Answered step by step

Verified Expert Solution

Question

1 Approved Answer

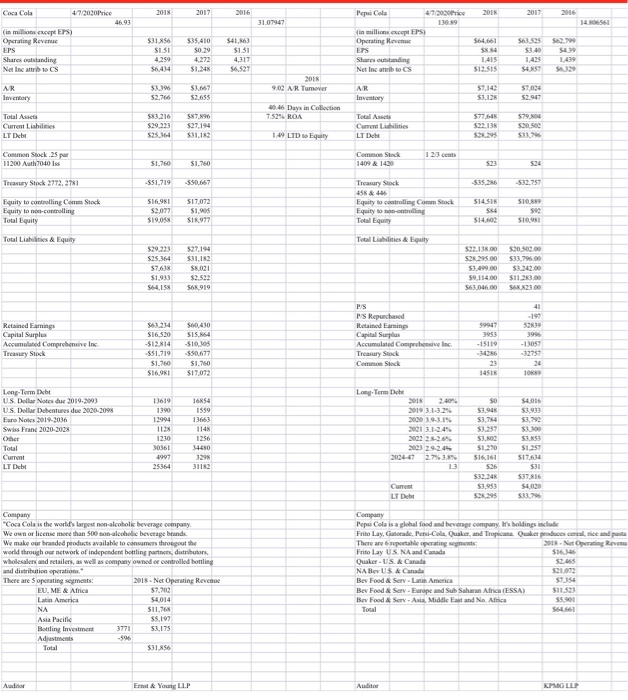

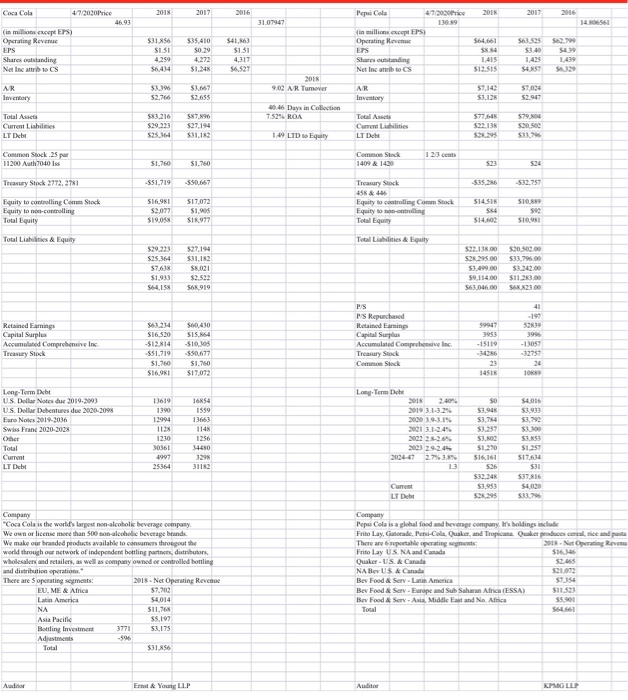

2. List the Operating Revenue for Coca Cola and Pepsi Cola for 2018, 2017 and 2016. Calculate the Year to Year percentage increase in Operating

2. List the Operating Revenue for Coca Cola and Pepsi Cola for 2018, 2017 and 2016. Calculate the Year to Year percentage increase in Operating Revenue for each company: 3. List the Earnings per Share for Coca Cola and Pepsi Cola for 2018, 2017 and 2016. Calculate the Year to Year percentage increase in Earnings per Share for each company:  2018 2017 2016 Pepa Cola 2018 2017 31.07947 130.9 14 Coca Cola 472020 Price 4693 (in millions except) Operating Revenue EPS Shares outstanding Net Incrocs $31.56 SI.SI 4.30 $6414 $63.525 $340 $35,410 $0.29 4272 S1.248 in millions scept EPS Operating Race EPS Shures standing Net Inc bocs $41,863 $1.SI 4,317 $6.527 $64.661 SX4 1.415 $12.515 $ 143 S485 S. $2.766 2015 9.02 AR Tumor AR Inventory $7.142 53.12 $2.655 $2.949 AR Inventory Total Assets Current Liabilities LTDb 10.46 Days in Collection 7.52% ROA $83.216 5.29.223 $25.367 $87.896 527,194 $31.12 Total Assets Current Les LT Date 57764 $22,13 SON 579.00 San SI 149 LTD Equity Common Stock 25 11200 Auth7040 Iss Comme Stock 1409 & 1430 51.700 $1.760 Treasury Stack 2772, 2781 -$51,719 -S$0,667 -$35.286 -58253 Equity to controlling CommStack Equity tone-controlling Total liquity $14.SI $16,931 $2.072 $19.058 Treasury Stock 458 & 445 Equity to controlling Cow Stack Equity to montrolling Total Equity $17,072 $1.2015 SIK 977 SIR Se S10 $14.000 Total Lib & Equity Total Lities & Equity 525364 57.638 $1,933 564158 52,194 $31,182 SK.021 $2.522 566919 $22.138.00 200 52.295.00 $33.796.00 S100 $12000 $9,114.00 SIIS 563,046,00 56% 23.00 Retained aming Capital Surplus Accumulated Comprehensive Inc Trasy Stock S430 SI5.864 -S10305 PS PS Repurchased Retained Earning Capital Susplus Accumulated Comprehensive Inc Treasury Stock Come Stock 59947 3953 -15119 -190 5230 399 -1105 $63214 $16.520 SI2814 -551,719 51.760 $16.981 S1,150 $17,072 14518 10 16854 1559 13663 Long Term Date 2018 2019 3.1.3.2% 2009.15 Long-Term Ibe US Dollar Notes de 2019-2003 U.S. Dollar Debentures due 2020-2098 Euro Notes 2019-2036 Swiss Franc 2020-2024 Other Total Current LT Debt 13619 1390 12994 1123 1230 30361 1997 25364 1256 34450 SO $3.945 53, $3.57 53,00 S1.270 $16161 526 $32.34 $3.953 $26.295 $4.018 $3.933 53 St 53S SI 253 SIA 531 $37. $4020 31182 1.3 Cum LT Debt Company "Coca Cola is the world's largest alcoholk beverage company We own or license meee than 500 non-alcoholic beverage brands We make our branded products wailable to consumers thropout the world through our network of independent bottling partners, distributors wholesalers and retailers, as well as company owned or controlled bottling and distribution operation. There are operating symets 2018. Net Operating Revenue EU, ME & Africa $7.202 Latin America $4.014 NA $11.768 Asia Pacific $5,197 Bottling Investment 3771 SUITS Adjustments Total $31.856 Company Pepsi Cola is a global food and beverage company. It's holdings include Frito Lay, Gatoradie. Perso-Cola Quaker, and Tropicana Quaker produces cereals and pasta There are reportable paratingements 2018. Reven Frito Lay US NA and Canada Quaker US & Canada $2.05 NA BUS & Canada $21.072 Bev Food & Serv - Latin America 57.354 Bev Food & Serv - Europe and SubSaharan Africa (ESSA) $11.923 Bev Food & Serv-Asia Middle East and Ne Africa SS.901 Total Audio Ernst & Young LLP Auditor

2018 2017 2016 Pepa Cola 2018 2017 31.07947 130.9 14 Coca Cola 472020 Price 4693 (in millions except) Operating Revenue EPS Shares outstanding Net Incrocs $31.56 SI.SI 4.30 $6414 $63.525 $340 $35,410 $0.29 4272 S1.248 in millions scept EPS Operating Race EPS Shures standing Net Inc bocs $41,863 $1.SI 4,317 $6.527 $64.661 SX4 1.415 $12.515 $ 143 S485 S. $2.766 2015 9.02 AR Tumor AR Inventory $7.142 53.12 $2.655 $2.949 AR Inventory Total Assets Current Liabilities LTDb 10.46 Days in Collection 7.52% ROA $83.216 5.29.223 $25.367 $87.896 527,194 $31.12 Total Assets Current Les LT Date 57764 $22,13 SON 579.00 San SI 149 LTD Equity Common Stock 25 11200 Auth7040 Iss Comme Stock 1409 & 1430 51.700 $1.760 Treasury Stack 2772, 2781 -$51,719 -S$0,667 -$35.286 -58253 Equity to controlling CommStack Equity tone-controlling Total liquity $14.SI $16,931 $2.072 $19.058 Treasury Stock 458 & 445 Equity to controlling Cow Stack Equity to montrolling Total Equity $17,072 $1.2015 SIK 977 SIR Se S10 $14.000 Total Lib & Equity Total Lities & Equity 525364 57.638 $1,933 564158 52,194 $31,182 SK.021 $2.522 566919 $22.138.00 200 52.295.00 $33.796.00 S100 $12000 $9,114.00 SIIS 563,046,00 56% 23.00 Retained aming Capital Surplus Accumulated Comprehensive Inc Trasy Stock S430 SI5.864 -S10305 PS PS Repurchased Retained Earning Capital Susplus Accumulated Comprehensive Inc Treasury Stock Come Stock 59947 3953 -15119 -190 5230 399 -1105 $63214 $16.520 SI2814 -551,719 51.760 $16.981 S1,150 $17,072 14518 10 16854 1559 13663 Long Term Date 2018 2019 3.1.3.2% 2009.15 Long-Term Ibe US Dollar Notes de 2019-2003 U.S. Dollar Debentures due 2020-2098 Euro Notes 2019-2036 Swiss Franc 2020-2024 Other Total Current LT Debt 13619 1390 12994 1123 1230 30361 1997 25364 1256 34450 SO $3.945 53, $3.57 53,00 S1.270 $16161 526 $32.34 $3.953 $26.295 $4.018 $3.933 53 St 53S SI 253 SIA 531 $37. $4020 31182 1.3 Cum LT Debt Company "Coca Cola is the world's largest alcoholk beverage company We own or license meee than 500 non-alcoholic beverage brands We make our branded products wailable to consumers thropout the world through our network of independent bottling partners, distributors wholesalers and retailers, as well as company owned or controlled bottling and distribution operation. There are operating symets 2018. Net Operating Revenue EU, ME & Africa $7.202 Latin America $4.014 NA $11.768 Asia Pacific $5,197 Bottling Investment 3771 SUITS Adjustments Total $31.856 Company Pepsi Cola is a global food and beverage company. It's holdings include Frito Lay, Gatoradie. Perso-Cola Quaker, and Tropicana Quaker produces cereals and pasta There are reportable paratingements 2018. Reven Frito Lay US NA and Canada Quaker US & Canada $2.05 NA BUS & Canada $21.072 Bev Food & Serv - Latin America 57.354 Bev Food & Serv - Europe and SubSaharan Africa (ESSA) $11.923 Bev Food & Serv-Asia Middle East and Ne Africa SS.901 Total Audio Ernst & Young LLP Auditor

2. List the Operating Revenue for Coca Cola and Pepsi Cola for 2018, 2017 and 2016.

Calculate the Year to Year percentage increase in Operating Revenue for each company:

3. List the Earnings per Share for Coca Cola and Pepsi Cola for 2018, 2017 and 2016.

Calculate the Year to Year percentage increase in Earnings per Share for each company:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started