Answered step by step

Verified Expert Solution

Question

1 Approved Answer

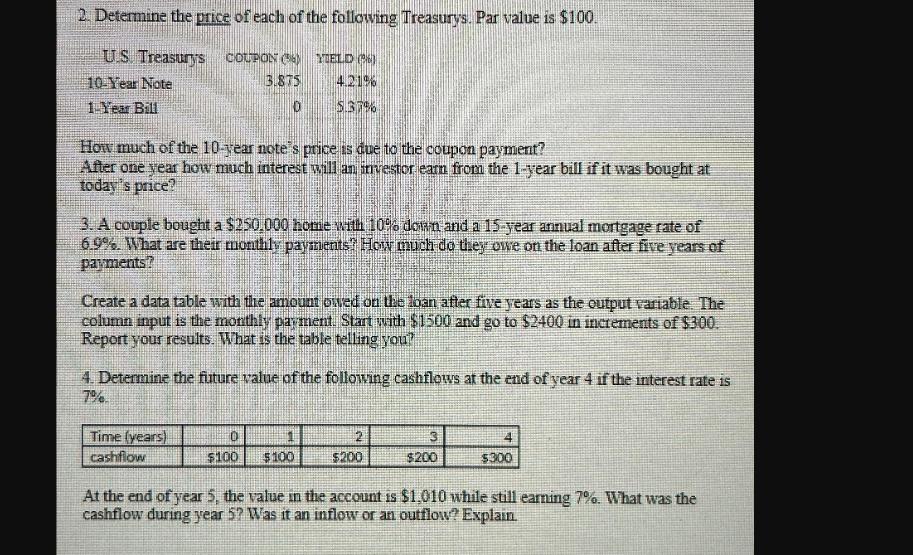

2. Determine the price of each of the following Treasurys. Par value is $100. US Treasurys COUPON (6) YIELD (8) 3.875 4.21% D 5.37%

2. Determine the price of each of the following Treasurys. Par value is $100. US Treasurys COUPON (6) YIELD (8) 3.875 4.21% D 5.37% 10-Year Note 1 Year Bill How much of the 10-year note's price is due to the coupon payment? After one year how much interest will an investor earn from the 1-year bill if it was bought at today's price? 3. A couple bought a $250.000 home with 10% down and a 15-year annual mortgage rate of 6.9%. What are their monthly payments? How much do they owe on the loan after five years of payments? Create a data table with the amount owed on the loan after five years as the output variable. The column input is the monthly payment. Start with $1500 and go to $2400 in increments of $300. Report your results. What is the table telling you? 4. Determine the future value of the following cashflows at the end of year 4 if the interest rate is 7%. Time (years) cashflow 0 $100 1 $100 2 $200 3 $200 $300 At the end of year 5, the value in the account is $1,010 while still earning 7%. What was the cashflow during year 5? Was it an inflow or an outflow? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Treasury Pricing and Analysis 2 Treasury Pricing 10Year Note Par value 100 Coupon rate 3875 Yield 421 1Year Bill Par value 100 Yield 537 Calculating t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started