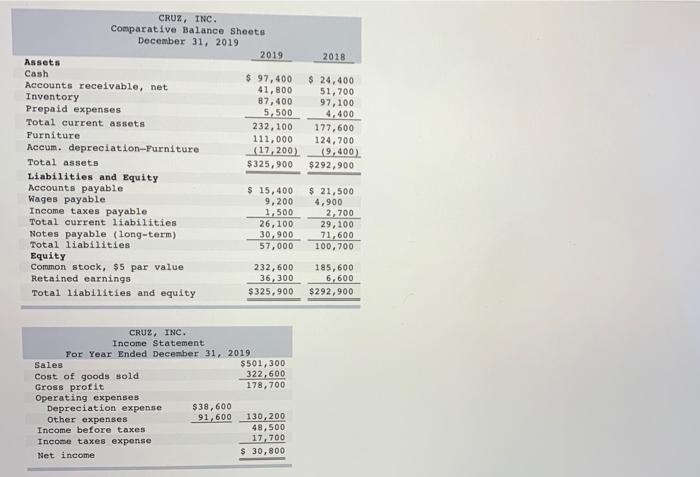

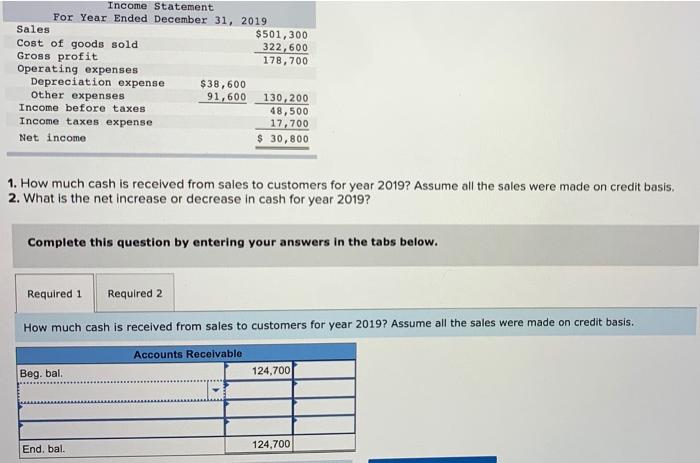

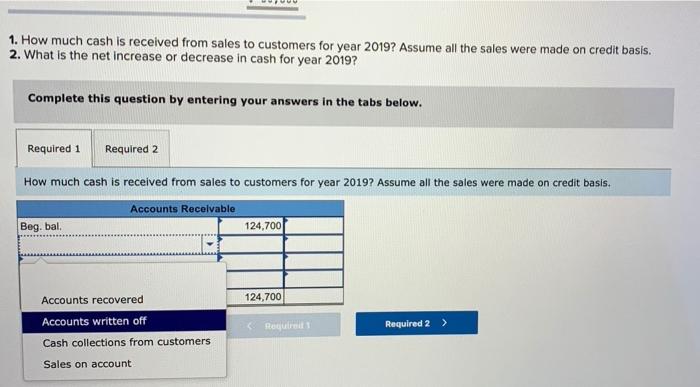

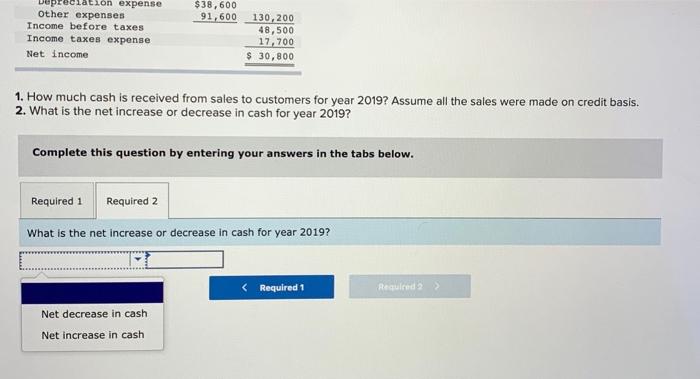

2018 CRUZ, INC. Comparative Balance Sheets December 31, 2019 2019 Assets Cash $ 97,400 Accounts receivable, net 41,800 Inventory 87,400 Prepaid expenses 5,500 Total current assets 232, 100 Furniture 111,000 Accum. depreciation-Furniture (17,200) Total assets $325,900 Liabilities and Equity Accounts payable $ 15,400 Wages payable 9, 200 Income taxes payable 1,500 Total current liabilities 26.100 Notes payable (long-term) 30,900 Total liabilities 57,000 Equity Common stock, $5 par value 232,600 Retained earnings 36,300 Total liabilities and equity $325,900 $ 24,400 51,700 97,100 4.400 177,600 124,700 (9,400) $292,900 $ 21,500 4,900 2,700 29,100 71,600 100,700 185,600 6,600 $292,900 CRUZ, INC. Income Statement For Year Ended December 31, 2019 Sales $501,300 Cost of goods sold 322,600 Gross profit 178,700 Operating expenses Depreciation expense $38,600 Other expenses 91,600 130,200 Income before taxes 48,500 Income taxes expense 17,700 Net income $ 30,000 Income Statement For Year Ended December 31, 2019 Sales $501,300 Cost of goods sold 322,600 Gross profit 178, 700 Operating expenses Depreciation expense $38,600 other expenses 91,600 130,200 Income before taxes 48,500 Income taxes expense 17,700 Net income $ 30,800 1. How much cash is received from sales to customers for year 2019? Assume all the sales were made on credit basis. 2. What is the net increase or decrease in cash for year 2019? Complete this question by entering your answers in the tabs below. Required 1 Required 2 How much cash is received from sales to customers for year 2019? Assume all the sales were made on credit basis. Accounts Receivable 124,700 Beg. bal. End, bal. 124,700 1. How much cash is received from sales to customers for year 2019? Assume all the sales were made on credit basis. 2. What is the net increase or decrease in cash for year 2019? Complete this question by entering your answers in the tabs below. Required 1 Required 2 How much cash is received from sales to customers for year 2019? Assume all the sales were made on credit basis. Accounts Recolvable Beg. bal 124,700 Accounts recovered 124,700 Accounts written off Required Required 2 > Cash collections from customers Sales on account eciation expense Other expenses Income before taxes Income taxes expense $38,600 91,600 130,200 48,500 17,700 Net income $ 30,800 1. How much cash is received from sales to customers for year 2019? Assume all the sales were made on credit basis. 2. What is the net increase or decrease in cash for year 2019? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the net increase or decrease in cash for year 2019?