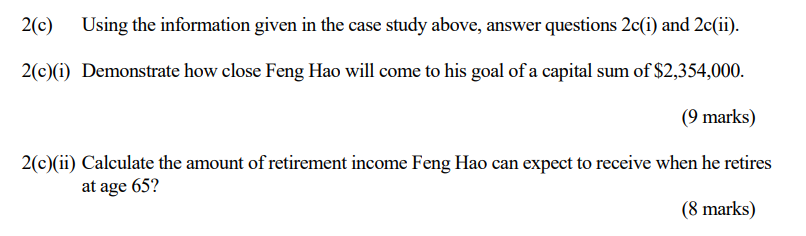

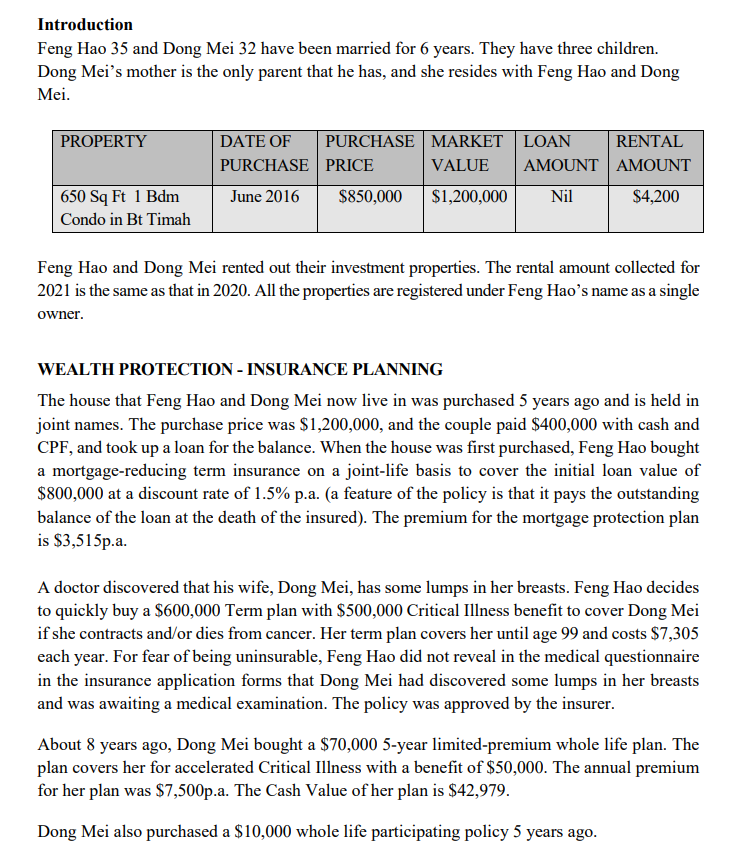

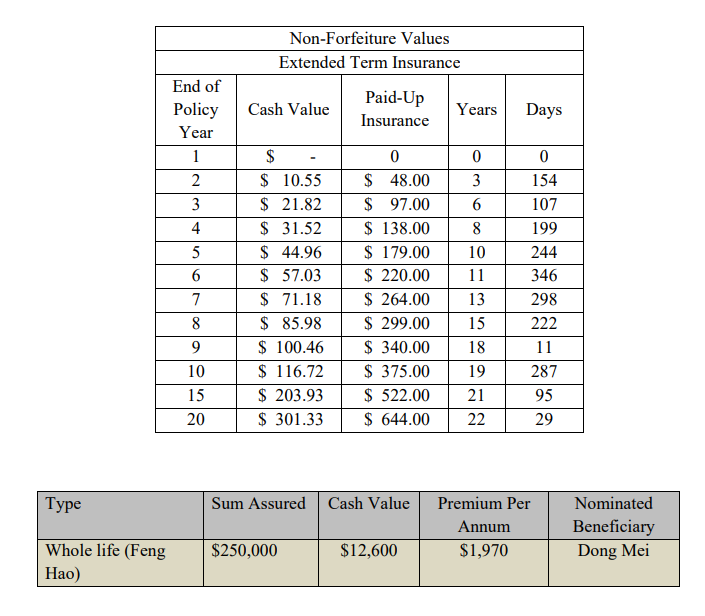

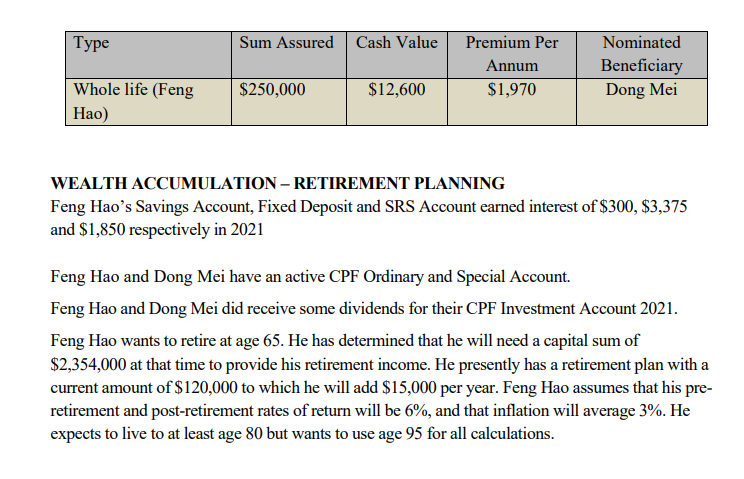

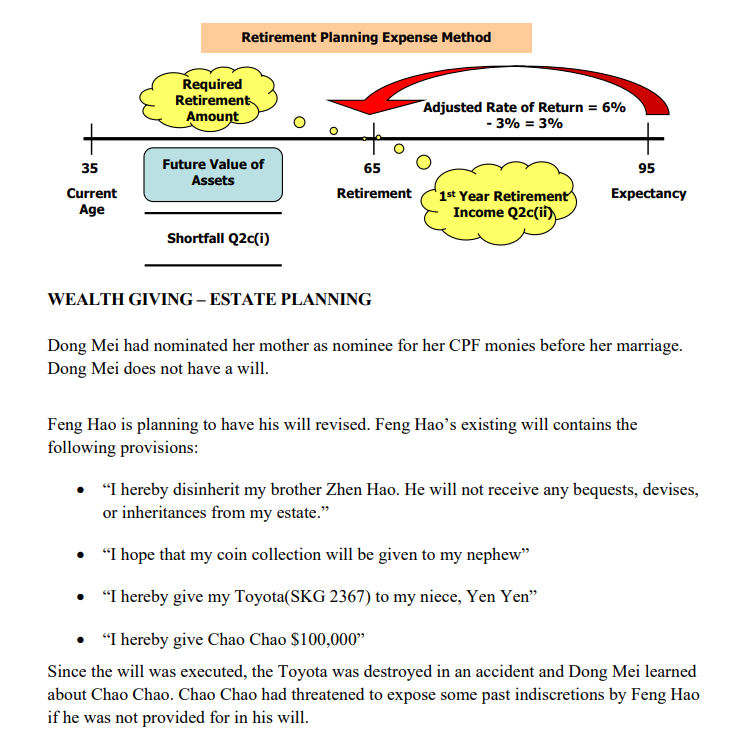

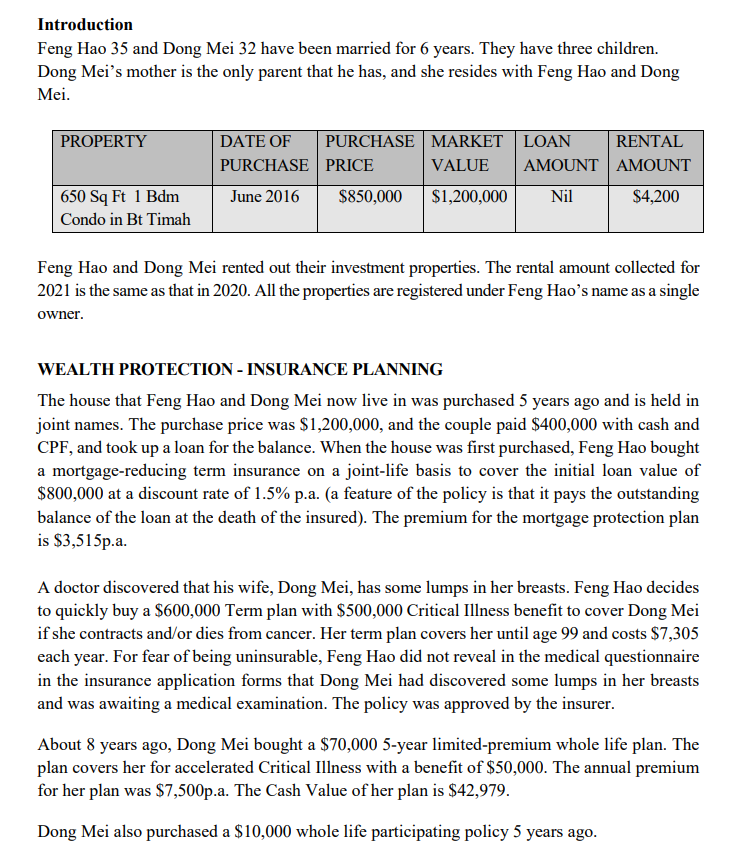

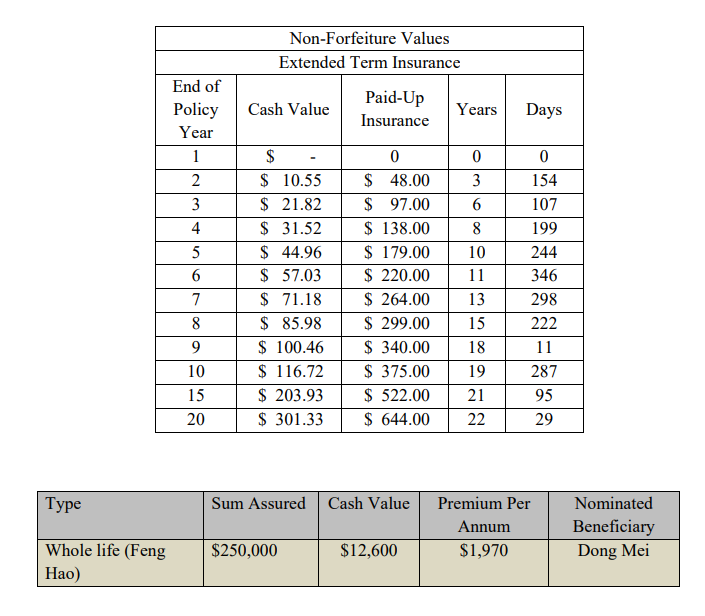

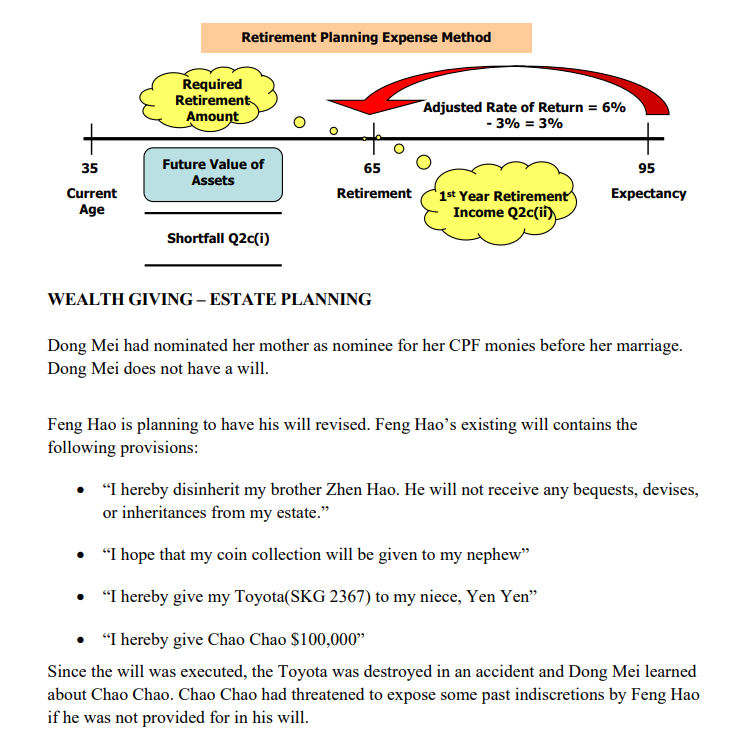

20) Using the information given in the case study above, answer questions 2c(i) and 2c(ii). 2)(i) Demonstrate how close Feng Hao will come to his goal of a capital sum of $2,354,000. (9 marks) 2(c)(ii) Calculate the amount of retirement income Feng Hao can expect to receive when he retires at age 65? (8 marks) Introduction Feng Hao 35 and Dong Mei 32 have been married for 6 years. They have three children. Dong Mei's mother is the only parent that he has, and she resides with Feng Hao and Dong Mei. PROPERTY DATE OF PURCHASE MARKET LOAN RENTAL PURCHASE PRICE VALUE AMOUNT AMOUNT June 2016 $850,000 $1,200,000 Nil $4,200 650 Sq Ft 1 Bdm Condo in Bt Timah Feng Hao and Dong Mei rented out their investment properties. The rental amount collected for 2021 is the same as that in 2020. All the properties are registered under Feng Hao's name as a single owner. WEALTH PROTECTION - INSURANCE PLANNING The house that Feng Hao and Dong Mei now live in was purchased 5 years ago and is held in joint names. The purchase price was $1,200,000, and the couple paid $400,000 with cash and CPF, and took up a loan for the balance. When the house was first purchased, Feng Hao bought a mortgage-reducing term insurance on a joint-life basis to cover the initial loan value of $800,000 at a discount rate of 1.5% p.a. (a feature of the policy is that it pays the outstanding balance of the loan at the death of the insured). The premium for the mortgage protection plan is $3,515p.a. A doctor discovered that his wife, Dong Mei, has some lumps in her breasts. Feng Hao decides to quickly buy a $600,000 Term plan with $500,000 Critical Illness benefit to cover Dong Mei if she contracts and/or dies from cancer. Her term plan covers her until age 99 and costs $7,305 each year. For fear of being uninsurable, Feng Hao did not reveal in the medical questionnaire in the insurance application forms that Dong Mei had discovered some lumps in her breasts and was awaiting a medical examination. The policy was approved by the insurer. About 8 years ago, Dong Mei bought a $70,000 5-year limited-premium whole life plan. The plan covers her for accelerated Critical Illness with a benefit of $50,000. The annual premium for her plan was $7,500p.a. The Cash Value of her plan is $42,979. Dong Mei also purchased a $10,000 whole life participating policy 5 years ago. Non-Forfeiture Values Extended Term Insurance Cash Value Paid-Up Insurance Years Days 0 End of Policy Year 1 2 3 4 5 6 7 8 9 10 15 20 $ $ 10.55 $ 21.82 $ 31.52 $ 44.96 $ 57.03 $ 71.18 $ 85.98 $ 100.46 $ 116.72 $ 203.93 $ 301.33 0 $ 48.00 $ 97.00 $ 138.00 $ 179.00 $ 220.00 $ 264.00 $ 299.00 $ 340.00 $ 375.00 $ 522.00 $ 644.00 0 3 6 8 10 11 13 15 18 19 21 22 154 107 199 244 346 298 222 11 287 95 29 Type Sum Assured Cash Value Premium Per Annum $1,970 Nominated Beneficiary Dong Mei $250,000 $12,600 Whole life (Feng Hao) Type Sum Assured Cash Value Premium Per Annum $1,970 Nominated Beneficiary Dong Mei $250,000 $12,600 Whole life (Feng Hao) WEALTH ACCUMULATION - RETIREMENT PLANNING Feng Haos Savings Account, Fixed Deposit and SRS Account earned interest of $300, $3,375 and $1,850 respectively in 2021 Feng Hao and Dong Mei have an active CPF Ordinary and Special Account. Feng Hao and Dong Mei did receive some dividends for their CPF Investment Account 2021. Feng Hao wants to retire at age 65. He has determined that he will need a capital sum of $2,354,000 at that time to provide his retirement income. He presently has a retirement plan with a current amount of $120,000 to which he will add $15,000 per year. Feng Hao assumes that his pre- retirement and post-retirement rates of return will be 6%, and that inflation will average 3%. He expects to live to at least age 80 but wants to use age 95 for all calculations. Retirement Planning Expense Method Required Retirement Amount Adjusted Rate of Return = 6% - 3% = 3% + + + 35 Current Age Future Value of Assets 65 Retirement 95 Expectancy * 1st Year Retirement Income Q2c(in) Shortfall Q2c() WEALTH GIVING-ESTATE PLANNING Dong Mei had nominated her mother as nominee for her CPF monies before her marriage. Dong Mei does not have a will. Feng Hao is planning to have his will revised. Feng Hao's existing will contains the following provisions: "I hereby disinherit my brother Zhen Hao. He will not receive any bequests, devises, or inheritances from my estate. I hope that my coin collection will be given to my nephew" I hereby give my Toyota(SKG 2367) to my niece, Yen Yen I hereby give Chao Chao $100,000" Since the will was executed, the Toyota was destroyed in an accident and Dong Mei learned about Chao Chao. Chao Chao had threatened to expose some past indiscretions by Feng Hao if he was not provided for in his will. 20) Using the information given in the case study above, answer questions 2c(i) and 2c(ii). 2)(i) Demonstrate how close Feng Hao will come to his goal of a capital sum of $2,354,000. (9 marks) 2(c)(ii) Calculate the amount of retirement income Feng Hao can expect to receive when he retires at age 65? (8 marks) Introduction Feng Hao 35 and Dong Mei 32 have been married for 6 years. They have three children. Dong Mei's mother is the only parent that he has, and she resides with Feng Hao and Dong Mei. PROPERTY DATE OF PURCHASE MARKET LOAN RENTAL PURCHASE PRICE VALUE AMOUNT AMOUNT June 2016 $850,000 $1,200,000 Nil $4,200 650 Sq Ft 1 Bdm Condo in Bt Timah Feng Hao and Dong Mei rented out their investment properties. The rental amount collected for 2021 is the same as that in 2020. All the properties are registered under Feng Hao's name as a single owner. WEALTH PROTECTION - INSURANCE PLANNING The house that Feng Hao and Dong Mei now live in was purchased 5 years ago and is held in joint names. The purchase price was $1,200,000, and the couple paid $400,000 with cash and CPF, and took up a loan for the balance. When the house was first purchased, Feng Hao bought a mortgage-reducing term insurance on a joint-life basis to cover the initial loan value of $800,000 at a discount rate of 1.5% p.a. (a feature of the policy is that it pays the outstanding balance of the loan at the death of the insured). The premium for the mortgage protection plan is $3,515p.a. A doctor discovered that his wife, Dong Mei, has some lumps in her breasts. Feng Hao decides to quickly buy a $600,000 Term plan with $500,000 Critical Illness benefit to cover Dong Mei if she contracts and/or dies from cancer. Her term plan covers her until age 99 and costs $7,305 each year. For fear of being uninsurable, Feng Hao did not reveal in the medical questionnaire in the insurance application forms that Dong Mei had discovered some lumps in her breasts and was awaiting a medical examination. The policy was approved by the insurer. About 8 years ago, Dong Mei bought a $70,000 5-year limited-premium whole life plan. The plan covers her for accelerated Critical Illness with a benefit of $50,000. The annual premium for her plan was $7,500p.a. The Cash Value of her plan is $42,979. Dong Mei also purchased a $10,000 whole life participating policy 5 years ago. Non-Forfeiture Values Extended Term Insurance Cash Value Paid-Up Insurance Years Days 0 End of Policy Year 1 2 3 4 5 6 7 8 9 10 15 20 $ $ 10.55 $ 21.82 $ 31.52 $ 44.96 $ 57.03 $ 71.18 $ 85.98 $ 100.46 $ 116.72 $ 203.93 $ 301.33 0 $ 48.00 $ 97.00 $ 138.00 $ 179.00 $ 220.00 $ 264.00 $ 299.00 $ 340.00 $ 375.00 $ 522.00 $ 644.00 0 3 6 8 10 11 13 15 18 19 21 22 154 107 199 244 346 298 222 11 287 95 29 Type Sum Assured Cash Value Premium Per Annum $1,970 Nominated Beneficiary Dong Mei $250,000 $12,600 Whole life (Feng Hao) Type Sum Assured Cash Value Premium Per Annum $1,970 Nominated Beneficiary Dong Mei $250,000 $12,600 Whole life (Feng Hao) WEALTH ACCUMULATION - RETIREMENT PLANNING Feng Haos Savings Account, Fixed Deposit and SRS Account earned interest of $300, $3,375 and $1,850 respectively in 2021 Feng Hao and Dong Mei have an active CPF Ordinary and Special Account. Feng Hao and Dong Mei did receive some dividends for their CPF Investment Account 2021. Feng Hao wants to retire at age 65. He has determined that he will need a capital sum of $2,354,000 at that time to provide his retirement income. He presently has a retirement plan with a current amount of $120,000 to which he will add $15,000 per year. Feng Hao assumes that his pre- retirement and post-retirement rates of return will be 6%, and that inflation will average 3%. He expects to live to at least age 80 but wants to use age 95 for all calculations. Retirement Planning Expense Method Required Retirement Amount Adjusted Rate of Return = 6% - 3% = 3% + + + 35 Current Age Future Value of Assets 65 Retirement 95 Expectancy * 1st Year Retirement Income Q2c(in) Shortfall Q2c() WEALTH GIVING-ESTATE PLANNING Dong Mei had nominated her mother as nominee for her CPF monies before her marriage. Dong Mei does not have a will. Feng Hao is planning to have his will revised. Feng Hao's existing will contains the following provisions: "I hereby disinherit my brother Zhen Hao. He will not receive any bequests, devises, or inheritances from my estate. I hope that my coin collection will be given to my nephew" I hereby give my Toyota(SKG 2367) to my niece, Yen Yen I hereby give Chao Chao $100,000" Since the will was executed, the Toyota was destroyed in an accident and Dong Mei learned about Chao Chao. Chao Chao had threatened to expose some past indiscretions by Feng Hao if he was not provided for in his will