Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 2 Your second option to raise funding is to go public with an IPO. To do this, you can either use an Auction IPO

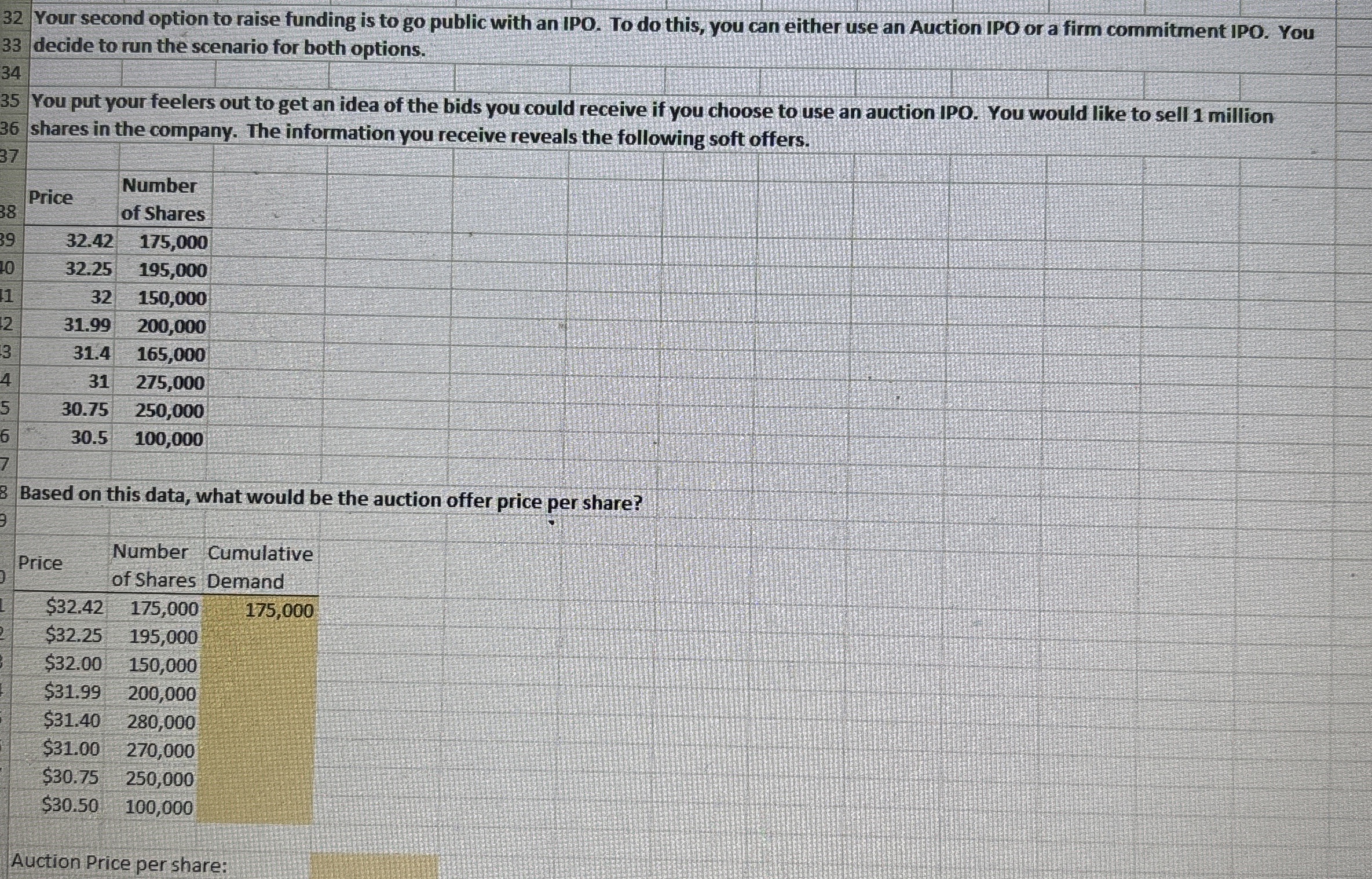

Your second option to raise funding is to go public with an IPO. To do this, you can either use an Auction IPO or a firm commitment IPO. You

decide to run the scenario for both options.

You put your feelers out to get an idea of the bids you could receive if you choose to use an auction IPO. You would like to sell million shares in the company. The information you receive reveals the following soft offers.

Based on this data, what would be the auction offer price per share?

tablePricetableNumberof SharestableCumulativeDemand$$$$$$$$

Auction Price per share:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started