Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you give the answer and its explanation 5. Amortizing the discounts on bond payable: Reduces the annual cash payment for interest. Is necessary only

can you give the answer and its explanation

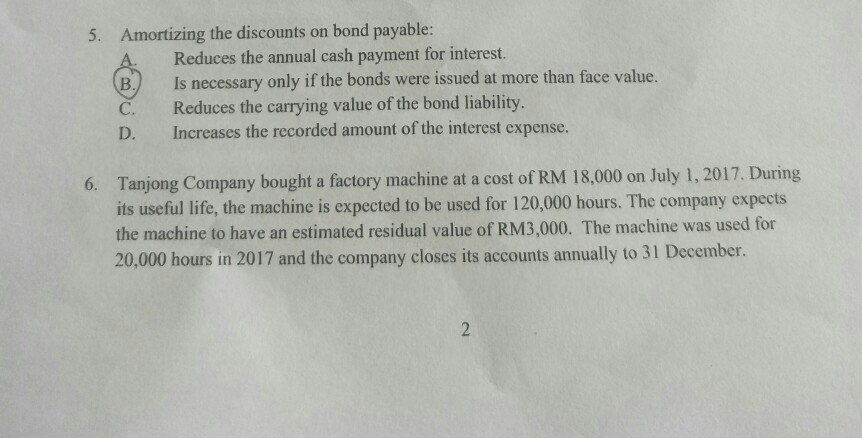

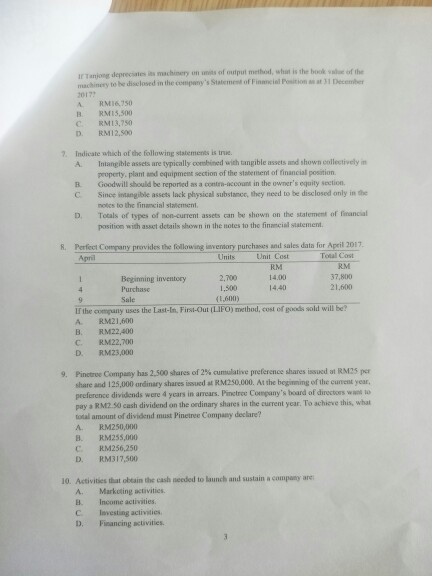

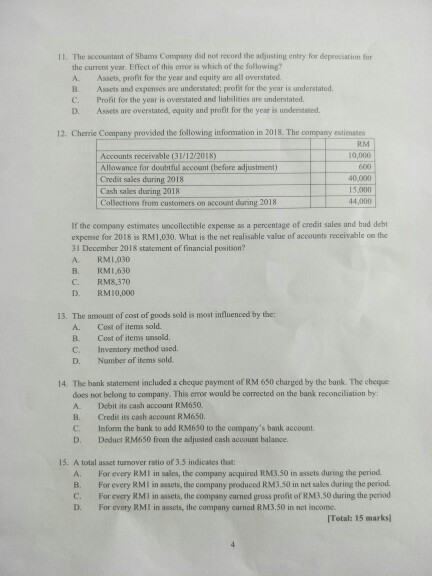

5. Amortizing the discounts on bond payable: Reduces the annual cash payment for interest. Is necessary only if the bonds were issued at more than face value. Reduces the carrying value of the bond liability. Increases the recorded amount of the interest expense. B. C. D. Tanjong Company bought a factory machine at a cost of RM 18,000 on July 1, 2017. During its useful life, the machine is expected to be used for 120,000 hours. The company expects the machine to have an estimated residual value of RM3,000. The machine was used for 6. 20,000 hours in 2017 and the company closes its accounts annually to 31 December. IrTanjong deprecsates is machinery on umits of output method, what is the book val f the machinery to be disclosed in the company's Statement of Finmeial Position a at 31 Decenber 2017 RMI6750 RMI5.500 A. B. C. RMI3,750 RM12.500 D. 7. Indicate which of the following statements is true. Intangible assets are typically combined with tangible assets and shown collectively in property, plant and equipment section of the statement of financial position. Goodwill should be reported s a contra-acount in the owner's equity section. Since intangible assets lack physical substance, they need to be disclosed only in the A. B. C. notes to the financial statement. Totals of types of non-current assets can be shown on the statement of financial position with asset details shown in the notes to the financial statement. D. R. Perfect Company provides the following inventory purchases and sales data for April 2017. Units Unit Cost Total Cost April RM 37,800 Beginning inventory Purchase 2,700 1,500 14.00 21.600 14.40 4. (1,600) If the company uses the Last-In. First-Out (LIFO) method, cost of goods sold will be? Sale RM21,600 RM22,400 A. B. RM22, N00 RM23,000 C. D. Pinctroe Company has 2,500 shares of 2% cumulative preference shares issued at RM25 per share and 125,000 ordinary shares issued at RM250.000. At the beginning of the cunent year, preference dividends were 4 years in arrears. Pinetree Company's board of directors want lo 9. pay a RM2.50 cash dividend on the ordinary shares in the current year. To achieve this, whal total amount of dividend must Pinetree Company declare? RM250,000 RM255,000 A. B. RM256,250 C. D. RM317,500 10. Activities that obtain the cash needed to launch and sustain a company are Marketing activities. Income activities. A. Investing activities. Financing activities C. D. 11. The sccountant of Shams Company did not record the adjusting entry for depreciation for the current year. Eflect of this error is which of the following? Assets, profit for the year and equity are all overstated. Assets and expenses are understated; profit for the year is understated. Profit for the year is overstated and liabilities are understated. Assets are overstated, equity and profit for the year is undenstated. A. B. C. D. 12. Cherrie Company provided the following information in 2018. The company estimates RM 10,000 Accounts receivable (31/12/2018) Allowance for doubtful account (before adjustment) Credit sales during 2018 600 40.000 15.000 Cash sales duuring 2018 44,000 Collections from customers on account during 2018 If the company estimates uncollectible expense as a percentage of credit sales and bad debt expense for 2018 is RM1,030. What is the net realisable value of accounts receivable on the 31 December 2018 statement of financial position? RMI,030 B. RM1.630 C. RM8,370 D. RMI0,000 13. The amount of cost of goods sold is most influenced by the: A. Cost of items sold. Cost of items unsold. Inventory method used. Number of items sold. B. C. D. 14. The bank statement included a cheque payment of RM 650 charged by the bank. The cheque does not belong to company. This error would be corrected on the bank reconciliation by: Debit its cash account RM650 A. B. Credit its cash account RM650, Inform the bank to add RM650 to the company's bank account. C. D. Deduct RM650 from the adjusted cash account balance. 15. A total asset turmover ratio of 3,5 indicates that: For every RMI in sales, the company acquired RMS,50 in assets during the period. For every RMI in assets, the company produced RM3.50 in net sales during the period. For every RMI in assets, the company earned gross profit of RM3.50 during the period For every RMI in assets, the company carned RM3.50 in net income. A. B. C. D. [Total: 15 marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started