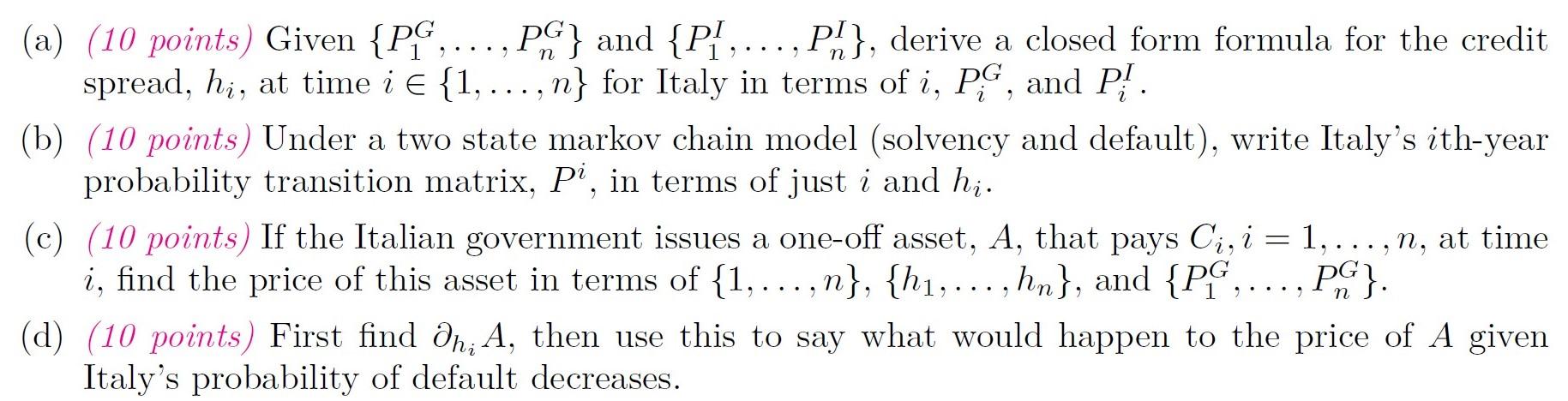

2. (40 points) Assume that Germany's bonds are risk-free and Italy's bonds are risk-prone, and that each country issues zero coupon bonds with a face value of 1. We denote a German bond with an outstanding term of i years simply by its current price PC, and an Italian bond with outstanding term of i years also simply by P. Finally, assume everything henceforth is priced using continuous discounting, and a 25% recovery rate under default. (a) (10 points) Given {PG,... P.G} and {P/....,P!}, derive a closed form formula for the credit spread, hi, at time i E {1,...,n} for Italy in terms of i, PG, and P;} . (b) (10 points) Under a two state markov chain model (solvency and default), write Italy's ith-year probability transition matrix, Pi, in terms of just i and hi. (c) (10 points) If the Italian government issues a one-off asset, A, that pays Ci, i = 1,...,n, at time i, find the price of this asset in terms of {1,...,n}, {h1,..., hn}, and {PG, ...,P.C}. (d) (10 points) First find an: A, then use this to say what would happen to the price of A given Italy's probability of default decreases. 2. (40 points) Assume that Germany's bonds are risk-free and Italy's bonds are risk-prone, and that each country issues zero coupon bonds with a face value of 1. We denote a German bond with an outstanding term of i years simply by its current price PC, and an Italian bond with outstanding term of i years also simply by P. Finally, assume everything henceforth is priced using continuous discounting, and a 25% recovery rate under default. (a) (10 points) Given {PG,... P.G} and {P/....,P!}, derive a closed form formula for the credit spread, hi, at time i E {1,...,n} for Italy in terms of i, PG, and P;} . (b) (10 points) Under a two state markov chain model (solvency and default), write Italy's ith-year probability transition matrix, Pi, in terms of just i and hi. (c) (10 points) If the Italian government issues a one-off asset, A, that pays Ci, i = 1,...,n, at time i, find the price of this asset in terms of {1,...,n}, {h1,..., hn}, and {PG, ...,P.C}. (d) (10 points) First find an: A, then use this to say what would happen to the price of A given Italy's probability of default decreases