Answered step by step

Verified Expert Solution

Question

1 Approved Answer

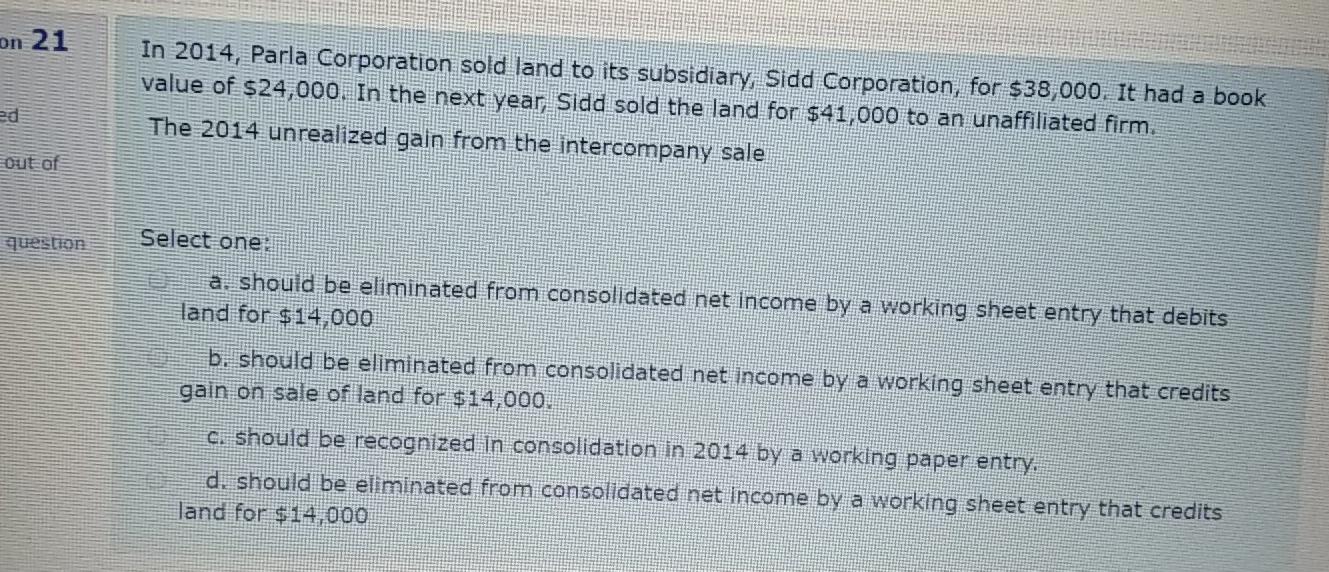

on 21 In 2014, Parla Corporation sold land to its subsidiary, Sidd Corporation, for $38,000. It had a book value of $24,000. In the next

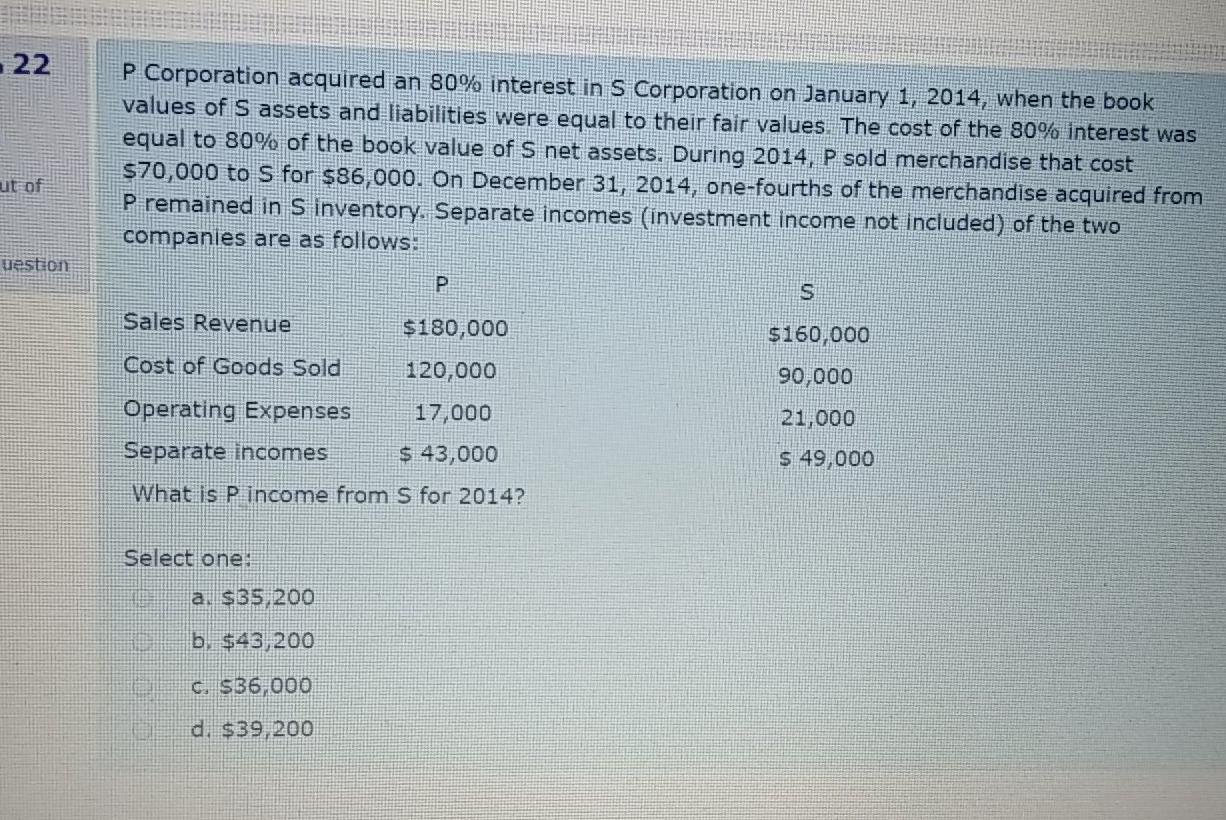

on 21 In 2014, Parla Corporation sold land to its subsidiary, Sidd Corporation, for $38,000. It had a book value of $24,000. In the next year Sidd sold the land for $41,000 to an unaffiliated firm. The 2014 unrealized gain from the intercompany sale out of question Select one a. should be eliminated from consolidated net income by a working sheet entry that debits land for $14,000 b. should be eliminated from consolidated net income by a working sheet entry that credits gain on sale of land for $14,000. c. should be recognized in consolidation in 2014 by a working paper entry. d. should be eliminated from consolidated net Income by a working sheet entry that credits land for $14,000 22 P Corporation acquired an 80% interest in S Corporation on January 1, 2014, when the book values of S assets and liabilities were equal to their fair values. The cost of the 80% interest was equal to 80% of the book value of S net assets. During 2014, P sold merchandise that cost $70,000 to S for $86,000. On December 31, 2014, one-fourths of the merchandise acquired from P remained in S Inventory. Separate incomes (investment income not included) of the two companies are as follows: ut of Weston P S Sales Revenue $180,000 $160,000 cost of Goods Sold 120,000 90,000 21,000 Operating Expenses 17,000 Separate incomes $ 43,000 What is P income from S for 2014? $ 49,000 Select one: a. $35,200 b $45) 200 C. $36,000 d $39,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started