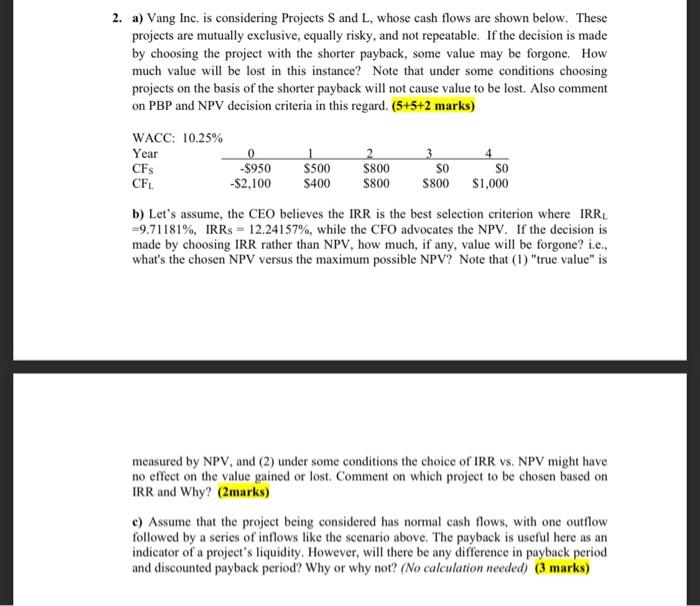

Question: 2. a) Vang Inc. is considering Projects and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable.

2. a) Vang Inc. is considering Projects and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the shorter payback, some value may be forgone. How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost. Also comment on PBP and NPV decision criteria in this regard. (5+5+2 marks) WACC: 10.25% Year 1 CFS -$950 $500 $800 SO CFL -$2,100 $400 $800 $1,000 b) Let's assume, the CEO believes the IRR is the best selection criterion where IRRL =9.71181%, IRRs = 12.24157%, while the CFO advocates the NPV. If the decision is made by choosing IRR rather than NPV, how much, if any, value will be forgone? i.e., what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is 0 SO 5800 measured by NPV, and (2) under some conditions the choice of IRR vs. NPV might have no effect on the value gained or lost. Comment on which project to be chosen based on IRR and Why? (2 marks) c) Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows like the scenario above. The payback is useful here as an indicator of a project's liquidity. However, will there be any difference in payback period and discounted payback period? Why or why not? (No calculation needed) (3 marks) 2. a) Vang Inc. is considering Projects and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the shorter payback, some value may be forgone. How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost. Also comment on PBP and NPV decision criteria in this regard. (5+5+2 marks) WACC: 10.25% Year 1 CFS -$950 $500 $800 SO CFL -$2,100 $400 $800 $1,000 b) Let's assume, the CEO believes the IRR is the best selection criterion where IRRL =9.71181%, IRRs = 12.24157%, while the CFO advocates the NPV. If the decision is made by choosing IRR rather than NPV, how much, if any, value will be forgone? i.e., what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is 0 SO 5800 measured by NPV, and (2) under some conditions the choice of IRR vs. NPV might have no effect on the value gained or lost. Comment on which project to be chosen based on IRR and Why? (2 marks) c) Assume that the project being considered has normal cash flows, with one outflow followed by a series of inflows like the scenario above. The payback is useful here as an indicator of a project's liquidity. However, will there be any difference in payback period and discounted payback period? Why or why not? (No calculation needed)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts