Answered step by step

Verified Expert Solution

Question

1 Approved Answer

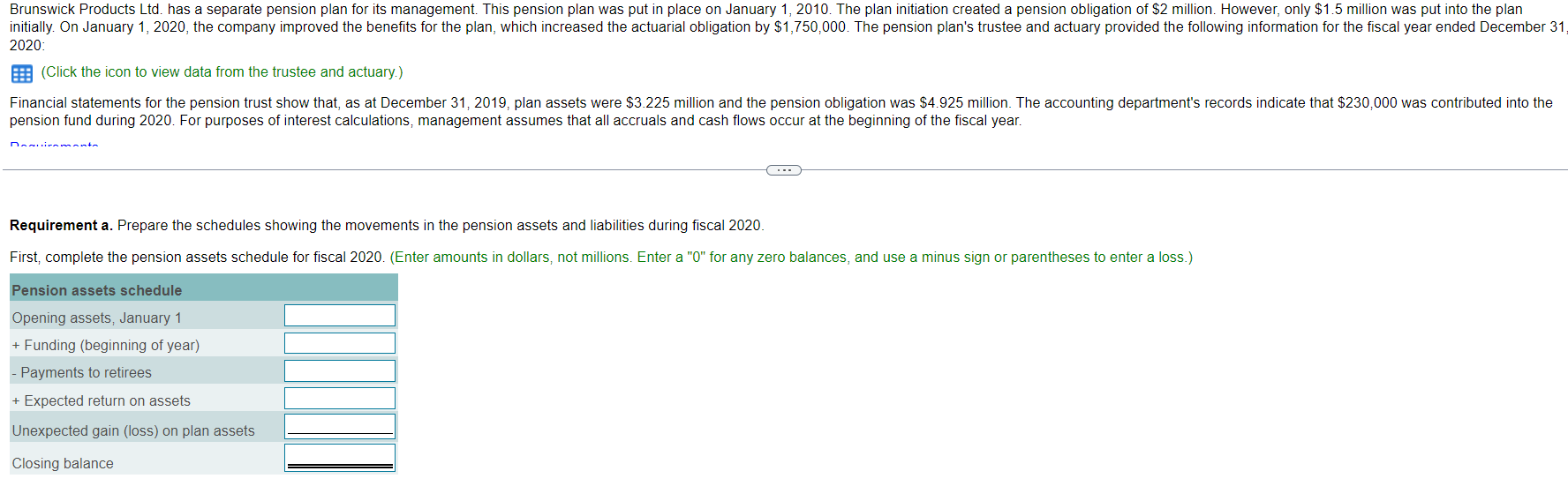

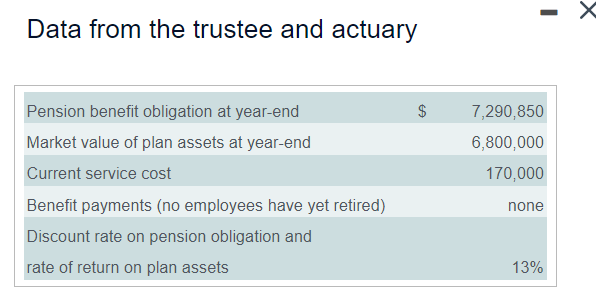

2020: (Click the icon to view data from the trustee and actuary.) pension fund during 2020. For purposes of interest calculations, management assumes that all

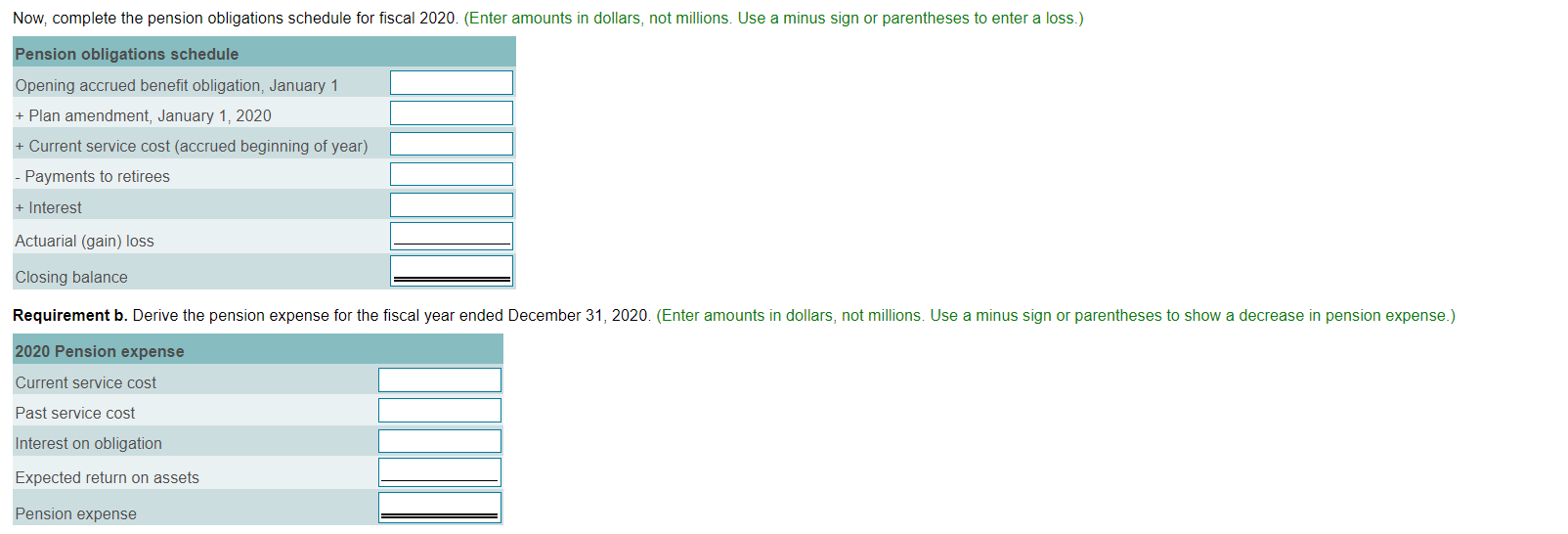

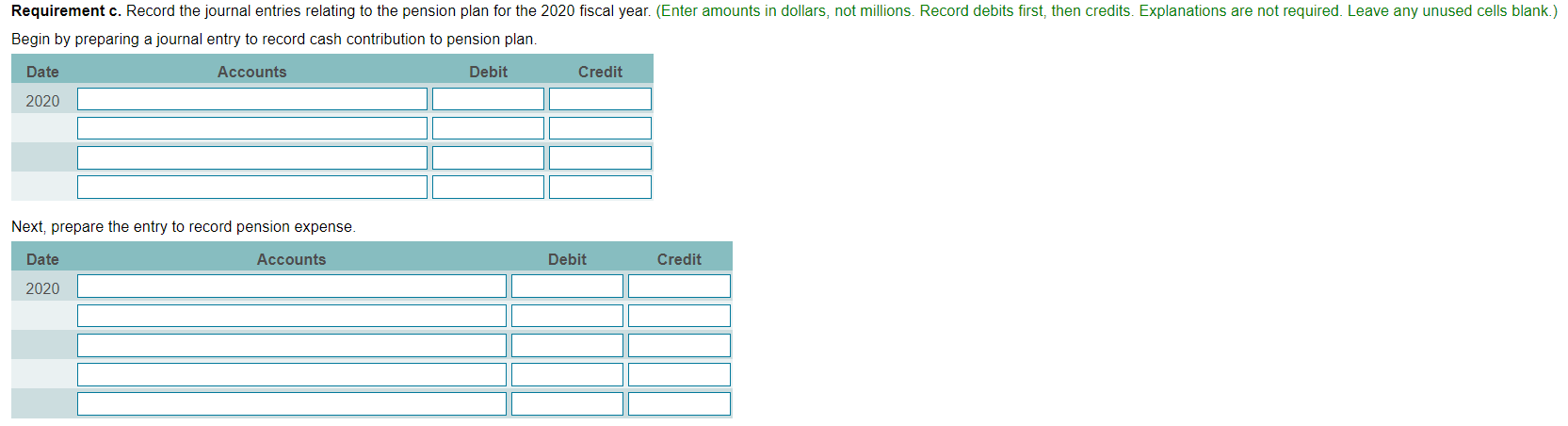

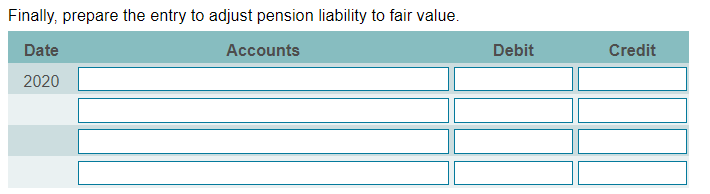

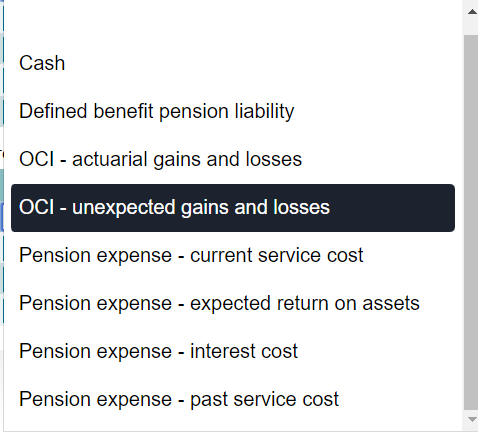

2020: (Click the icon to view data from the trustee and actuary.) pension fund during 2020. For purposes of interest calculations, management assumes that all accruals and cash flows occur at the beginning of the fiscal year. Requirement a. Prepare the schedules showing the movements in the pension assets and liabilities during fiscal 2020. First, complete the pension assets schedule for fiscal 2020. (Enter amounts in dollars, not millions. Enter a "0" for any zero balances, and use a minus sign or parentheses to enter a loss.) Now, complete the pension obligations schedule for fiscal 2020. (Enter amounts in dollars, not millions. Use a minus sign or parentheses to enter a loss.) Pension obligations schedule Opening accrued benefit obligation, January 1 + Plan amendment, January 1, 2020 + Current service cost (accrued beginning of year) - Payments to retirees + Interest Actuarial (gain) loss Closing balance 2020 Pension expense Current service cost Past service cost Interest on obligation Expected return on assets Pension expense Begin by preparing a journal entry to record cash contribution to pension plan. Date Accounts Next, prepare the entry to record pension expense. Finally, prepare the entry to adjust pension liability to fair value. Data from the trustee and actuary Defined benefit pension liability OCl - actuarial gains and losses OCl - unexpected gains and losses Pension expense - current service cost Pension expense - expected return on assets Pension expense - interest cost Pension expense - past service cost 2020: (Click the icon to view data from the trustee and actuary.) pension fund during 2020. For purposes of interest calculations, management assumes that all accruals and cash flows occur at the beginning of the fiscal year. Requirement a. Prepare the schedules showing the movements in the pension assets and liabilities during fiscal 2020. First, complete the pension assets schedule for fiscal 2020. (Enter amounts in dollars, not millions. Enter a "0" for any zero balances, and use a minus sign or parentheses to enter a loss.) Now, complete the pension obligations schedule for fiscal 2020. (Enter amounts in dollars, not millions. Use a minus sign or parentheses to enter a loss.) Pension obligations schedule Opening accrued benefit obligation, January 1 + Plan amendment, January 1, 2020 + Current service cost (accrued beginning of year) - Payments to retirees + Interest Actuarial (gain) loss Closing balance 2020 Pension expense Current service cost Past service cost Interest on obligation Expected return on assets Pension expense Begin by preparing a journal entry to record cash contribution to pension plan. Date Accounts Next, prepare the entry to record pension expense. Finally, prepare the entry to adjust pension liability to fair value. Data from the trustee and actuary Defined benefit pension liability OCl - actuarial gains and losses OCl - unexpected gains and losses Pension expense - current service cost Pension expense - expected return on assets Pension expense - interest cost Pension expense - past service cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started