Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2-e- Received a $2,800 credit memorandum from CD Company for the return of unsatisfactory merchandise purchased on March 14. Received a $555 credit memorandum from

2-e- Received a $2,800 credit memorandum from CD Company for the return of unsatisfactory merchandise purchased on March 14. Received a $555 credit memorandum from Spell Supply for office equipment received on March 9 and returned for credit.

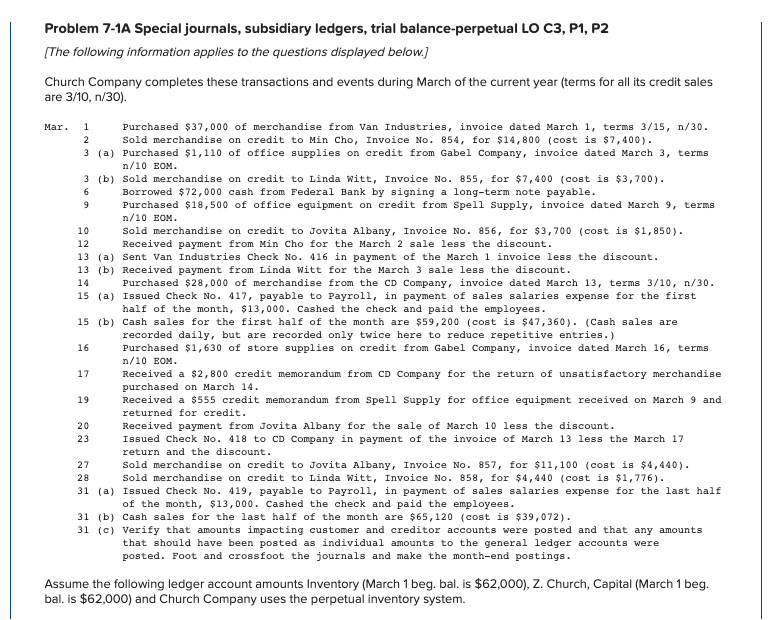

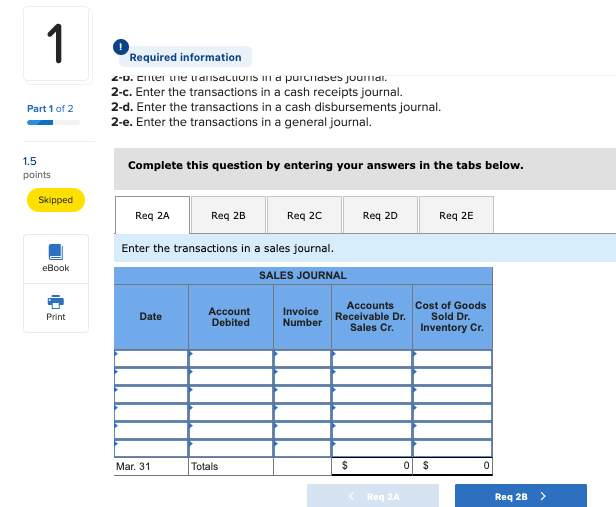

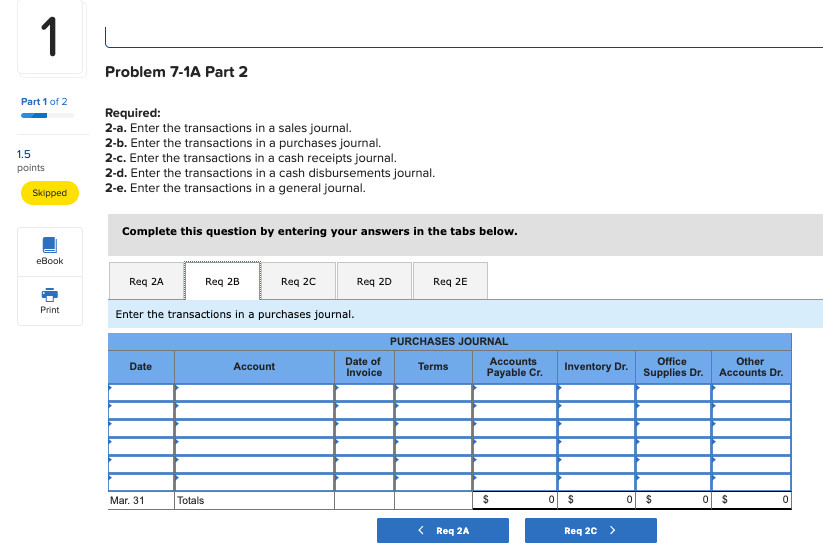

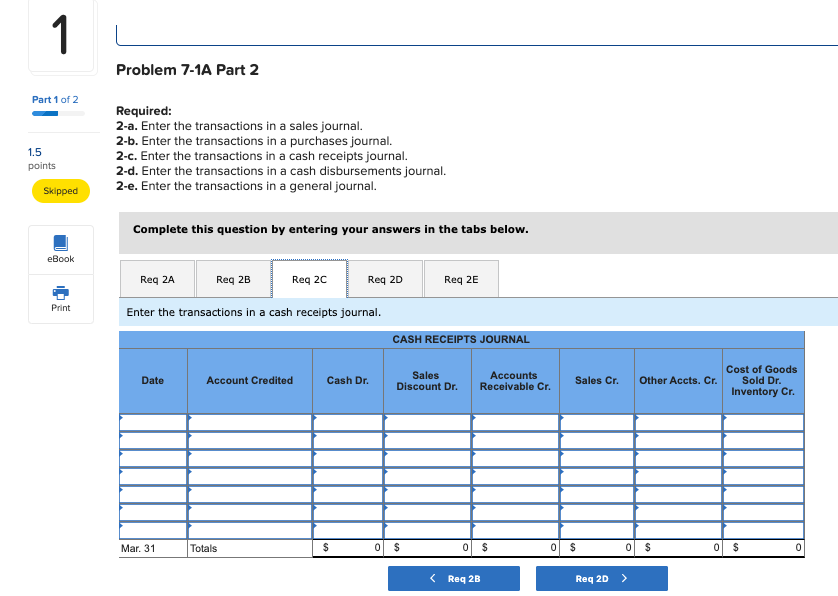

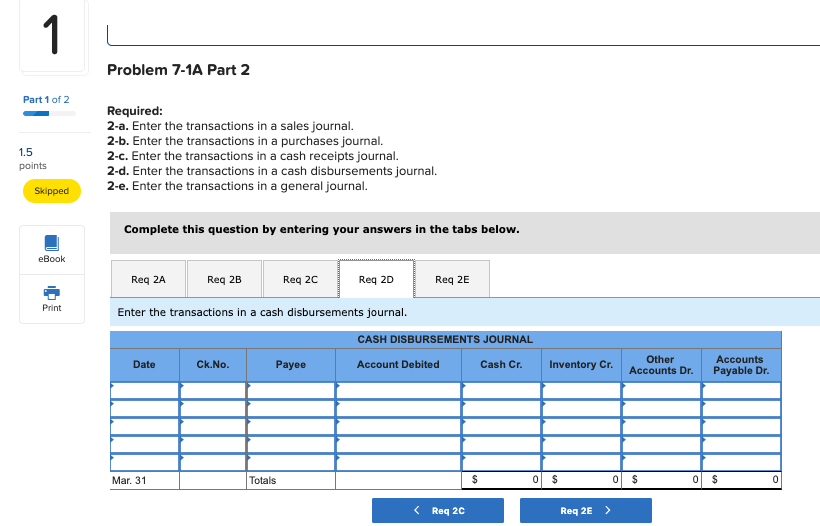

Problem 7-1A Special journals, subsidiary ledgers, trial balance-perpetual LO C3, P1, P2 (The following information applies to the questions displayed below.) Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 3/10, n/30). Mar. 10 1 Purchased $37,000 of merchandise from Van Industries, invoice dated March 1, terms 3/15, n/30. 2 Sold merchandise on credit to Min Cho, Invoice No. 854, for $14,800 (cost is $7,400). 3 (a) Purchased $1,110 of office supplies on credit from Gabel Company, invoice dated March 3, terms n/10 EOM. 3 (b) Sold merchandise on credit to Linda Witt, Invoice No. 855, for $7,400 (cost is $3,700). 6 Borrowed $72,000 cash from Federal Bank by signing a long-term note payable Purchased $18,500 of office equipment on credit from Spell Supply, invoice dated March 9, terms n/10 EOM. Sold merchandise on credit to Jovita Albany, Invoice No. 856, for $3,700 (cost is $1,850). Received payment from Min Cho for the March 2 sale less the discount. 13 (a) Sent Van Industries Check No. 416 in payment of the March 1 invoice less the discount. 13 (b) Received payment from Linda Witt for the March 3 sale less the discount. 14 Purchased $28,000 of merchandise from the CD Company, invoice dated March 13, terms 3/10, n/30. 15 (a) Issued Check No. 417, payable to Payroll, in payment of sales salaries expense for the first half of the month, $13,000. Cashed the check and paid the employees. 15 (b) Cash sales for the first half of the month are $59,200 (cost is $47,360). (Cash sales are recorded daily, but are recorded only twice here to reduce repetitive entries.) Purchased $1,630 of store supplies on credit from Gabel Company, invoice dated March 16, terms n/10 EOM. Received a $2,800 credit memorandum from CD Company for the return of unsatisfactory merchandise purchased on March 14. Received a $555 credit memorandum from Spell Supply for office equipment received on March 9 and returned for credit. Received payment from Jovita Albany for the sale of March 10 less the discount. Issued Check No. 418 to CD Company in payment of the invoice of March 13 less the March 17 return and the discount. Sold merchandise on credit to Jovita Albany, Invoice No. 857, for $11,100 (cost is $4,440). Sold merchandise on credit to Linda Witt, Invoice No. 858, for $4,440 (cost is $1,776). 31 (a) Issued Check No. 419, payable to Payroll, in payment of sales salaries expense for the last half of the month, $13,000. Cashed the check and paid the employees. 31 (b) Cash sales for the last half of the month are $65,120 (cost is $39,072). 31 (c) Verify that amounts impacting customer and creditor accounts were posted and that any amounts that should have been posted as individual amounts to the general ledger accounts were posted. Foot and crossfoot the journals and make the month-end postings. Assume the following ledger account amounts Inventory (March 1 beg. bal. is $62,000), Z. Church, Capital (March 1 beg. bal. is $62,000) and Church Company uses the perpetual inventory system. Required information 2-0. Cullel te Lidl SdCLIONIS III d purcildses juurlidi. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash disbursements journal. 2-e. Enter the transactions in a general journal. Part 1 of 2 1.5 points Complete this question by entering your answers in the tabs below. Skipped Req 2A Reg 2B Reg 20 Req 2D Req 2E Enter the transactions in a sales journal. eBook SALES JOURNAL Date Account Debited Invoice Number Accounts Receivable Dr. Sales Cr. Cost of Goods Sold Dr. Inventory Cr. Mar. 31 Totals 0 $ 0 Reg 2A Reg 2B> Problem 7-1A Part 2 Part 1 of 2 1.5 points Required: 2-a. Enter the transactions in a sales journal. 2-b. Enter the transactions in a purchases journal. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash disbursements journal. 2-e. Enter the transactions in a general journal. Skipped Complete this question by entering your answers in the tabs below. eBook Reg 2A Req 2B Reg 20 Req 2D Req 2E Print Enter the transactions in a purchases journal. PURCHASES JOURNAL Date Account Date of Invoice Terms Accounts Payable Cr. Inventory Dr. Office Supplies Dr. Other Accounts Dr. Mar. 31 Totals 0 $ 0 $ 0 $ Problem 7-1A Part 2 Part 1 of 2 1.5 Required: 2-a. Enter the transactions in a sales journal. 2-b. Enter the transactions in a purchases journal. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash disbursements journal. 2-e. Enter the transactions in a general journal. points Skipped Complete this question by entering your answers in the tabs below. eBook Reg 2A Reg 2B Reg 20 Req 2D Req 2E Print Enter the transactions in a cash receipts journal. CASH RECEIPTS JOURNAL Date Account Credited Cash Dr. Sales Discount Dr. Accounts Receivable Cr. Sales Cr. Cost of Goods Other Accts. Cr. Sold Dr. Inventory Cr. Mar. 31 Totals $ 0 $ 0 $ 0 $ 0 $ 0 $ Problem 7-1A Part 2 Part 1 of 2 Required: 2-a. Enter the transactions in a sales journal. 2-b. Enter the transactions in a purchases journal. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash disbursements journal. 2-e. Enter the transactions in a general journal. points Skipped Complete this question by entering your answers in the tabs below. eBook Req 2A Reg 2B Req 20 Req 2D Req 2E Print Enter the transactions in a cash disbursements journal. CASH DISBURSEMENTS JOURNAL Date Ck.No. Payee Account Debited Cash Cr. Inventory Cr. Other Accounts Dr. Accounts Payable Dr. Mar. 31 Totals 0 0 0 $ Reg 20 Req2E> Problem 7-1A Special journals, subsidiary ledgers, trial balance-perpetual LO C3, P1, P2 (The following information applies to the questions displayed below.) Church Company completes these transactions and events during March of the current year (terms for all its credit sales are 3/10, n/30). Mar. 10 1 Purchased $37,000 of merchandise from Van Industries, invoice dated March 1, terms 3/15, n/30. 2 Sold merchandise on credit to Min Cho, Invoice No. 854, for $14,800 (cost is $7,400). 3 (a) Purchased $1,110 of office supplies on credit from Gabel Company, invoice dated March 3, terms n/10 EOM. 3 (b) Sold merchandise on credit to Linda Witt, Invoice No. 855, for $7,400 (cost is $3,700). 6 Borrowed $72,000 cash from Federal Bank by signing a long-term note payable Purchased $18,500 of office equipment on credit from Spell Supply, invoice dated March 9, terms n/10 EOM. Sold merchandise on credit to Jovita Albany, Invoice No. 856, for $3,700 (cost is $1,850). Received payment from Min Cho for the March 2 sale less the discount. 13 (a) Sent Van Industries Check No. 416 in payment of the March 1 invoice less the discount. 13 (b) Received payment from Linda Witt for the March 3 sale less the discount. 14 Purchased $28,000 of merchandise from the CD Company, invoice dated March 13, terms 3/10, n/30. 15 (a) Issued Check No. 417, payable to Payroll, in payment of sales salaries expense for the first half of the month, $13,000. Cashed the check and paid the employees. 15 (b) Cash sales for the first half of the month are $59,200 (cost is $47,360). (Cash sales are recorded daily, but are recorded only twice here to reduce repetitive entries.) Purchased $1,630 of store supplies on credit from Gabel Company, invoice dated March 16, terms n/10 EOM. Received a $2,800 credit memorandum from CD Company for the return of unsatisfactory merchandise purchased on March 14. Received a $555 credit memorandum from Spell Supply for office equipment received on March 9 and returned for credit. Received payment from Jovita Albany for the sale of March 10 less the discount. Issued Check No. 418 to CD Company in payment of the invoice of March 13 less the March 17 return and the discount. Sold merchandise on credit to Jovita Albany, Invoice No. 857, for $11,100 (cost is $4,440). Sold merchandise on credit to Linda Witt, Invoice No. 858, for $4,440 (cost is $1,776). 31 (a) Issued Check No. 419, payable to Payroll, in payment of sales salaries expense for the last half of the month, $13,000. Cashed the check and paid the employees. 31 (b) Cash sales for the last half of the month are $65,120 (cost is $39,072). 31 (c) Verify that amounts impacting customer and creditor accounts were posted and that any amounts that should have been posted as individual amounts to the general ledger accounts were posted. Foot and crossfoot the journals and make the month-end postings. Assume the following ledger account amounts Inventory (March 1 beg. bal. is $62,000), Z. Church, Capital (March 1 beg. bal. is $62,000) and Church Company uses the perpetual inventory system. Required information 2-0. Cullel te Lidl SdCLIONIS III d purcildses juurlidi. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash disbursements journal. 2-e. Enter the transactions in a general journal. Part 1 of 2 1.5 points Complete this question by entering your answers in the tabs below. Skipped Req 2A Reg 2B Reg 20 Req 2D Req 2E Enter the transactions in a sales journal. eBook SALES JOURNAL Date Account Debited Invoice Number Accounts Receivable Dr. Sales Cr. Cost of Goods Sold Dr. Inventory Cr. Mar. 31 Totals 0 $ 0 Reg 2A Reg 2B> Problem 7-1A Part 2 Part 1 of 2 1.5 points Required: 2-a. Enter the transactions in a sales journal. 2-b. Enter the transactions in a purchases journal. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash disbursements journal. 2-e. Enter the transactions in a general journal. Skipped Complete this question by entering your answers in the tabs below. eBook Reg 2A Req 2B Reg 20 Req 2D Req 2E Print Enter the transactions in a purchases journal. PURCHASES JOURNAL Date Account Date of Invoice Terms Accounts Payable Cr. Inventory Dr. Office Supplies Dr. Other Accounts Dr. Mar. 31 Totals 0 $ 0 $ 0 $ Problem 7-1A Part 2 Part 1 of 2 1.5 Required: 2-a. Enter the transactions in a sales journal. 2-b. Enter the transactions in a purchases journal. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash disbursements journal. 2-e. Enter the transactions in a general journal. points Skipped Complete this question by entering your answers in the tabs below. eBook Reg 2A Reg 2B Reg 20 Req 2D Req 2E Print Enter the transactions in a cash receipts journal. CASH RECEIPTS JOURNAL Date Account Credited Cash Dr. Sales Discount Dr. Accounts Receivable Cr. Sales Cr. Cost of Goods Other Accts. Cr. Sold Dr. Inventory Cr. Mar. 31 Totals $ 0 $ 0 $ 0 $ 0 $ 0 $ Problem 7-1A Part 2 Part 1 of 2 Required: 2-a. Enter the transactions in a sales journal. 2-b. Enter the transactions in a purchases journal. 2-c. Enter the transactions in a cash receipts journal. 2-d. Enter the transactions in a cash disbursements journal. 2-e. Enter the transactions in a general journal. points Skipped Complete this question by entering your answers in the tabs below. eBook Req 2A Reg 2B Req 20 Req 2D Req 2E Print Enter the transactions in a cash disbursements journal. CASH DISBURSEMENTS JOURNAL Date Ck.No. Payee Account Debited Cash Cr. Inventory Cr. Other Accounts Dr. Accounts Payable Dr. Mar. 31 Totals 0 0 0 $ Reg 20 Req2E>Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started