Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2a. Prepare the journal entry to record Palmer's 2019 pension expense on December 31 if it funds the pension plan in the amount of $159,000.

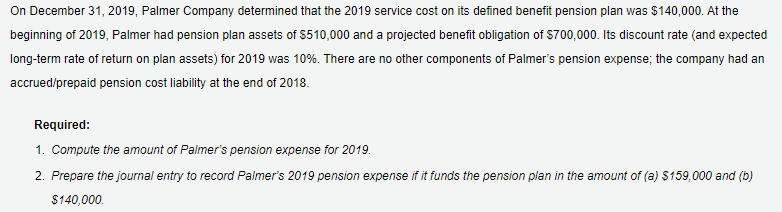

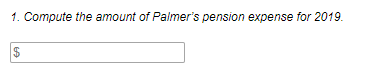

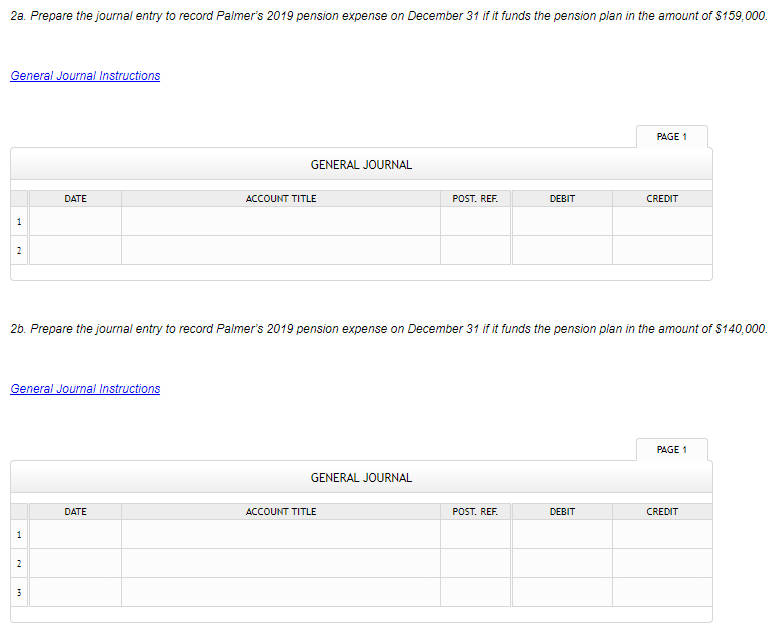

2a. Prepare the journal entry to record Palmer's 2019 pension expense on December 31 if it funds the pension plan in the amount of $159,000. 2b. Prepare the journal entry to record Palmer's 2019 pension expense on December 31 if it funds the pension plan in the amount of $140,000. CHART OF ACCOUNTS Palmer Company General Ledger ASSETS 111 Cash 121 Accounts Receivable 141 Inventory 152 Prepaid Insurance 181 Equipment 198 Accumulated Depreciation LIABILITIES 211 Accounts Payable 231 Salaries Payable 250 Unearned Revenue 251 Accrued/Prepaid Pension Cost 261 Income Taxes Payable REVENUE 411 Sales Revenue EXPENSES 500 Cost of Goods Sold 511 Insurance Expense 512 Utilities Expense 521 Salaries Expense 522 Pension Expense 532 Bad Debt Expense 540 Interest Expense 541 Depreciation Expense 559 Miscellaneous Expenses 910 Income Tax Expense EQUITY 311 Common Stock 331 Retained Earnings On December 31,2019 , Palmer Company determined that the 2019 service cost on its defined benefit pension plan was $140,000. At the beginning of 2019 , Palmer had pension plan assets of $510,000 and a projected benefit obligation of $700,000. Its discount rate (and expected long-term rate of return on plan assets) for 2019 was 10%. There are no other components of Palmer's pension expense; the company had an accrued/prepaid pension cost liability at the end of 2018 . Required: 1. Compute the amount of Palmer's pension expense for 2019. 2. Prepare the journal entry to record Palmer's 2019 pension expense if it funds the pension plan in the amount of (a) $159,000 and (b) $140,000. 1. Compute the amount of Palmer's pension expense for 2019

2a. Prepare the journal entry to record Palmer's 2019 pension expense on December 31 if it funds the pension plan in the amount of $159,000. 2b. Prepare the journal entry to record Palmer's 2019 pension expense on December 31 if it funds the pension plan in the amount of $140,000. CHART OF ACCOUNTS Palmer Company General Ledger ASSETS 111 Cash 121 Accounts Receivable 141 Inventory 152 Prepaid Insurance 181 Equipment 198 Accumulated Depreciation LIABILITIES 211 Accounts Payable 231 Salaries Payable 250 Unearned Revenue 251 Accrued/Prepaid Pension Cost 261 Income Taxes Payable REVENUE 411 Sales Revenue EXPENSES 500 Cost of Goods Sold 511 Insurance Expense 512 Utilities Expense 521 Salaries Expense 522 Pension Expense 532 Bad Debt Expense 540 Interest Expense 541 Depreciation Expense 559 Miscellaneous Expenses 910 Income Tax Expense EQUITY 311 Common Stock 331 Retained Earnings On December 31,2019 , Palmer Company determined that the 2019 service cost on its defined benefit pension plan was $140,000. At the beginning of 2019 , Palmer had pension plan assets of $510,000 and a projected benefit obligation of $700,000. Its discount rate (and expected long-term rate of return on plan assets) for 2019 was 10%. There are no other components of Palmer's pension expense; the company had an accrued/prepaid pension cost liability at the end of 2018 . Required: 1. Compute the amount of Palmer's pension expense for 2019. 2. Prepare the journal entry to record Palmer's 2019 pension expense if it funds the pension plan in the amount of (a) $159,000 and (b) $140,000. 1. Compute the amount of Palmer's pension expense for 2019 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started