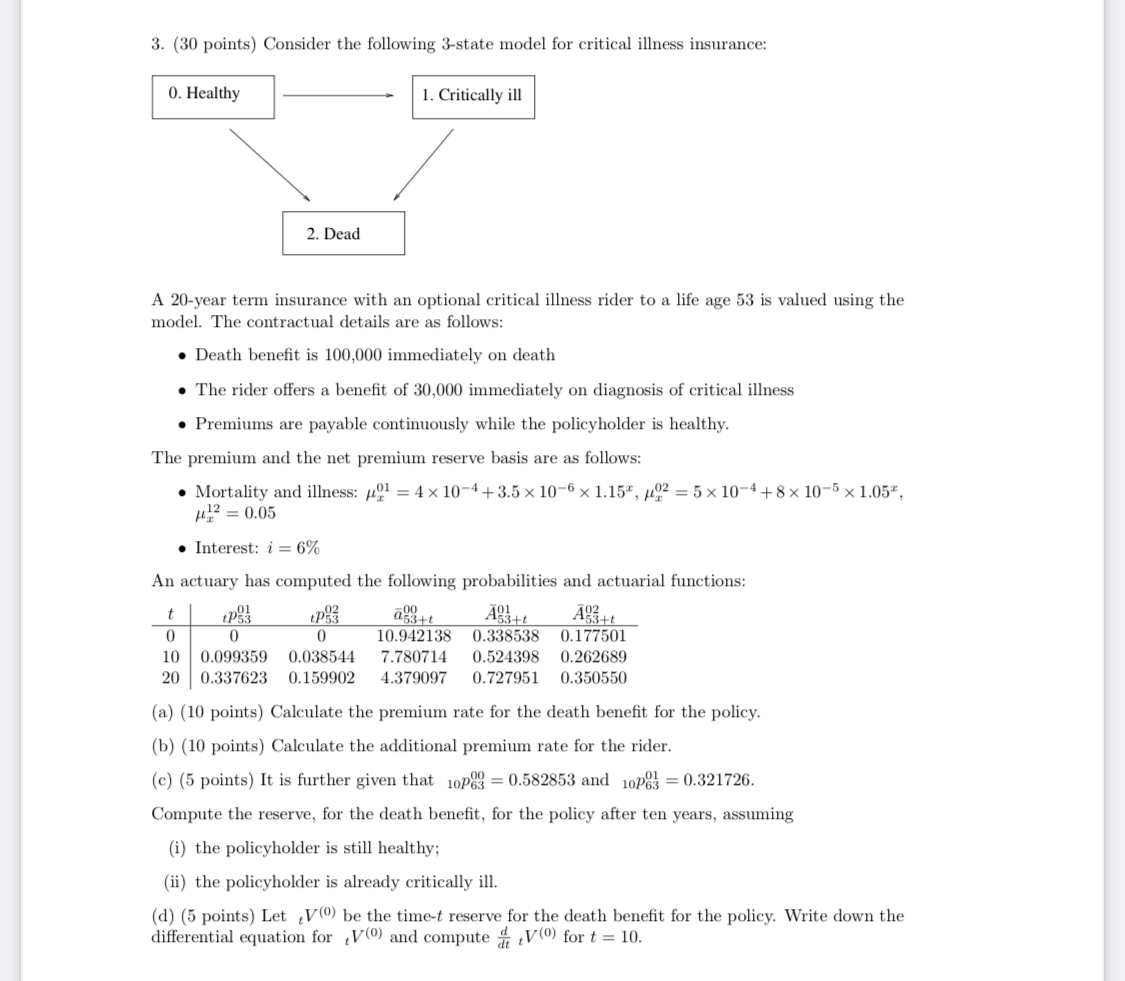

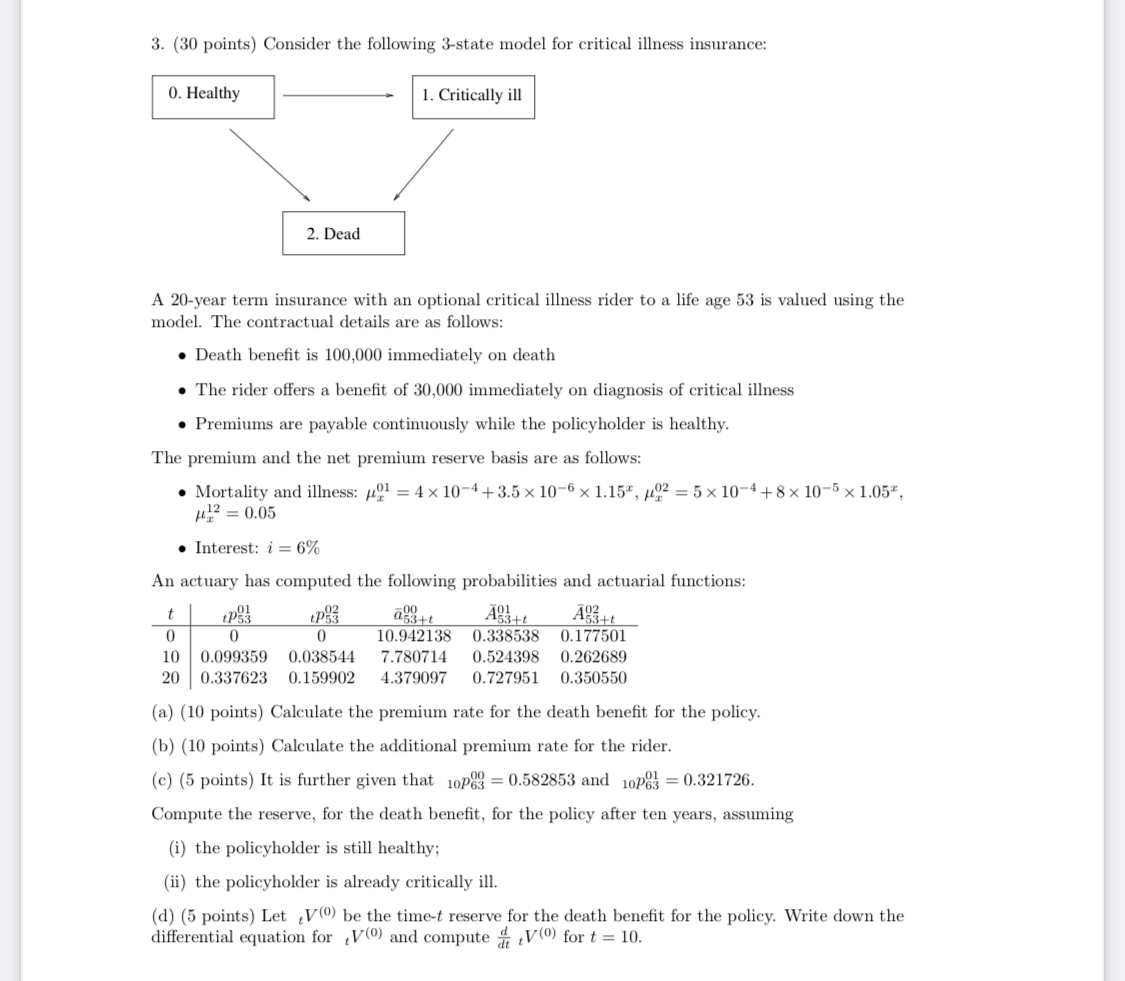

3. (30 points) Consider the following 3-state model for critical illness insurance: 0. Healthy 1. Critically ill 2. Dead A 20-year term insurance with an optional critical illness rider to a life age 53 is valued using the model. The contractual details are as follows: Death benefit is 100,000 immediately on death The rider offers a benefit of 30,000 immediately on diagnosis of critical illness Premiums are payable continuously while the policyholder is healthy. The premium and the net premium reserve basis are as follows: Mortality and illness: Mem? = 4 x 10-4 +3.5 x 10-6 x 1.154, 422 = 5 x 10-4 +8 x 10-5 x 1.05, 412 = 0.05 Interest: i = 6% An actuary has computed the following probabilities and actuarial functions: t tp33 0 0 0 10.942138 0.338538 0.177501 10 0.099359 0.038544 7.780714 0.524398 0.262689 20 0.337623 0.159902 4.379097 0.727951 0.350550 att A 3+1 AS3++ (a) (10 points) Calculate the premium rate for the death benefit for the policy. (b) (10 points) Calculate the additional premium rate for the rider. (c) (5 points) It is further given that 10p89 = 0.582853 and 10283 = 0.321726. Compute the reserve, for the death benefit, for the policy after ten years, assuming (i) the policyholder is still healthy; (ii) the policyholder is already critically ill. (d) (5 points) Let V(0) be the time-t reserve for the death benefit for the policy. Write down the differential equation for V() and compute V0) for t = 10. 3. (30 points) Consider the following 3-state model for critical illness insurance: 0. Healthy 1. Critically ill 2. Dead A 20-year term insurance with an optional critical illness rider to a life age 53 is valued using the model. The contractual details are as follows: Death benefit is 100,000 immediately on death The rider offers a benefit of 30,000 immediately on diagnosis of critical illness Premiums are payable continuously while the policyholder is healthy. The premium and the net premium reserve basis are as follows: Mortality and illness: Mem? = 4 x 10-4 +3.5 x 10-6 x 1.154, 422 = 5 x 10-4 +8 x 10-5 x 1.05, 412 = 0.05 Interest: i = 6% An actuary has computed the following probabilities and actuarial functions: t tp33 0 0 0 10.942138 0.338538 0.177501 10 0.099359 0.038544 7.780714 0.524398 0.262689 20 0.337623 0.159902 4.379097 0.727951 0.350550 att A 3+1 AS3++ (a) (10 points) Calculate the premium rate for the death benefit for the policy. (b) (10 points) Calculate the additional premium rate for the rider. (c) (5 points) It is further given that 10p89 = 0.582853 and 10283 = 0.321726. Compute the reserve, for the death benefit, for the policy after ten years, assuming (i) the policyholder is still healthy; (ii) the policyholder is already critically ill. (d) (5 points) Let V(0) be the time-t reserve for the death benefit for the policy. Write down the differential equation for V() and compute V0) for t = 10