2.

3.

4.

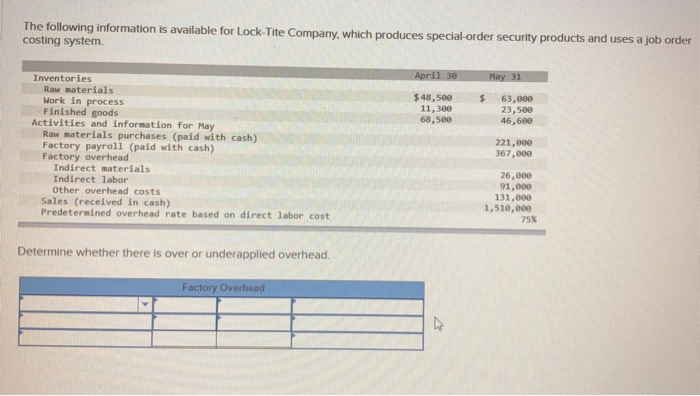

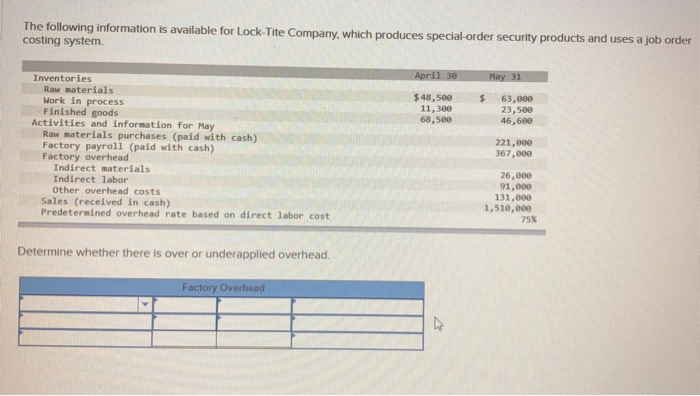

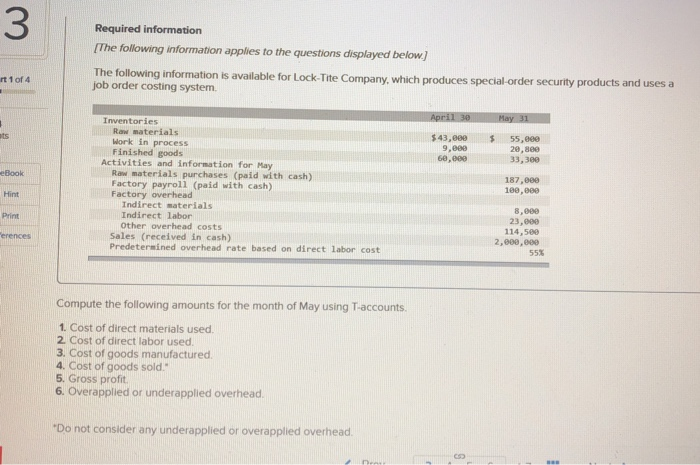

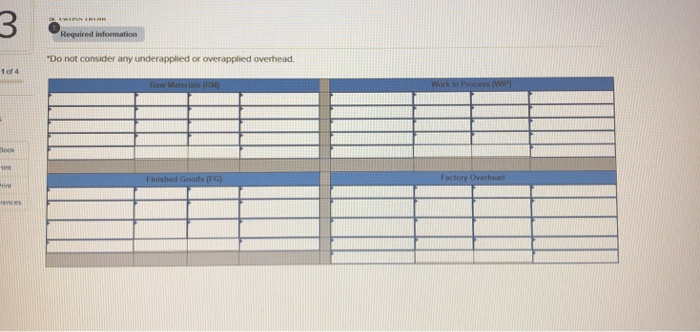

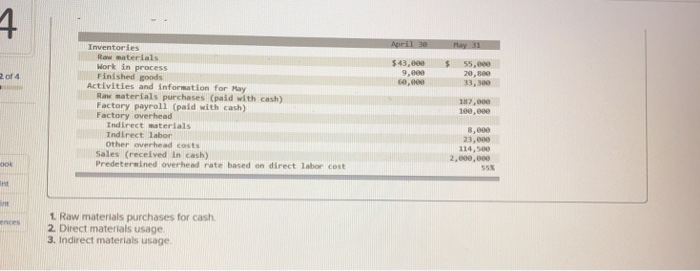

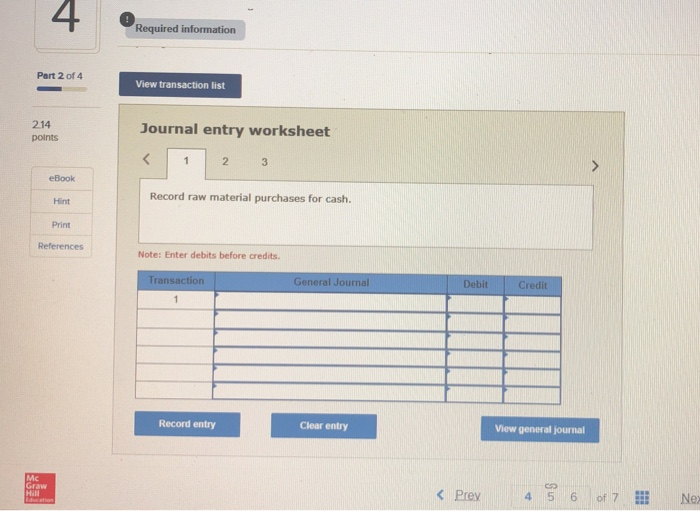

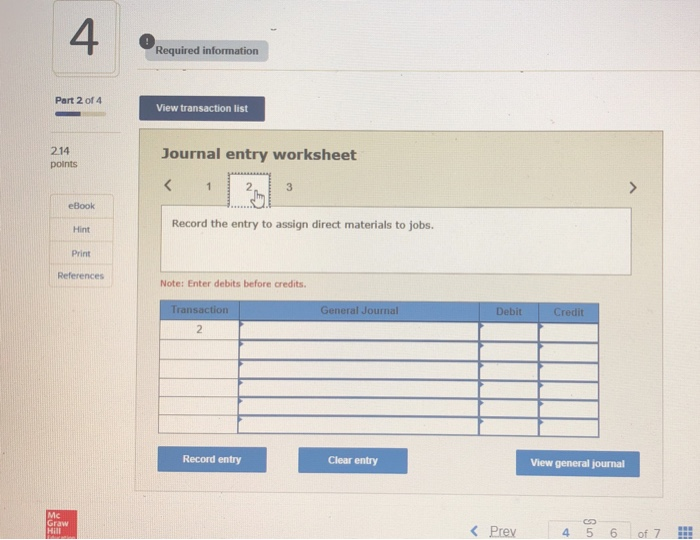

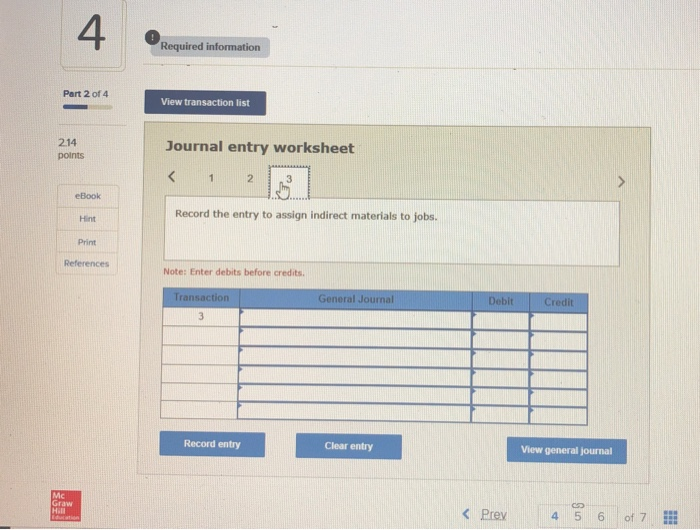

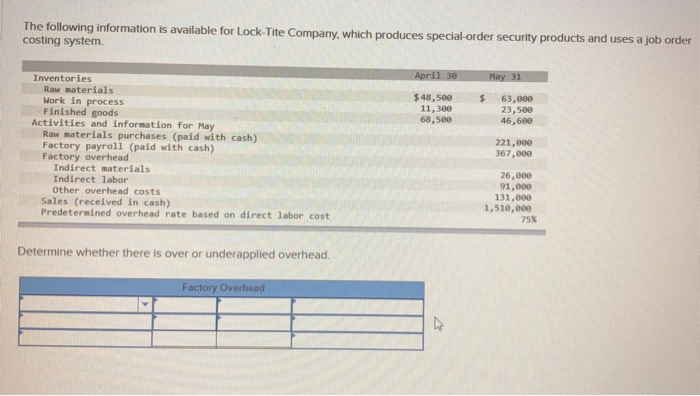

The following information is available for Lock- Tite Company, which produces special-order security products and uses a job order costing system. Inventories Raw materials Work in process Finished goods $48,500 63,0e0 23,580 46,688 11,380 68,580 Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead 221,80 367,909 Indirect materials Indirect labor Other overhead costs 26,000 91,000 131,000 1,510,000 Sales (received in cash) Predetermined overhead rate based on direct labor cost 75% Determine whether there is over or underapplied overhead. Factory Overhead 3 Required information [The following information applies to the questions displayed below] The following information is available for Lock-Tite Company, which produces special-order security products and uses a rt 1 of 4 job order costing system. Inventories Raw materials Work in process Finished goods $43,00055,80e 28,880 33,300 ts 9,000 6e,e0e Activities and information for May Raw materials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead 187,688 168,800 eBook Hint Print erences Indirect materials Indirect Labor Other overhead costs 8,000 23,080 114,588 2,800,0ee Sales (received in cash) Predetermined overhead rate based on direct labor cost 55% Compute the following amounts for the month of May using T-accounts. 1. Cost of direct materials used 2. Cost of direct labor used 3. Cost of goods manufactured 4. Cost of goods sold. 5. Gross profit 6. Overapplied or underapplied overhead "Do not consider any underapplied or overapplied overhead. Required information Do not consider any underapplied or overapplied overhead 1 of 4 rint Required information Part 1 of 4 2.14 points eBook Hint Print References Income statement (partial) Inventories Raw materials Work in process Finished goods $43,000 9,909 60,000 55,000 29,800 33, 300 2 of 4 Activities and information for May Raw naterials purchases (paid with cash) Factory payroll (paid with cash) Factory overhead 187,000 100,eee Indirect materials Indirect labor Other overhead costs 8,000 23,000 14,54 Sales (received in cash) Predetermined overhead rate based on direct labor cost 2,009,900 ook 55% nt 1 Raw materials purchases for cash 2. Direct materials usage 3. Indirect materials usage 4 Required information Part 2 of 4 View transaction list 214 points Journal entry worksheet eBook Hint Print Record raw material purchases for cash. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Mc Graw K Prey 4 5 6 of 7 li 4 Required information Part 2 of 4 View transaction list 214 points Journal entry worksheet 2 eBook Record the entry to assign direct materials to jobs. Hint Print ferences Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Graw Prev 4 5 6 of 7 4 Required information Part 2 of 4 View transaction list 214 points Journal entry worksheet eBook Record the entry to assign indirect materials to jobs. Hint Print References Note: Enter debits before credits. Transactio General Journal Debit r Record entry Clear entry View general journal Mc Graw