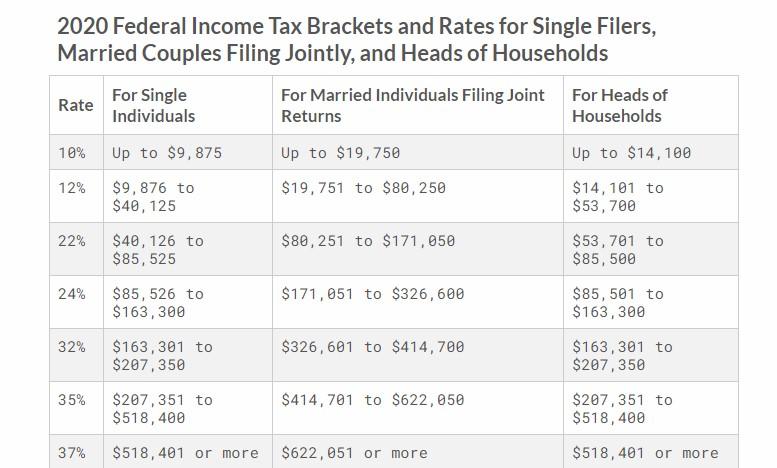

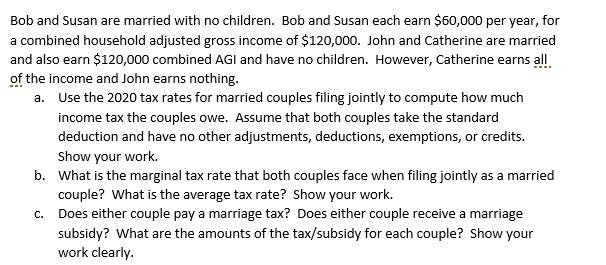

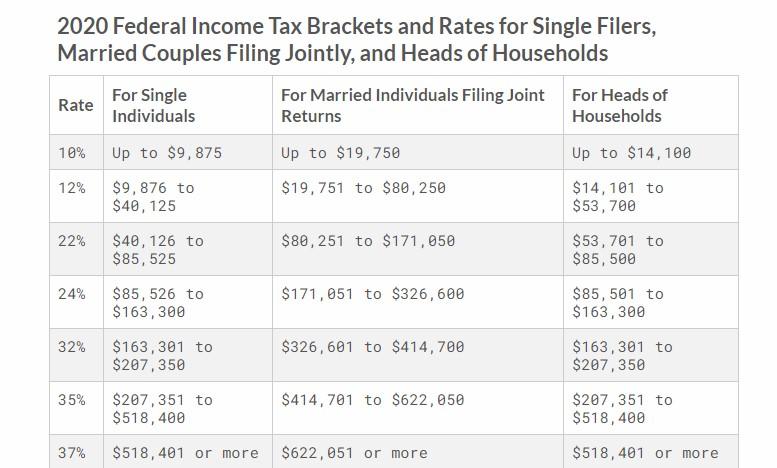

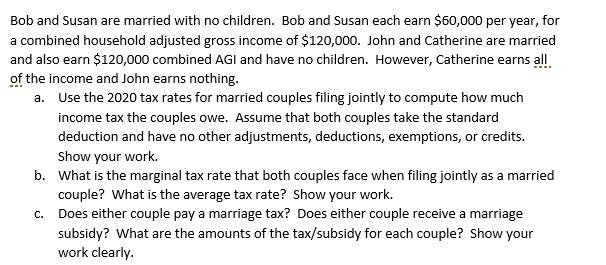

2020 Federal Income Tax Brackets and Rates for Single Filers, Married couples Filing Jointly, and Heads of Households Rate For Single For Married Individuals Filing Joint For Heads of Individuals Returns Households 10% Up to $9.875 Up to $19.750 Up to $14,100 12% $9,876 to $40, 125 $19,751 to $80,250 $14, 101 to $53, 700 22% $80, 251 to $171,050 $40, 126 to $85, 525 $53,701 to $85,500 24% $85, 526 to $163,300 $171,051 to $326,600 $85,501 to $163,300 32% $ 163, 301 to $207,350 $326,601 to $414,700 $ 163,301 to $207,350 35% $414,701 to $622,050 $207,351 to $518,400 $207,351 to $518,400 37% $518,401 or more $622,051 or more $518,401 or more Bob and Susan are married with no children. Bob and Susan each earn $60,000 per year, for a combined household adjusted gross income of $120,000. John and Catherine are married and also earn $120,000 combined AGI and have no children. However, Catherine earns all of the income and John earns nothing. a. Use the 2020 tax rates for married couples filing jointly to compute how much income tax the couples owe. Assume that both couples take the standard deduction and have no other adjustments, deductions, exemptions, or credits. Show your work. b. What is the marginal tax rate that both couples face when filing jointly as a married couple? What is the average tax rate? Show your work. C. Does either couple pay a marriage tax? Does either couple receive a marriage subsidy? What are the amounts of the tax/subsidy for each couple? Show your work clearly. 2020 Federal Income Tax Brackets and Rates for Single Filers, Married couples Filing Jointly, and Heads of Households Rate For Single For Married Individuals Filing Joint For Heads of Individuals Returns Households 10% Up to $9.875 Up to $19.750 Up to $14,100 12% $9,876 to $40, 125 $19,751 to $80,250 $14, 101 to $53, 700 22% $80, 251 to $171,050 $40, 126 to $85, 525 $53,701 to $85,500 24% $85, 526 to $163,300 $171,051 to $326,600 $85,501 to $163,300 32% $ 163, 301 to $207,350 $326,601 to $414,700 $ 163,301 to $207,350 35% $414,701 to $622,050 $207,351 to $518,400 $207,351 to $518,400 37% $518,401 or more $622,051 or more $518,401 or more Bob and Susan are married with no children. Bob and Susan each earn $60,000 per year, for a combined household adjusted gross income of $120,000. John and Catherine are married and also earn $120,000 combined AGI and have no children. However, Catherine earns all of the income and John earns nothing. a. Use the 2020 tax rates for married couples filing jointly to compute how much income tax the couples owe. Assume that both couples take the standard deduction and have no other adjustments, deductions, exemptions, or credits. Show your work. b. What is the marginal tax rate that both couples face when filing jointly as a married couple? What is the average tax rate? Show your work. C. Does either couple pay a marriage tax? Does either couple receive a marriage subsidy? What are the amounts of the tax/subsidy for each couple? Show your work clearly