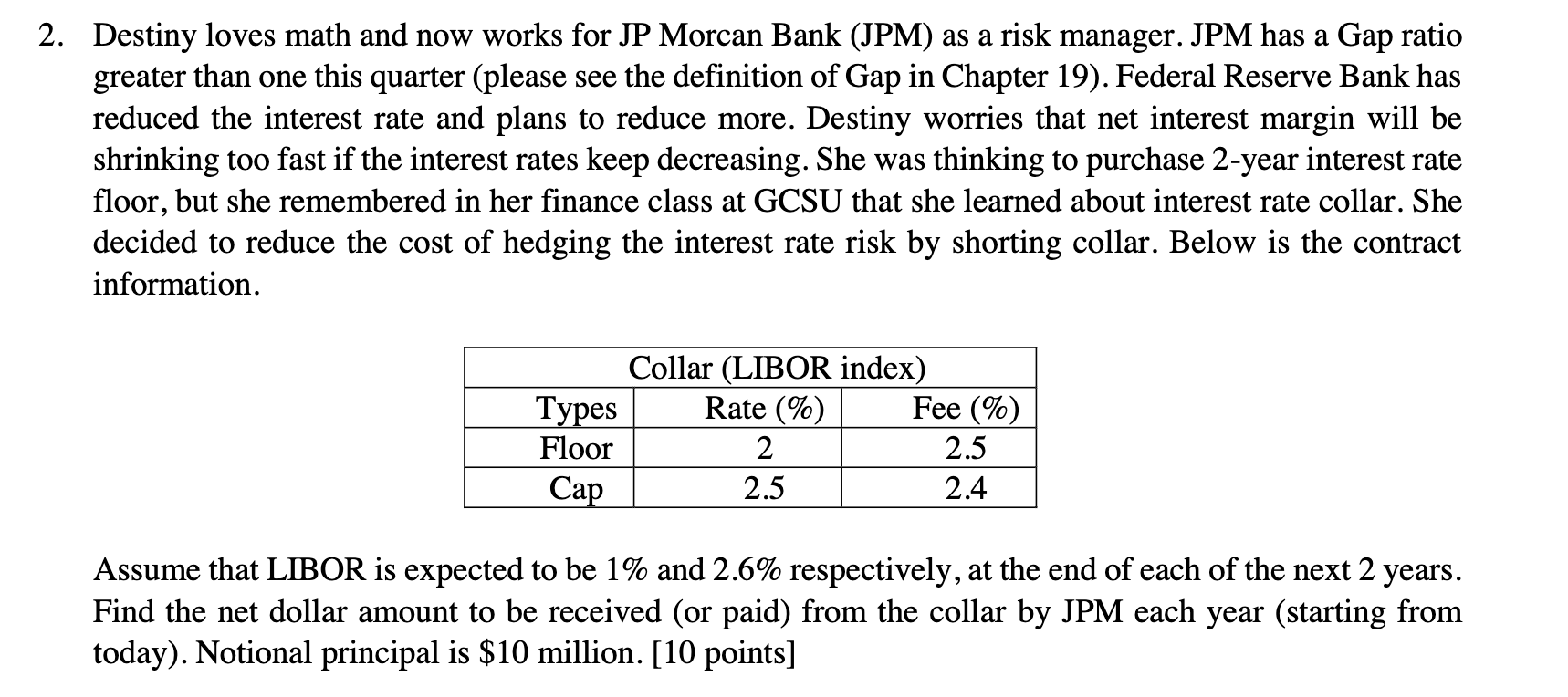

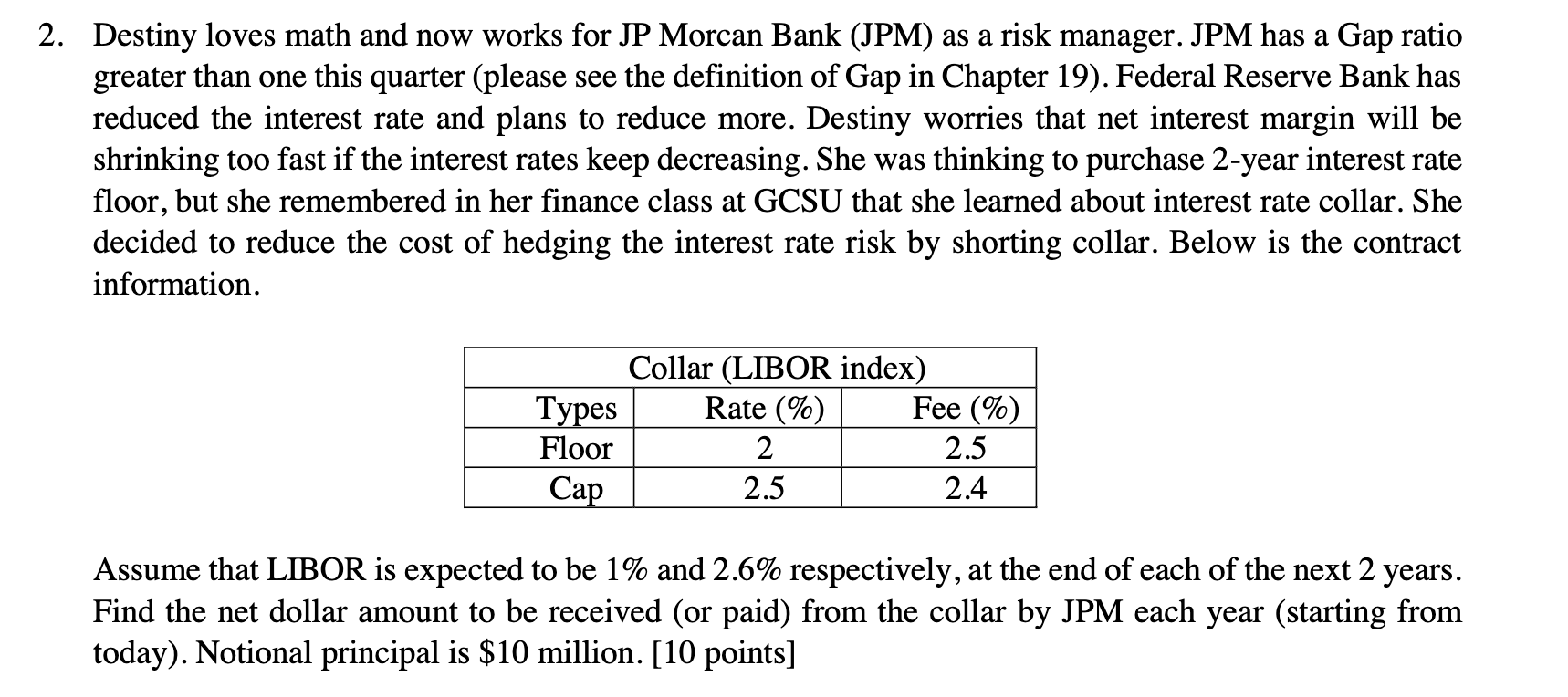

2. Destiny loves math and now works for JP Morcan Bank (JPM) as a risk manager. JPM has a Gap ratio greater than one this quarter (please see the definition of Gap in Chapter 19). Federal Reserve Bank has reduced the interest rate and plans to reduce more. Destiny worries that net interest margin will be shrinking too fast if the interest rates keep decreasing. She was thinking to purchase 2-year interest rate floor, but she remembered in her finance class at GCSU that she learned about interest rate collar. She decided to reduce the cost of hedging the interest rate risk by shorting collar. Below is the contract information. Collar (LIBOR index) Types Rate (%) Fee (%) Floor 2 2.5 Cap 2.5 2.4 Assume that LIBOR is expected to be 1% and 2.6% respectively, at the end of each of the next 2 years. Find the net dollar amount to be received (or paid) from the collar by JPM each year (starting from today). Notional principal is $10 million. [10 points] 2. Destiny loves math and now works for JP Morcan Bank (JPM) as a risk manager. JPM has a Gap ratio greater than one this quarter (please see the definition of Gap in Chapter 19). Federal Reserve Bank has reduced the interest rate and plans to reduce more. Destiny worries that net interest margin will be shrinking too fast if the interest rates keep decreasing. She was thinking to purchase 2-year interest rate floor, but she remembered in her finance class at GCSU that she learned about interest rate collar. She decided to reduce the cost of hedging the interest rate risk by shorting collar. Below is the contract information. Collar (LIBOR index) Types Rate (%) Fee (%) Floor 2 2.5 Cap 2.5 2.4 Assume that LIBOR is expected to be 1% and 2.6% respectively, at the end of each of the next 2 years. Find the net dollar amount to be received (or paid) from the collar by JPM each year (starting from today). Notional principal is $10 million. [10 points]