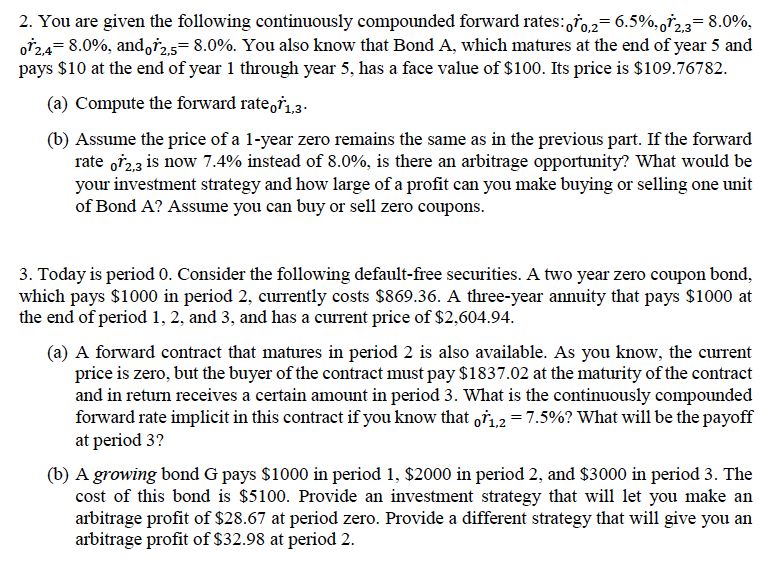

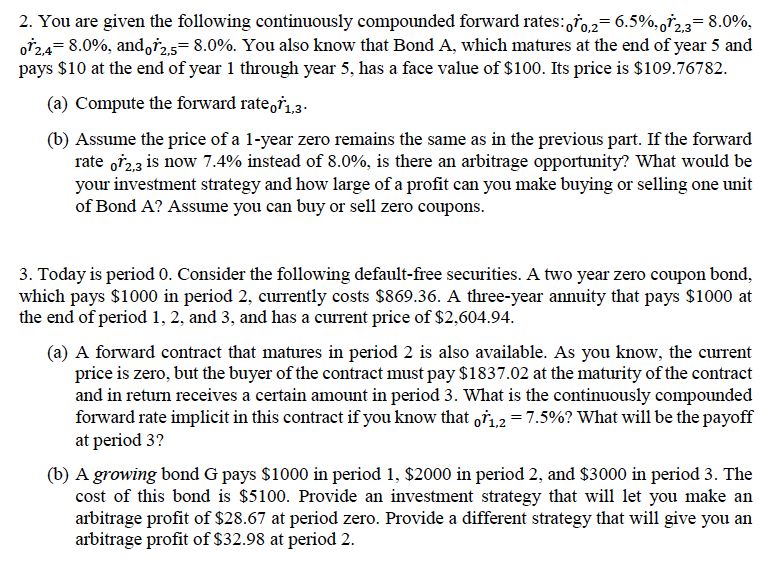

2. You are given the following continuously compounded forward rates: 070,2= 6.5%,o$2,3 = 8.0%, 072,4= 8.0%, and, 12,5= 8.0%. You also know that Bond A, which matures at the end of year 5 and pays $10 at the end of year 1 through year 5, has a face value of $100. Its price is $109.76782. (a) Compute the forward rate of 1,3- (b) Assume the price of a 1-year zero remains the same as in the previous part. If the forward rate of2,2 is now 7.4% instead of 8.0%, is there an arbitrage opportunity? What would be your investment strategy and how large of a profit can you make buying or selling one unit of Bond A? Assume you can buy or sell zero coupons. 3. Today is period 0. Consider the following default-free securities. A two year zero coupon bond, which pays $1000 in period 2, currently costs $869.36. A three-year annuity that pays $1000 at the end of period 1, 2, and 3, and has a current price of $2,604.94. (a) A forward contract that matures in period 2 is also available. As you know, the current price is zero, but the buyer of the contract must pay $1837.02 at the maturity of the contract and in return receives a certain amount in period 3. What is the continuously compounded forward rate implicit in this contract if you know that o1,2 = 7.5%? What will be the payoff at period 3? (b) A growing bond G pays $1000 in period 1, $2000 in period 2, and $3000 in period 3. The cost of this bond is $5100. Provide an investment strategy that will let you make an arbitrage profit of $28.67 at period zero. Provide a different strategy that will give you an arbitrage profit of $32.98 at period 2. 2. You are given the following continuously compounded forward rates: 070,2= 6.5%,o$2,3 = 8.0%, 072,4= 8.0%, and, 12,5= 8.0%. You also know that Bond A, which matures at the end of year 5 and pays $10 at the end of year 1 through year 5, has a face value of $100. Its price is $109.76782. (a) Compute the forward rate of 1,3- (b) Assume the price of a 1-year zero remains the same as in the previous part. If the forward rate of2,2 is now 7.4% instead of 8.0%, is there an arbitrage opportunity? What would be your investment strategy and how large of a profit can you make buying or selling one unit of Bond A? Assume you can buy or sell zero coupons. 3. Today is period 0. Consider the following default-free securities. A two year zero coupon bond, which pays $1000 in period 2, currently costs $869.36. A three-year annuity that pays $1000 at the end of period 1, 2, and 3, and has a current price of $2,604.94. (a) A forward contract that matures in period 2 is also available. As you know, the current price is zero, but the buyer of the contract must pay $1837.02 at the maturity of the contract and in return receives a certain amount in period 3. What is the continuously compounded forward rate implicit in this contract if you know that o1,2 = 7.5%? What will be the payoff at period 3? (b) A growing bond G pays $1000 in period 1, $2000 in period 2, and $3000 in period 3. The cost of this bond is $5100. Provide an investment strategy that will let you make an arbitrage profit of $28.67 at period zero. Provide a different strategy that will give you an arbitrage profit of $32.98 at period 2