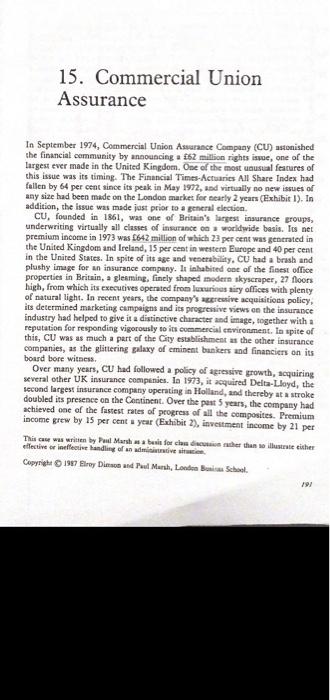

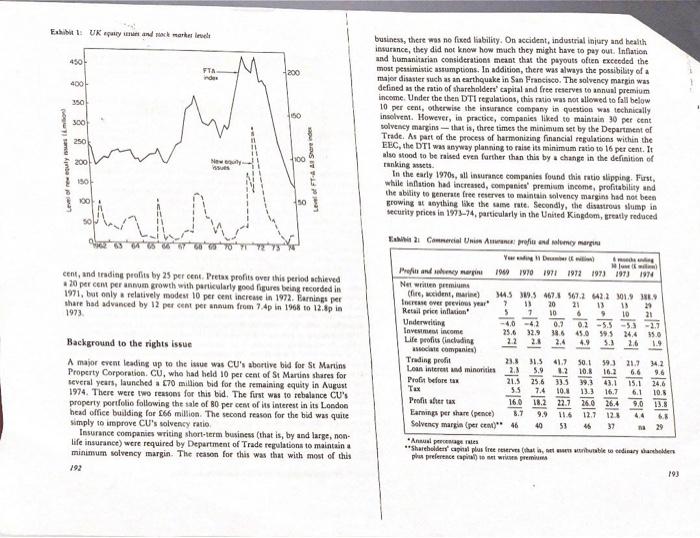

Assurance leat bort athat trusiceas, thene was fo fued tiabDily, Or acciernh, induerial infury and hrate. inaurasor, they did soi knew hew mach they might hare to ply oor. Inflein and huimaricerian considerationt mieast that the pajosts oftes excesded the most pessimintic assumptiona. Is atdition, there was alweya the posibiliny of a main diaater sach ar en earthquake is 5 an Francisos. The selinency marein was drfinel as the ratis of shareholderv' cepiral and free secerves to annual premium. ineeme. Under the thes DTI regalaciens, this ratio was sot allowed to fall below 19 gor pert, ofherwise the innarance compoby in quention was vehnically. intelvear. Hewever, ia gractier, etmpanies liknt ts maintain 30 per cent selvency mazgins - that ia, three times the nininum set by the Departreet of Trade. As purt of the process of tarmanizing finanoal rraguationa widkin the elao nood to be raized even farther than this by a chanar in the definitien of rankita antets. In the early 1$NO, all inuarasce eapanies fousd thin fatie slipring. Firn. will infation had increived, eampanier' peemium inceme, peoficabeliry asd the atility to semoraie free reserves to maintain solvency. margens had not been growing at anything like the ame rate. Secnodly, the disatrous alump in stearity prices in 1913-74, particularly in the Unitrd Kingutem, gestly reduood cent, and radine profits by 25 ger cent. Prras prefits over thit period achiered a 20 per cent per annum grouth with paricalarly pood fipures bring recorded in 17t, bat only a relacively roodeat 10 per ernt instaie in 1972 . liarniags per ahaie had alvanced by 12 prer cont per alaum frmm 7.4p in tYt to 12.5p in 1978. Backgrotead to the rights issue A major trent leidisg up to the ituue wat CU a aborive bid for 5M Martin Preperty Coeporatiea. CU, who had held 10 jer oent of St Marias thares for sevenal yaars, launched a [To mittion bid for the remaining tyaify in Aagat 1974. There were two tamens for this bid. The first was to rebalonce CU's properry portfolio following the iale of B per cent of ita intereat in its Loodon heid offire building for fof million. The sossod reaten for the bid wat quite lingly to impeove Ct, solvency rutio. fauraser campaties writing ahert-tem hutiness (that is, by ind isne, nea. life in urance) were requared by Depertment of Trade regalationt ts maincain a minimum solvency margin. The rtasod fer thin was that wisth most of thin Eatibit 2. Camnessed Unim Ainnene: jofes ant ahnoy megiai 15. Commercial Union Assurance In September 1974, Commercial Union Astaranct Company (CU) astonished the financial cammanity by announcing a $62 million rights ispue, one of the largest ever gnade in the United Kingdom. One of the most uaustal fearures of this issue was its timang. The Financial Timen-Actuarics All Share Index had fallen by 64 per cent since its peak in May 1912, and virtually no new issues of any size had been made on the Londoa market fer nearly 2 years (Exhibit I). In addition, the issue was made jast prior to a general clection. CU, founded in 1861 , was one of Britain's larnest inaurance groups, underwriting virtually all classer of insuranct oa a uorldwide basis. Irs net premium income in 1973 was $642 million of which 23 per cent was gentrated in the United Kingdom and Ireland, 15 per cent in weatern Eurupe and 40 per cent in the United States. In spite of its age and vettability, CU had a brash and plushy image for an insurance cornpkny. Ir inhabited one of the fisest office propertics in Britsin, a glesmine. finely shaped modern skyscraper, 27. floors high, from which its executives operated from luxurioes airy offices with plenty of natural light. In recent years, the company's aceressive acquisitiods policy, its determined marketing esmpaignt and its progrewive views en the insurance industry had helped to give it a distinctive character and ianage, together with a reputation for responding vigorously so ils commercial environment, la spite of thin, CU was as much a part of the City establisthment at the other insurance companies, as the glittering galaxy of eminent bunkers and financiers on its bousd bore witeess. Over many years, CU had followed a policy of agressive growth, acquiring several other UK insurance compenies. Is 1973 , it acquired Delta-I.loyd, the second largest insurance company operatiag in Holland, and thereby at a stroke doubled its presence on ehe Continent. Over the past 5 years, the company had achieved oae of the fastest rates of peogress of all the composites. Premium income grew by 15 per cent a year (Exhibir 2), inveitment income by 21 per This case was writen by Ful Marsh as a besin for chas diwcusive nather than ao illustrale cisther eliective or ineffective handling of an admitiaintive airarien. Copynght 81987 Elrey Dirrow and Paul Marh, Londen Beaisa School. Exbibit I: UK equily wert and nock markes lowat business, there was no fixed lability. On accident, industrial injury and health issurance, they did not know how mach they might have to gay out. Inflation and humanitarian consideratioss meant that the payouts often exceeded the most pestimistic assumptions. In additioe, there was always the possibility of a major disaster such as an earthquake in San Franciseo. The solvency margin was defined as the ratio of shareholders' capital and free reserves to annual premiom income. Under the then DT1 regalations, this ratio was not allowed to fall below 10 per cent, otherwise the insurance eompany in question was technically insolvest. However, ia practice, companies liked to maintain 30 per stnt solvency margins - that is, three times the minimum set by the Departaneat of Trade. As part of the process of harmonizing financial regulations within the EEC, the DTI was anyway planniog to raise its minimum ratio to 16 per cent. It also stood to be raised even farther than this by a ehange in the defieition of ranking assets. In the early 1970 s, all insurance companies found this ratio alipping. First, while indation had increased, coengasiet' preminm income, profitability and the abdility to generate free teverves to maintain volvency margins had not been growing at asytbing lake the aise rate. Secondly, the disaurous stump in security prices in 1973-74, particularly in the United Kingdom, greatly redoced cent, and irading profhts by 25 per cent. Pretax profits over this period achieved a 20 per cen per ansum growth wth particularly good figures being recoeded in 1971, bat only s relatively modes 10 per cent inerease in 1972 . Barninge per share had advanced by 12 per sent per ansum from 7.4D in 1968 to 12.4p in 1973. Background to the rights issue A major event leading up to the istue was CU's abortive bid for. St Marins Property Corporation. CU, who had held 10 per cent of St Martins shares for several years, launelved a 570 million bid for the remaining equity in Avgust 1974. There were two reasoes for this bid. The first was to tebalance CU's property perffolio following the sale of 80 per cen of ins interest in its Loedoe head office building for 166 million. The second reason for the bid was quite simply to improve CU's solvency ranio. Insurance coenpanies writing short-tetm business (that is, by and large, nonlife inqueance) were required by Department of Trade regulations to maintain a minimum solvency margin. The reason for this was that with most of this 192 - Ansual percencage iates phas prefertsce capioli) to ant wriwhs gitmiums (9) Assurance leat bort athat trusiceas, thene was fo fued tiabDily, Or acciernh, induerial infury and hrate. inaurasor, they did soi knew hew mach they might hare to ply oor. Inflein and huimaricerian considerationt mieast that the pajosts oftes excesded the most pessimintic assumptiona. Is atdition, there was alweya the posibiliny of a main diaater sach ar en earthquake is 5 an Francisos. The selinency marein was drfinel as the ratis of shareholderv' cepiral and free secerves to annual premium. ineeme. Under the thes DTI regalaciens, this ratio was sot allowed to fall below 19 gor pert, ofherwise the innarance compoby in quention was vehnically. intelvear. Hewever, ia gractier, etmpanies liknt ts maintain 30 per cent selvency mazgins - that ia, three times the nininum set by the Departreet of Trade. As purt of the process of tarmanizing finanoal rraguationa widkin the elao nood to be raized even farther than this by a chanar in the definitien of rankita antets. In the early 1$NO, all inuarasce eapanies fousd thin fatie slipring. Firn. will infation had increived, eampanier' peemium inceme, peoficabeliry asd the atility to semoraie free reserves to maintain solvency. margens had not been growing at anything like the ame rate. Secnodly, the disatrous alump in stearity prices in 1913-74, particularly in the Unitrd Kingutem, gestly reduood cent, and radine profits by 25 ger cent. Prras prefits over thit period achiered a 20 per cent per annum grouth with paricalarly pood fipures bring recorded in 17t, bat only a relacively roodeat 10 per ernt instaie in 1972 . liarniags per ahaie had alvanced by 12 prer cont per alaum frmm 7.4p in tYt to 12.5p in 1978. Backgrotead to the rights issue A major trent leidisg up to the ituue wat CU a aborive bid for 5M Martin Preperty Coeporatiea. CU, who had held 10 jer oent of St Marias thares for sevenal yaars, launched a [To mittion bid for the remaining tyaify in Aagat 1974. There were two tamens for this bid. The first was to rebalonce CU's properry portfolio following the iale of B per cent of ita intereat in its Loodon heid offire building for fof million. The sossod reaten for the bid wat quite lingly to impeove Ct, solvency rutio. fauraser campaties writing ahert-tem hutiness (that is, by ind isne, nea. life in urance) were requared by Depertment of Trade regalationt ts maincain a minimum solvency margin. The rtasod fer thin was that wisth most of thin Eatibit 2. Camnessed Unim Ainnene: jofes ant ahnoy megiai 15. Commercial Union Assurance In September 1974, Commercial Union Astaranct Company (CU) astonished the financial cammanity by announcing a $62 million rights ispue, one of the largest ever gnade in the United Kingdom. One of the most uaustal fearures of this issue was its timang. The Financial Timen-Actuarics All Share Index had fallen by 64 per cent since its peak in May 1912, and virtually no new issues of any size had been made on the Londoa market fer nearly 2 years (Exhibit I). In addition, the issue was made jast prior to a general clection. CU, founded in 1861 , was one of Britain's larnest inaurance groups, underwriting virtually all classer of insuranct oa a uorldwide basis. Irs net premium income in 1973 was $642 million of which 23 per cent was gentrated in the United Kingdom and Ireland, 15 per cent in weatern Eurupe and 40 per cent in the United States. In spite of its age and vettability, CU had a brash and plushy image for an insurance cornpkny. Ir inhabited one of the fisest office propertics in Britsin, a glesmine. finely shaped modern skyscraper, 27. floors high, from which its executives operated from luxurioes airy offices with plenty of natural light. In recent years, the company's aceressive acquisitiods policy, its determined marketing esmpaignt and its progrewive views en the insurance industry had helped to give it a distinctive character and ianage, together with a reputation for responding vigorously so ils commercial environment, la spite of thin, CU was as much a part of the City establisthment at the other insurance companies, as the glittering galaxy of eminent bunkers and financiers on its bousd bore witeess. Over many years, CU had followed a policy of agressive growth, acquiring several other UK insurance compenies. Is 1973 , it acquired Delta-I.loyd, the second largest insurance company operatiag in Holland, and thereby at a stroke doubled its presence on ehe Continent. Over the past 5 years, the company had achieved oae of the fastest rates of peogress of all the composites. Premium income grew by 15 per cent a year (Exhibir 2), inveitment income by 21 per This case was writen by Ful Marsh as a besin for chas diwcusive nather than ao illustrale cisther eliective or ineffective handling of an admitiaintive airarien. Copynght 81987 Elrey Dirrow and Paul Marh, Londen Beaisa School. Exbibit I: UK equily wert and nock markes lowat business, there was no fixed lability. On accident, industrial injury and health issurance, they did not know how mach they might have to gay out. Inflation and humanitarian consideratioss meant that the payouts often exceeded the most pestimistic assumptions. In additioe, there was always the possibility of a major disaster such as an earthquake in San Franciseo. The solvency margin was defined as the ratio of shareholders' capital and free reserves to annual premiom income. Under the then DT1 regalations, this ratio was not allowed to fall below 10 per cent, otherwise the insurance eompany in question was technically insolvest. However, ia practice, companies liked to maintain 30 per stnt solvency margins - that is, three times the minimum set by the Departaneat of Trade. As part of the process of harmonizing financial regulations within the EEC, the DTI was anyway planniog to raise its minimum ratio to 16 per cent. It also stood to be raised even farther than this by a ehange in the defieition of ranking assets. In the early 1970 s, all insurance companies found this ratio alipping. First, while indation had increased, coengasiet' preminm income, profitability and the abdility to generate free teverves to maintain volvency margins had not been growing at asytbing lake the aise rate. Secondly, the disaurous stump in security prices in 1973-74, particularly in the United Kingdom, greatly redoced cent, and irading profhts by 25 per cent. Pretax profits over this period achieved a 20 per cen per ansum growth wth particularly good figures being recoeded in 1971, bat only s relatively modes 10 per cent inerease in 1972 . Barninge per share had advanced by 12 per sent per ansum from 7.4D in 1968 to 12.4p in 1973. Background to the rights issue A major event leading up to the istue was CU's abortive bid for. St Marins Property Corporation. CU, who had held 10 per cent of St Martins shares for several years, launelved a 570 million bid for the remaining equity in Avgust 1974. There were two reasoes for this bid. The first was to tebalance CU's property perffolio following the sale of 80 per cen of ins interest in its Loedoe head office building for 166 million. The second reason for the bid was quite simply to improve CU's solvency ranio. Insurance coenpanies writing short-tetm business (that is, by and large, nonlife inqueance) were required by Department of Trade regulations to maintain a minimum solvency margin. The reason for this was that with most of this 192 - Ansual percencage iates phas prefertsce capioli) to ant wriwhs gitmiums (9)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started