2.The Michaels Companies, Inc. adopted the new lease standard in fiscal year ending in February 2020.

a.What is the operating lease liability as of February 1, 2020? Verify the present value calculation in the footnote and the amount on the balance sheet match.

b.What is the amount of operating lease assets as of February 1, 2020? Why arent the asset and liability equal?

3.Operating lease (rent) expense for 2018 fiscal year (the year ended February 2, 2019) was $423.8 million. How does lease expense under the new standard compare to the prior year?

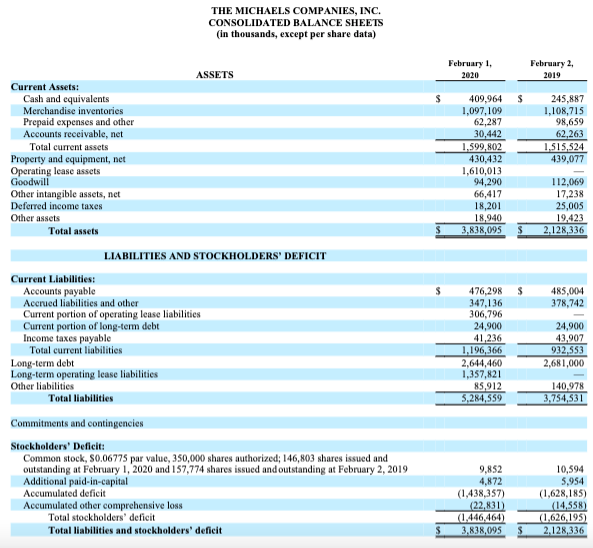

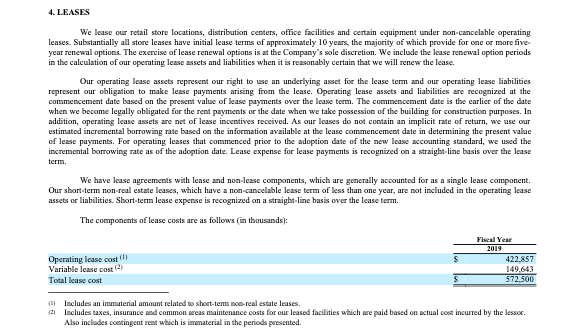

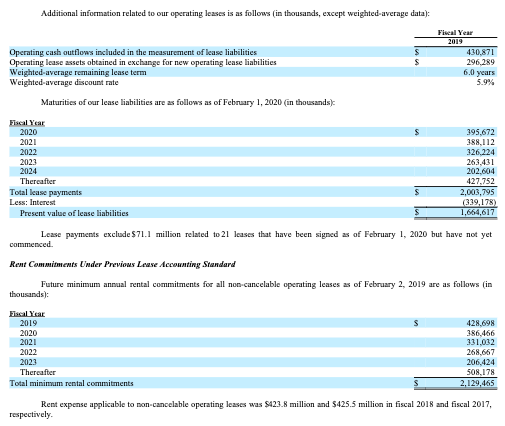

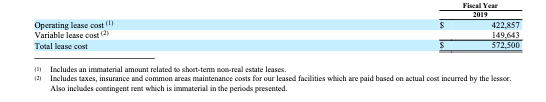

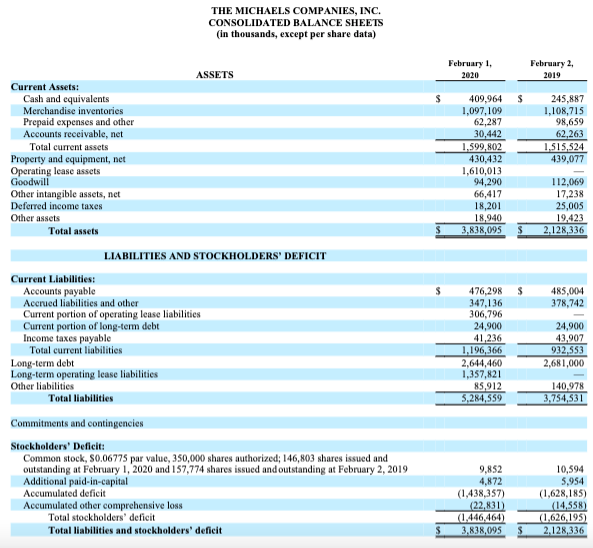

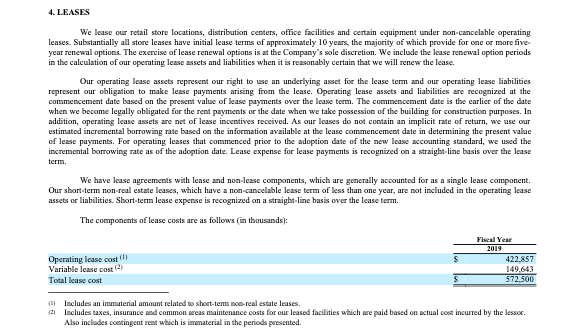

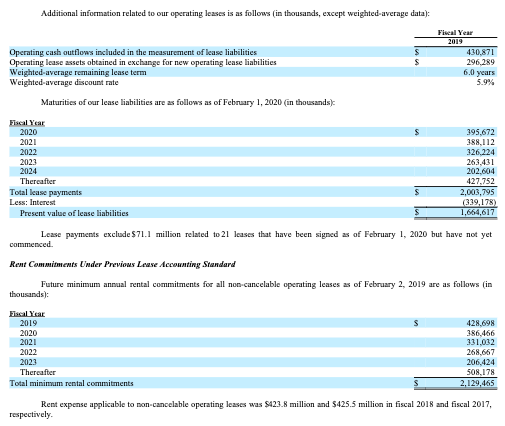

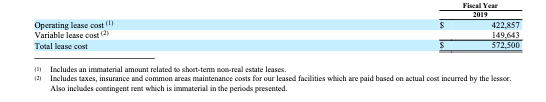

THE MICHAELS COMPANIES, INC. CONSOLIDATED BALANCE SHEETS (in thousands, except per share data) February 1, 2020 February 2 2019 409,964 1,097, 109 62,287 30,442 1.599,802 430,432 1,610,013 94,290 66,417 18,201 18,940 3,838,095 245,887 1,108,715 98,659 62,263 1,515,524 439,077 112,069 17,238 25,005 19,423 2,128,336 ASSETS Current Assets: Cash and equivalents Merchandise inventories Prepaid expenses and other Accounts receivable, net Total current assets Property and equipment, net Operating lease assets Goodwill Other intangible assets, net Deferred income taxes Other assets Total assets LIABILITIES AND STOCKHOLDERS' DEFICIT Current Liabilities: Accounts payable Accrued liabilities and other Current portion of operating lease liabilities Current portion of long-term debt Income taxes payable Total current liabilities Long-term debt Long-term operating lease liabilities Other liabilities Total liabilities Commitments and contingencies S 485,004 378,742 476,298 347,136 306,796 24,900 41,236 1,196,366 2,644,460 1,357,821 85,912 5,284,559 24,900 43,907 932,553 2,681,000 140,978 3,754,531 Stockholders' Deficit: Common stock, S0.06775 par value, 350,000 shares authorized; 146,803 shares issued and outstanding at February 1, 2020 and 157,774 shares issued and outstanding at February 2, 2019 Additional paid-in-capital Accumulated deficit Accumulated other comprehensive loss Total stockholders' deficit Total liabilities and stockholders' deficit 9,852 4,872 (1,438,357) (22.831) (1.446,464) 3,838,095 10,594 5,954 (1,628,185) (14,558) (1.626,195) 2,128,336 S $ 4. LEASES We lease our retail store locations, distribution centers, office facilities and certain equipment under non-cancelable operating leases. Substantially all store leases have initial lease terms of approximately 10 years, the majority of which provide for one or more five year renewal options. The exercise of lease renewal options is at the Company's sole discretion. We include the lease renewal option periods in the calculation of our operating lease assets and liabilities when it is reasonably certain that we will renew the lease. Our operating lease assets represent our right to use an underlying asset for the lease term and our operating lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease assets and liabilities are recognized at the commencement date based on the present value of lease payments over the lease term. The commencement date is the earlier of the date when we become legally obligated for the rent payments of the date when we take possession of the building for construction purposes. In addition, operating lease assets are net of lease incentives received. As our lease do not contain an implicit rate of return, we use our estimated incremental borrowing rate based on the information available at the lease commencement date in determining the present value of lease payments. For operating leases that commenced prior to the adoption date of the new lease accounting standard, we used the incremental borrowing rate as of the adoption date. Lease expense for lease payments is recognized on a straight-line basis over the lease term. We have lease agreements with lease and non-lease components, which are generally accounted for as a single lease component. Our short-term non-real estate leases, which have a non-cancelable lease term of less than one year, are not included in the operating lease assets or liabilities. Short-term lease expense is recognized on a straight-line basis over the lease term. The components of lease costs are as follows (in thousands): Fiscal Year 2019 Operating lease cost (1) Variable lease cost (2) Total lease cost 422.857 149.643 572,500 11 Includes an immaterial amount related to short-tem non-real estate leases (21 Includes taxes, insurance and common areas maintenance costs for our leased facilities which are paid based on actual cost incurred by the lessor. Also includes contingent rent which is immaterial in the periods presented. Additional information related to our operating leases is as follows (in thousands, except weighted-average data): Fiscal Year 2019 Operating cash outflows included in the measurement of lease liabilities 430,871 Operating lease assets obtained in exchange for new operating lease liabilities S 296,289 Weighted average remaining lease term 6.0 years Weighted average discount rate 5.9% Maturitics of our lease liabilities are as follows as of February 1, 2020 (in thousands) Fiscal Year 2020 395,672 2021 388,112 2022 326,224 2023 263,431 2024 202.604 Thereafter 427,752 Total lease payments 2,003,795 Less: Interest (3.39,178) Present value of lease liabilities 1,664,617 Lease payments exclude $71.1 million related to 21 leases that have been signed as of February 1, 2020 but have not yet commenced. Rent Commitments Under Previous Lease Accounting Standard Future minimum annual rental commitments for all non-cancelable operating leases as of February 2, 2019 are as follows (in thousands): Fiscal Year 2019 2020 2021 2022 2023 Thereafter Total minimum rental commitments 428,698 386.466 331,032 268,667 206,424 508,178 2,129,465 Rent expense applicable to non-cancelable operating leases was $423.8 million and $425.5 million in fiscal 2018 and fiscal 2017, respectively. Fiscal Year 2019 Operating lease costi) Variable lease cost (2) Total lease cost 422.857 149.643 572.500 10 Includes an immaterial amount related to short-term non-real estate leases. 12 Includes taxes, insurance and common areas maintenance costs for our leased facilities which are paid based on actual cost incurred by the lessor. Also includes contingent rent which is immaterial in the periods presented. THE MICHAELS COMPANIES, INC. CONSOLIDATED BALANCE SHEETS (in thousands, except per share data) February 1, 2020 February 2 2019 409,964 1,097, 109 62,287 30,442 1.599,802 430,432 1,610,013 94,290 66,417 18,201 18,940 3,838,095 245,887 1,108,715 98,659 62,263 1,515,524 439,077 112,069 17,238 25,005 19,423 2,128,336 ASSETS Current Assets: Cash and equivalents Merchandise inventories Prepaid expenses and other Accounts receivable, net Total current assets Property and equipment, net Operating lease assets Goodwill Other intangible assets, net Deferred income taxes Other assets Total assets LIABILITIES AND STOCKHOLDERS' DEFICIT Current Liabilities: Accounts payable Accrued liabilities and other Current portion of operating lease liabilities Current portion of long-term debt Income taxes payable Total current liabilities Long-term debt Long-term operating lease liabilities Other liabilities Total liabilities Commitments and contingencies S 485,004 378,742 476,298 347,136 306,796 24,900 41,236 1,196,366 2,644,460 1,357,821 85,912 5,284,559 24,900 43,907 932,553 2,681,000 140,978 3,754,531 Stockholders' Deficit: Common stock, S0.06775 par value, 350,000 shares authorized; 146,803 shares issued and outstanding at February 1, 2020 and 157,774 shares issued and outstanding at February 2, 2019 Additional paid-in-capital Accumulated deficit Accumulated other comprehensive loss Total stockholders' deficit Total liabilities and stockholders' deficit 9,852 4,872 (1,438,357) (22.831) (1.446,464) 3,838,095 10,594 5,954 (1,628,185) (14,558) (1.626,195) 2,128,336 S $ 4. LEASES We lease our retail store locations, distribution centers, office facilities and certain equipment under non-cancelable operating leases. Substantially all store leases have initial lease terms of approximately 10 years, the majority of which provide for one or more five year renewal options. The exercise of lease renewal options is at the Company's sole discretion. We include the lease renewal option periods in the calculation of our operating lease assets and liabilities when it is reasonably certain that we will renew the lease. Our operating lease assets represent our right to use an underlying asset for the lease term and our operating lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease assets and liabilities are recognized at the commencement date based on the present value of lease payments over the lease term. The commencement date is the earlier of the date when we become legally obligated for the rent payments of the date when we take possession of the building for construction purposes. In addition, operating lease assets are net of lease incentives received. As our lease do not contain an implicit rate of return, we use our estimated incremental borrowing rate based on the information available at the lease commencement date in determining the present value of lease payments. For operating leases that commenced prior to the adoption date of the new lease accounting standard, we used the incremental borrowing rate as of the adoption date. Lease expense for lease payments is recognized on a straight-line basis over the lease term. We have lease agreements with lease and non-lease components, which are generally accounted for as a single lease component. Our short-term non-real estate leases, which have a non-cancelable lease term of less than one year, are not included in the operating lease assets or liabilities. Short-term lease expense is recognized on a straight-line basis over the lease term. The components of lease costs are as follows (in thousands): Fiscal Year 2019 Operating lease cost (1) Variable lease cost (2) Total lease cost 422.857 149.643 572,500 11 Includes an immaterial amount related to short-tem non-real estate leases (21 Includes taxes, insurance and common areas maintenance costs for our leased facilities which are paid based on actual cost incurred by the lessor. Also includes contingent rent which is immaterial in the periods presented. Additional information related to our operating leases is as follows (in thousands, except weighted-average data): Fiscal Year 2019 Operating cash outflows included in the measurement of lease liabilities 430,871 Operating lease assets obtained in exchange for new operating lease liabilities S 296,289 Weighted average remaining lease term 6.0 years Weighted average discount rate 5.9% Maturitics of our lease liabilities are as follows as of February 1, 2020 (in thousands) Fiscal Year 2020 395,672 2021 388,112 2022 326,224 2023 263,431 2024 202.604 Thereafter 427,752 Total lease payments 2,003,795 Less: Interest (3.39,178) Present value of lease liabilities 1,664,617 Lease payments exclude $71.1 million related to 21 leases that have been signed as of February 1, 2020 but have not yet commenced. Rent Commitments Under Previous Lease Accounting Standard Future minimum annual rental commitments for all non-cancelable operating leases as of February 2, 2019 are as follows (in thousands): Fiscal Year 2019 2020 2021 2022 2023 Thereafter Total minimum rental commitments 428,698 386.466 331,032 268,667 206,424 508,178 2,129,465 Rent expense applicable to non-cancelable operating leases was $423.8 million and $425.5 million in fiscal 2018 and fiscal 2017, respectively. Fiscal Year 2019 Operating lease costi) Variable lease cost (2) Total lease cost 422.857 149.643 572.500 10 Includes an immaterial amount related to short-term non-real estate leases. 12 Includes taxes, insurance and common areas maintenance costs for our leased facilities which are paid based on actual cost incurred by the lessor. Also includes contingent rent which is immaterial in the periods presented