Answered step by step

Verified Expert Solution

Question

1 Approved Answer

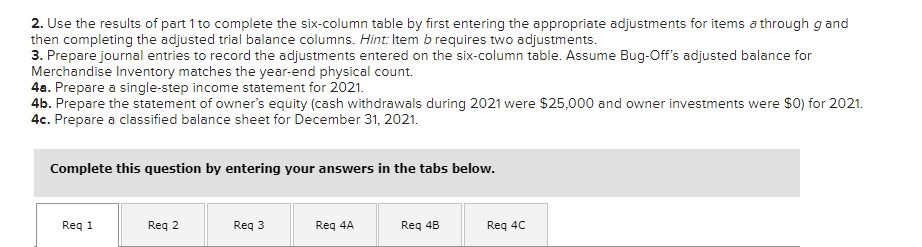

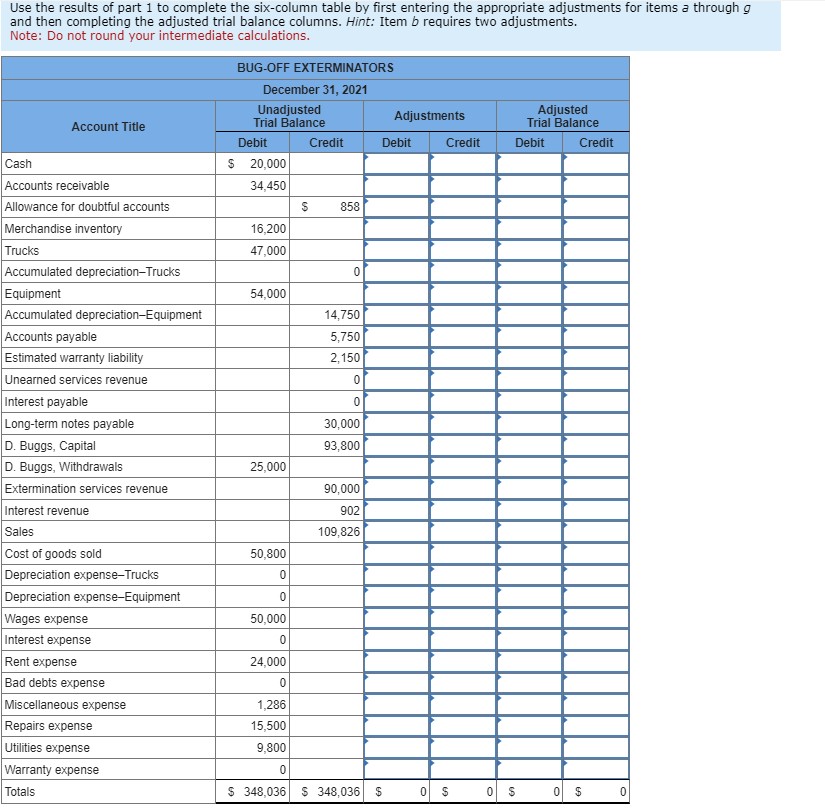

2. Use the results of part 1 to complete the six-column table by first entering the appropriate adjustments for items a through g and then

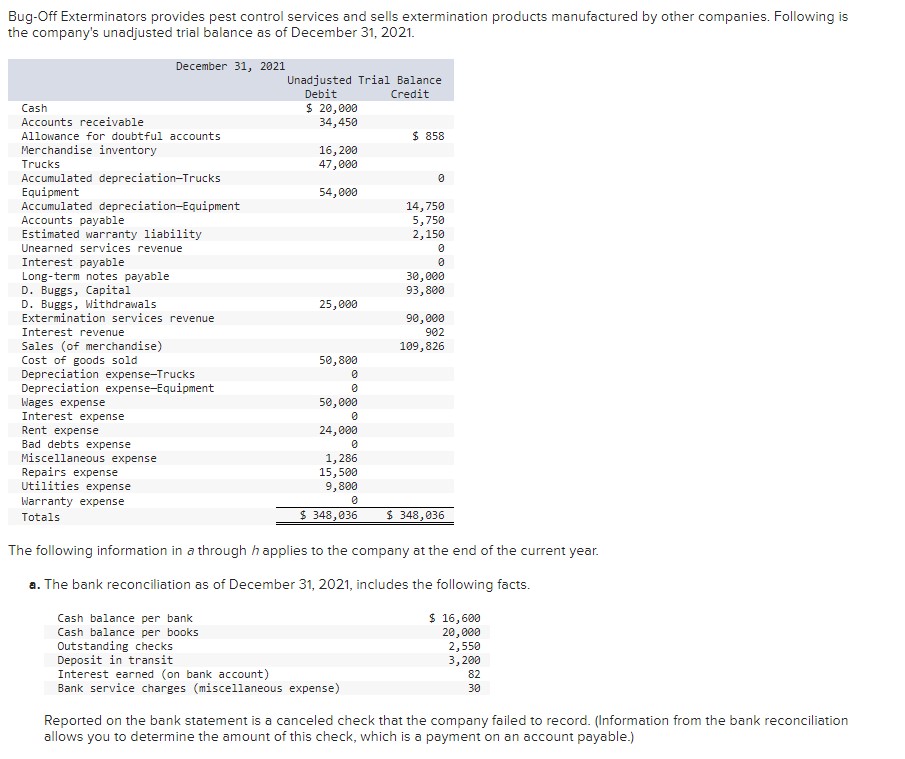

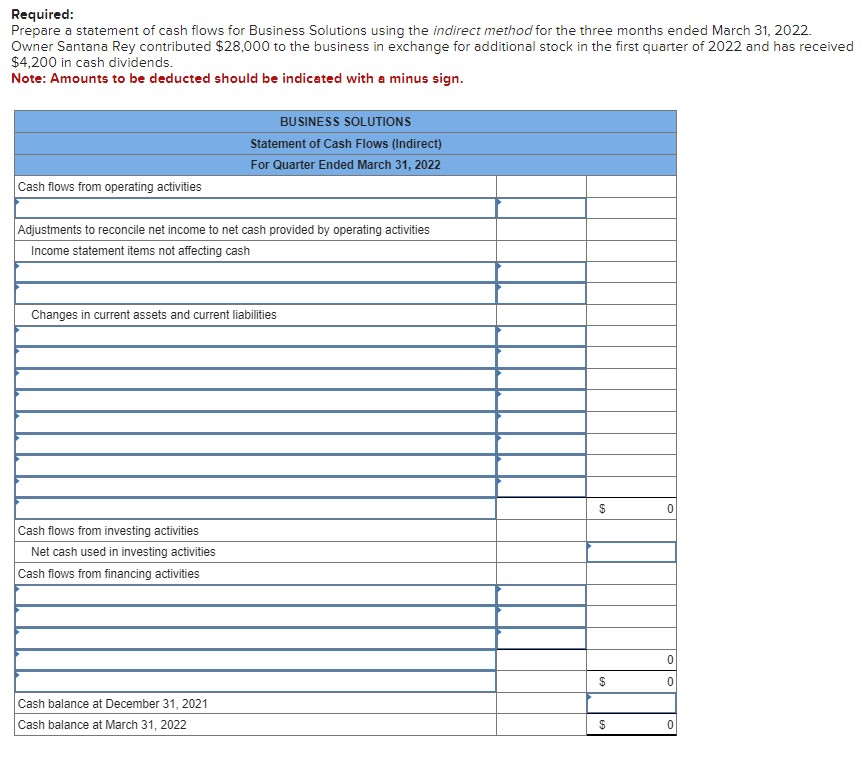

2. Use the results of part 1 to complete the six-column table by first entering the appropriate adjustments for items a through g and then completing the adjusted trial balance columns. Hint: Item b requires two adjustments. 3. Prepare journal entries to record the adjustments entered on the six-column table. Assume Bug-Off's adjusted balance for Merchandise Inventory matches the year-end physical count. 4a. Prepare a single-step income statement for 2021. 4b. Prepare the statement of owner's equity (cash withdrawals during 2021 were $25,000 and owner investments were $0 ) for 2021. 4c. Prepare a classified balance sheet for December 31, 2021. Complete this question by entering your answers in the tabs below. Required: Prepare a statement of cash flows for Business Solutions using the indirect method for the three months ended March 31,2022. Owner Santana Rey contributed $28,000 to the business in exchange for additional stock in the first quarter of 2022 and has received $4,200 in cash dividends. Note: Amounts to be deducted should be indicated with a minus sian. items a through g Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. Following is the company's unadjusted trial balance as of December 31, 2021. The following information in a through h applies to the company at the end of the current year. a. The bank reconciliation as of December 31,2021 , includes the following facts. Reported on the bank statement is a canceled check that the company failed to record. (Information from the bank reconciliation allows you to determine the amount of this check, which is a payment on an account payable.) 2. Use the results of part 1 to complete the six-column table by first entering the appropriate adjustments for items a through g and then completing the adjusted trial balance columns. Hint: Item b requires two adjustments. 3. Prepare journal entries to record the adjustments entered on the six-column table. Assume Bug-Off's adjusted balance for Merchandise Inventory matches the year-end physical count. 4a. Prepare a single-step income statement for 2021. 4b. Prepare the statement of owner's equity (cash withdrawals during 2021 were $25,000 and owner investments were $0 ) for 2021. 4c. Prepare a classified balance sheet for December 31, 2021. Complete this question by entering your answers in the tabs below. Required: Prepare a statement of cash flows for Business Solutions using the indirect method for the three months ended March 31,2022. Owner Santana Rey contributed $28,000 to the business in exchange for additional stock in the first quarter of 2022 and has received $4,200 in cash dividends. Note: Amounts to be deducted should be indicated with a minus sian. items a through g Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. Following is the company's unadjusted trial balance as of December 31, 2021. The following information in a through h applies to the company at the end of the current year. a. The bank reconciliation as of December 31,2021 , includes the following facts. Reported on the bank statement is a canceled check that the company failed to record. (Information from the bank reconciliation allows you to determine the amount of this check, which is a payment on an account payable.)

2. Use the results of part 1 to complete the six-column table by first entering the appropriate adjustments for items a through g and then completing the adjusted trial balance columns. Hint: Item b requires two adjustments. 3. Prepare journal entries to record the adjustments entered on the six-column table. Assume Bug-Off's adjusted balance for Merchandise Inventory matches the year-end physical count. 4a. Prepare a single-step income statement for 2021. 4b. Prepare the statement of owner's equity (cash withdrawals during 2021 were $25,000 and owner investments were $0 ) for 2021. 4c. Prepare a classified balance sheet for December 31, 2021. Complete this question by entering your answers in the tabs below. Required: Prepare a statement of cash flows for Business Solutions using the indirect method for the three months ended March 31,2022. Owner Santana Rey contributed $28,000 to the business in exchange for additional stock in the first quarter of 2022 and has received $4,200 in cash dividends. Note: Amounts to be deducted should be indicated with a minus sian. items a through g Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. Following is the company's unadjusted trial balance as of December 31, 2021. The following information in a through h applies to the company at the end of the current year. a. The bank reconciliation as of December 31,2021 , includes the following facts. Reported on the bank statement is a canceled check that the company failed to record. (Information from the bank reconciliation allows you to determine the amount of this check, which is a payment on an account payable.) 2. Use the results of part 1 to complete the six-column table by first entering the appropriate adjustments for items a through g and then completing the adjusted trial balance columns. Hint: Item b requires two adjustments. 3. Prepare journal entries to record the adjustments entered on the six-column table. Assume Bug-Off's adjusted balance for Merchandise Inventory matches the year-end physical count. 4a. Prepare a single-step income statement for 2021. 4b. Prepare the statement of owner's equity (cash withdrawals during 2021 were $25,000 and owner investments were $0 ) for 2021. 4c. Prepare a classified balance sheet for December 31, 2021. Complete this question by entering your answers in the tabs below. Required: Prepare a statement of cash flows for Business Solutions using the indirect method for the three months ended March 31,2022. Owner Santana Rey contributed $28,000 to the business in exchange for additional stock in the first quarter of 2022 and has received $4,200 in cash dividends. Note: Amounts to be deducted should be indicated with a minus sian. items a through g Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. Following is the company's unadjusted trial balance as of December 31, 2021. The following information in a through h applies to the company at the end of the current year. a. The bank reconciliation as of December 31,2021 , includes the following facts. Reported on the bank statement is a canceled check that the company failed to record. (Information from the bank reconciliation allows you to determine the amount of this check, which is a payment on an account payable.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started