Question

20.The Boardof Directors of National Brewing Inc. is considering the acquisition of a new still. The still is priced at $600,000 but would require $60,000

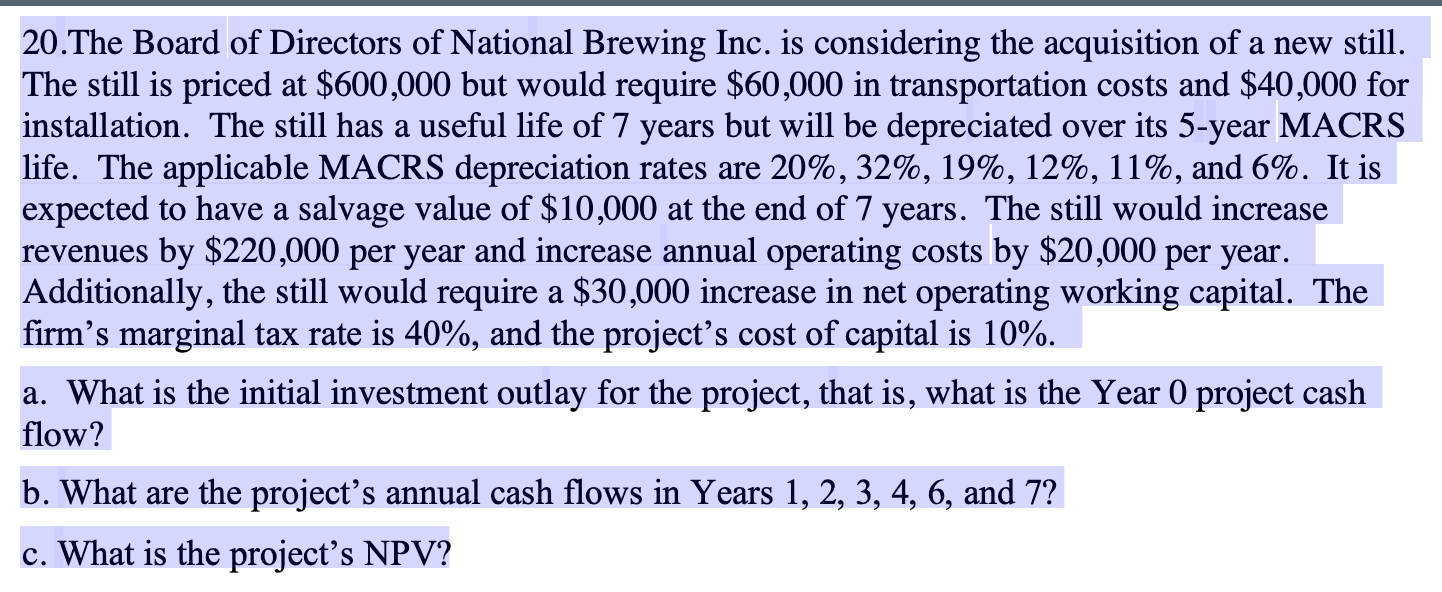

20.The Boardof Directors of National Brewing Inc. is considering the acquisition of a new still. The still is priced at $600,000 but would require $60,000 in transportation costs and $40,000 for installation. The still has a useful life of 7 years but will be depreciated over its 5-yearMACRS life. The applicable MACRS depreciation rates are 20%, 32%, 19%, 12%, 11%, and 6%. It is expected to have a salvage value of $10,000 at the end of 7 years. The still would increase revenues by $220,000 per year and increase annual operating costsby $20,000 per year. Additionally, the still would require a $30,000 increase in net operating working capital. The firms marginal tax rate is 40%, and the projects cost of capital is 10%. a. What is the initial investment outlay for the project, that is, what is the Year 0 project cash flow?b. What are the projects annual cash flows in Years 1, 2, 3, 4, 6, and 7?c. What is the projects NPV?

20.The Boardof Directors of National Brewing Inc. is considering the acquisition of a new still. The still is priced at $600,000 but would require $60,000 in transportation costs and $40,000 for installation. The still has a useful life of 7 years but will be depreciated over its 5-yearMACRS life. The applicable MACRS depreciation rates are 20%, 32%, 19%, 12%, 11%, and 6%. It is expected to have a salvage value of $10,000 at the end of 7 years. The still would increase revenues by $220,000 per year and increase annual operating costsby $20,000 per year. Additionally, the still would require a $30,000 increase in net operating working capital. The firms marginal tax rate is 40%, and the projects cost of capital is 10%. a. What is the initial investment outlay for the project, that is, what is the Year 0 project cash flow?b. What are the projects annual cash flows in Years 1, 2, 3, 4, 6, and 7?c. What is the projects NPV?

*************NO EXCEL PLEASE******************************NO EXCEL PLEASE*****************

*************NO EXCEL PLEASE*****************

*************NO EXCEL PLEASE*****************

20.The Board of Directors of National Brewing Inc. is considering the acquisition of a new still. The still is priced at $600,000 but would require $60,000 in transportation costs and $40,000 for installation. The still has a useful life of 7 years but will be depreciated over its 5-year MACRS life. The applicable MACRS depreciation rates are 20%, 32%, 19%, 12%, 11%, and 6%. It is expected to have a salvage value of $10,000 at the end of 7 years. The still would increase revenues by $220,000 per year and increase annual operating costs by $20,000 per year. Additionally, the still would require a $30,000 increase in net operating working capital. The firm's marginal tax rate is 40%, and the project's cost of capital is 10%. a. What is the initial investment outlay for the project, that is, what is the Year 0 project cash flow? b. What are the project's annual cash flows in Years 1, 2, 3, 4, 6, and 7? c. What is the project's NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started