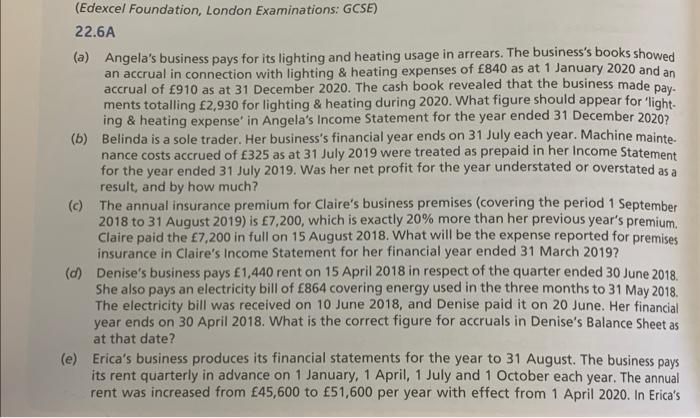

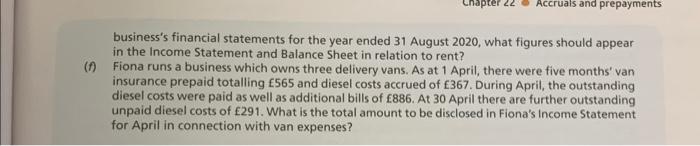

22.6A (a) Angela's business pays for its lighting and heating usage in arrears. The business's books showed an accrual in connection with lighting \& heating expenses of f840 as at 1 January 2020 and an accrual of f910 as at 31 December 2020. The cash book revealed that the business made payments totalling f2,930 for lighting \& heating during 2020. What figure should appear for 'lighting \& heating expense' in Angela's Income Statement for the year ended 31 December 2020 ? (b) Belinda is a sole trader. Her business's financial year ends on 31 July each year. Machine maintenance costs accrued of f325 as at 31 July 2019 were treated as prepaid in her Income Statement for the year ended 31 July 2019. Was her net profit for the year understated or overstated as a result, and by how much? (c) The annual insurance premium for Claire's business premises (covering the period 1 September 2018 to 31 August 2019) is 67,200 , which is exactly 20% more than her previous year's premium. Claire paid the f7,200 in full on 15 August 2018. What will be the expense reported for premises insurance in Claire's Income Statement for her financial year ended 31 March 2019 ? (d) Denise's business pays $1,440 rent on 15 April 2018 in respect of the quarter ended 30 June 2018. She also pays an electricity bill of 864 covering energy used in the three months to 31 May 2018. The electricity bill was received on 10 June 2018, and Denise paid it on 20 June. Her financial year ends on 30 April 2018. What is the correct figure for accruals in Denise's Balance Sheet as at that date? (e) Erica's business produces its financial statements for the year to 31 August. The business pays its rent quarterly in advance on 1 January, 1 April, 1 July and 1 October each year. The annual rent was increased from 45,600 to f51,600 per year with effect from 1 April 2020. In Erica's business's financial statements for the year ended 31 August 2020, what figures should appear in the Income Statement and Balance Sheet in relation to rent? Fiona runs a business which owns three delivery vans. As at 1 April, there were five months' van insurance prepaid totalling f565 and diesel costs accrued of f367. During April, the outstanding diesel costs were paid as well as additional bills of 8886. At 30 April there are further outstanding unpaid diesel costs of f291. What is the total amount to be disclosed in Fiona's Income Statement for April in connection with van expenses