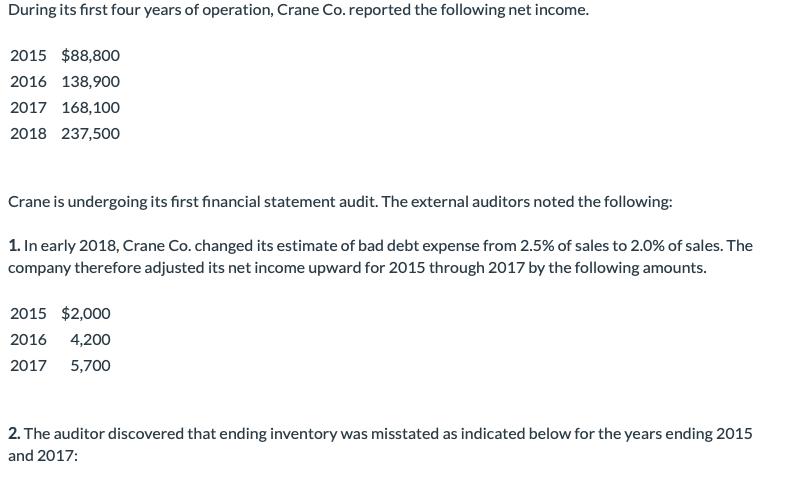

During its first four years of operation, Crane Co. reported the following net income. 2015 $88,800 2016 138,900 2017 168,100 2018 237,500 Crane is

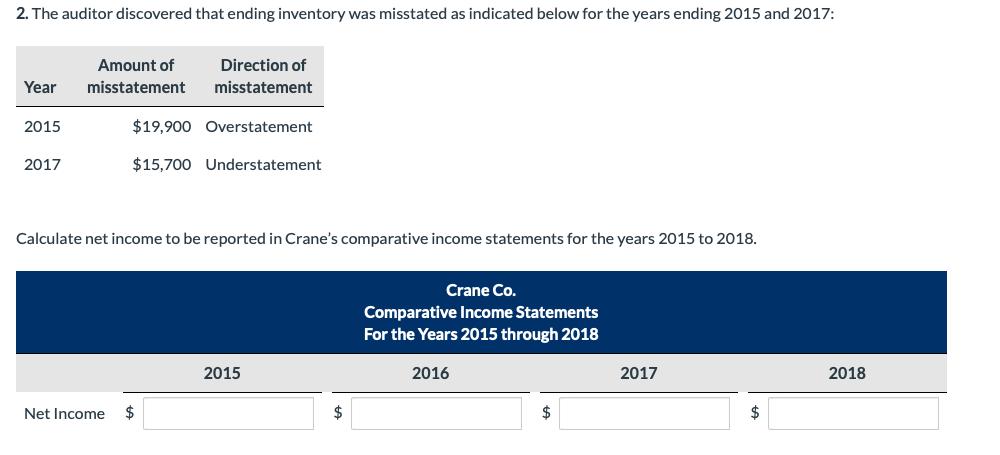

During its first four years of operation, Crane Co. reported the following net income. 2015 $88,800 2016 138,900 2017 168,100 2018 237,500 Crane is undergoing its first financial statement audit. The external auditors noted the following: 1. In early 2018, Crane Co. changed its estimate of bad debt expense from 2.5% of sales to 2.0% of sales. The company therefore adjusted its net income upward for 2015 through 2017 by the following amounts. 2015 $2,000 2016 4,200 2017 5,700 2. The auditor discovered that ending inventory was misstated as indicated below for the years ending 2015 and 2017: 2. The auditor discovered that ending inventory was misstated as indicated below for the years ending 2015 and 2017: Year 2015 2017 Amount of misstatement Net Income Direction of misstatement $19,900 Overstatement $15,700 Understatement Calculate net income to be reported in Crane's comparative income statements for the years 2015 to 2018. $ 2015 $ Crane Co. Comparative Income Statements For the Years 2015 through 2018 2016 $ 2017 $ 2018

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Income Before Adjustmet lessi Provision ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started