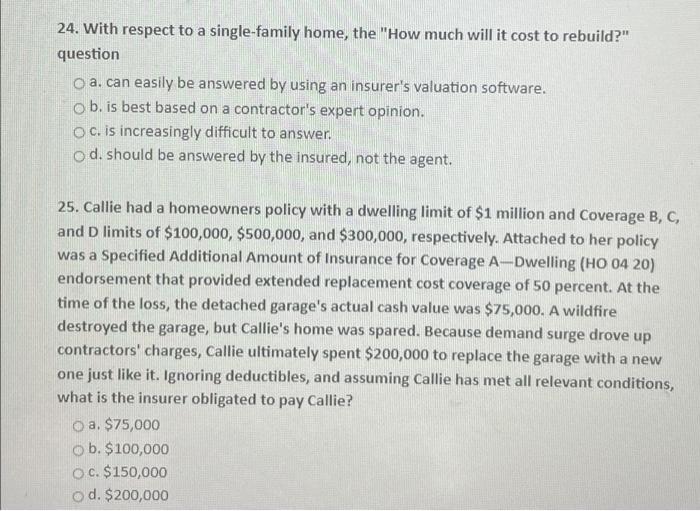

24. With respect to a single-family home, the "How much will it cost to rebuild?" question o a. can easily be answered by using an insurer's valuation software. o b. is best based on a contractor's expert opinion. oc. is increasingly difficult to answer. o d. should be answered by the insured, not the agent. 25. Callie had a homeowners policy with a dwelling limit of $1 million and Coverage B, C, and D limits of $100,000, $500,000, and $300,000, respectively. Attached to her policy was a Specified Additional Amount of Insurance for Coverage A-Dwelling (HO 04 20) endorsement that provided extended replacement cost coverage of 50 percent. At the time of the loss, the detached garage's actual cash value was $75,000. A wildfire destroyed the garage, but Callie's home was spared. Because demand surge drove up contractors' charges, Callie ultimately spent $200,000 to replace the garage with a new one just like it. Ignoring deductibles, and assuming Callie has met all relevant conditions, what is the insurer obligated to pay Callie? O a. $75,000 ob. $100,000 O c. $150,000 od. $200,000 24. With respect to a single-family home, the "How much will it cost to rebuild?" question o a. can easily be answered by using an insurer's valuation software. o b. is best based on a contractor's expert opinion. oc. is increasingly difficult to answer. o d. should be answered by the insured, not the agent. 25. Callie had a homeowners policy with a dwelling limit of $1 million and Coverage B, C, and D limits of $100,000, $500,000, and $300,000, respectively. Attached to her policy was a Specified Additional Amount of Insurance for Coverage A-Dwelling (HO 04 20) endorsement that provided extended replacement cost coverage of 50 percent. At the time of the loss, the detached garage's actual cash value was $75,000. A wildfire destroyed the garage, but Callie's home was spared. Because demand surge drove up contractors' charges, Callie ultimately spent $200,000 to replace the garage with a new one just like it. Ignoring deductibles, and assuming Callie has met all relevant conditions, what is the insurer obligated to pay Callie? O a. $75,000 ob. $100,000 O c. $150,000 od. $200,000