Answered step by step

Verified Expert Solution

Question

1 Approved Answer

25. A speculator buys a call option for Ghc3,000 with an exercise price of Ghc 50,000. The stock is currently priced at Ghc 49,000 and

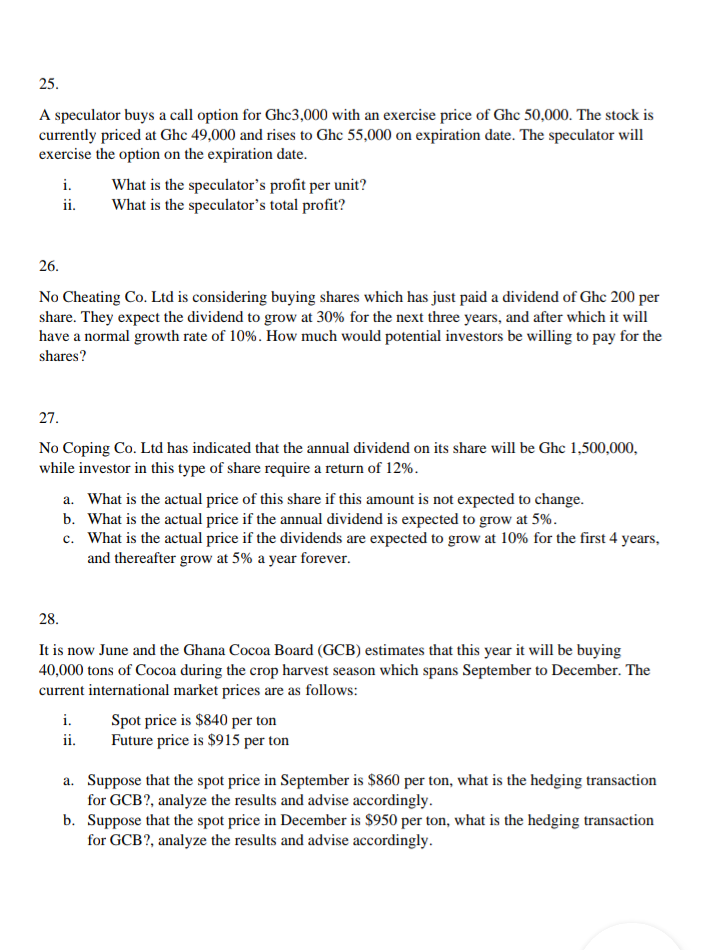

25. A speculator buys a call option for Ghc3,000 with an exercise price of Ghc 50,000. The stock is currently priced at Ghc 49,000 and rises to Ghc 55,000 on expiration date. The speculator will exercise the option on the expiration date. i. What is the speculator's profit per unit? ii. What is the speculator's total profit? 26. No Cheating Co. Ltd is considering buying shares which has just paid a dividend of Ghc 200 per share. They expect the dividend to grow at 30% for the next three years, and after which it will have a normal growth rate of 10%. How much would potential investors be willing to pay for the shares? 27. No Coping Co. Ltd has indicated that the annual dividend on its share will be Ghc 1,500,000, while investor in this type of share require a return of 12%. a. What is the actual price of this share if this amount is not expected to change. b. What is the actual price if the annual dividend is expected to grow at 5%. c. What is the actual price if the dividends are expected to grow at 10% for the first 4 years, and thereafter grow at 5% a year forever. 28. It is now June and the Ghana Cocoa Board (GCB) estimates that this year it will be buying 40,000 tons of Cocoa during the crop harvest season which spans September to December. The current international market prices are as follows: i. Spot price is $840 per ton ii. Future price is $915 per ton a. Suppose that the spot price in September is $860 per ton, what is the hedging transaction for GCB?, analyze the results and advise accordingly. b. Suppose that the spot price in December is $950 per ton, what is the hedging transaction for GCB?, analyze the results and advise accordingly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started