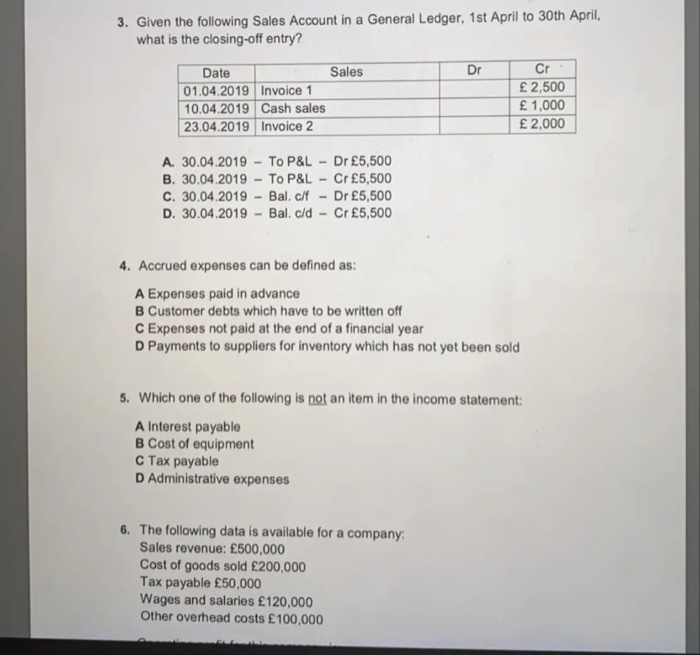

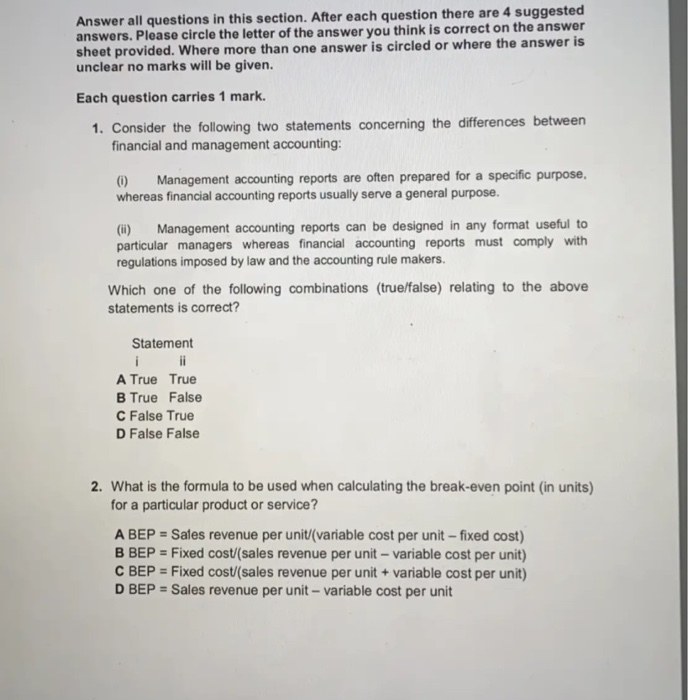

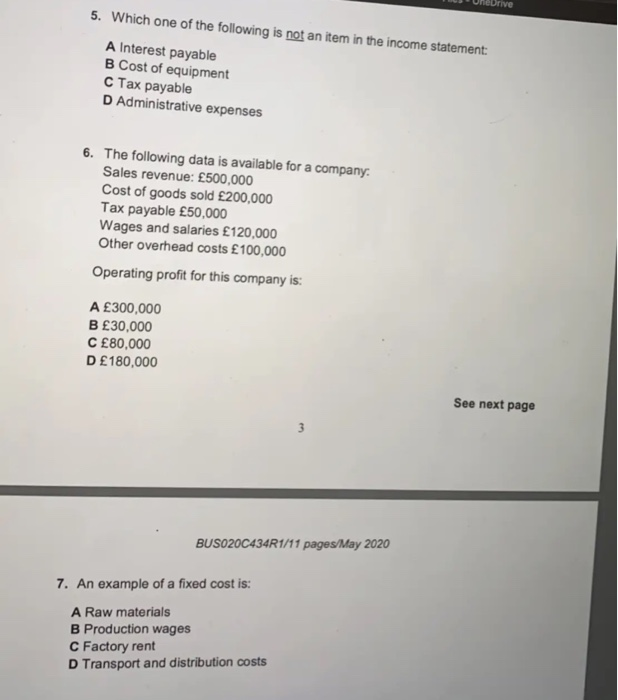

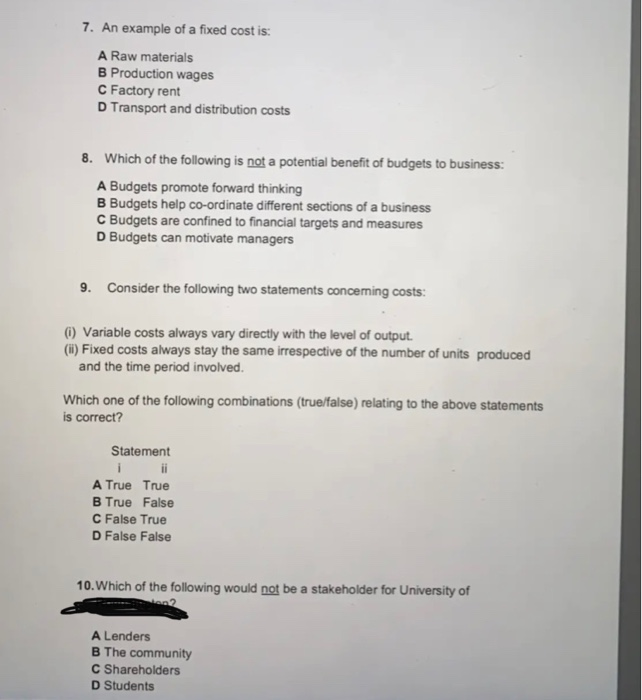

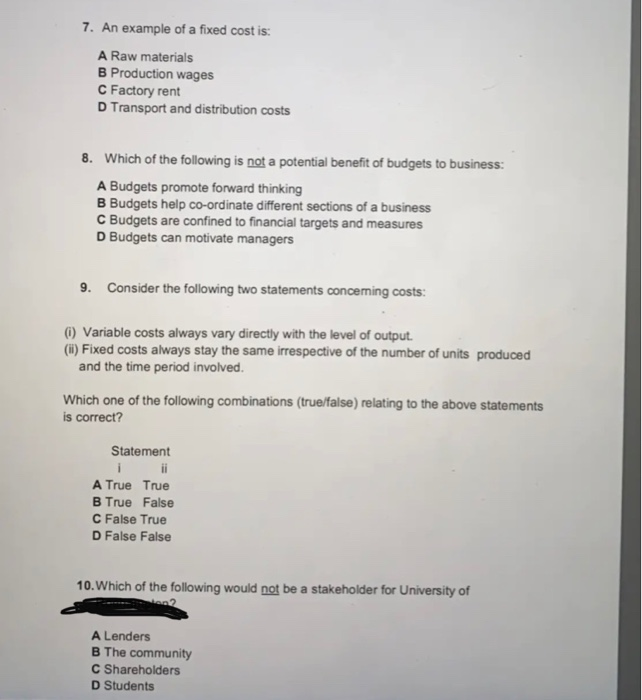

3. Given the following Sales Account in a General Ledger, 1st April to 30th April, what is the closing-off entry? Dr Date Sales 01.04.2019 Invoice 1 10.04.2019 Cash sales 23.04.2019 Invoice 2 2,500 1,000 2.000 A. 30.04.2019 - To P&L - Dr 5,500 B. 30.04.2019 - To P&L - Cr 5,500 C. 30.04.2019 - Bal. c/f - Dr 5,500 D. 30.04.2019 - Bal. c/d - Cr 5,500 4. Accrued expenses can be defined as: A Expenses paid in advance B Customer debts which have to be written off C Expenses not paid at the end of a financial year D Payments to suppliers for inventory which has not yet been sold 5. Which one of the following is not an item in the income statement: A Interest payable B Cost of equipment C Tax payable D Administrative expenses 6. The following data is available for a company: Sales revenue: 500,000 Cost of goods sold 200,000 Tax payable 50,000 Wages and salaries 120,000 Other overhead costs 100,000 Answer all questions in this section. After each question there are 4 suggested answers. Please circle the letter of the answer you think is correct on the answer sheet provided. Where more than one answer is circled or where the answer is unclear no marks will be given. Each question carries 1 mark. 1. Consider the following two statements concerning the differences between financial and management accounting: (0) Management accounting reports are often prepared for a specific purpose, whereas financial accounting reports usually serve a general purpose. (ii) Management accounting reports can be designed in any format useful to particular managers whereas financial accounting reports must comply with regulations imposed by law and the accounting rule makers. Which one of the following combinations (true/false) relating to the above statements is correct? Statement A True True B True False C False True D False False 2. What is the formula to be used when calculating the break-even point (in units) for a particular product or service? A BEP = Sales revenue per unit/(variable cost per unit - fixed cost) B BEP = Fixed cost (sales revenue per unit - variable cost per unit) C BEP = Fixed cost/(sales revenue per unit + variable cost per unit) D BEP = Sales revenue per unit - variable cost per unit rive 5. Which one of the following is not an item in the income statement: A Interest payable B Cost of equipment C Tax payable D Administrative expenses 6. The following data is available for a company. Sales revenue: 500,000 Cost of goods sold 200,000 Tax payable 50,000 Wages and salaries 120,000 Other overhead costs 100,000 Operating profit for this company is: A 300,000 B 30,000 C 80,000 D 180,000 See next page 3 BUSO20C434R1/11 pages/May 2020 7. An example of a fixed cost is: A Raw materials B Production wages C Factory rent D Transport and distribution costs 7. An example of a fixed cost is: A Raw materials B Production wages C Factory rent D Transport and distribution costs 8. Which of the following is not a potential benefit of budgets to business: A Budgets promote forward thinking B Budgets help co-ordinate different sections of a business C Budgets are confined to financial targets and measures D Budgets can motivate managers 9. Consider the following two statements concerning costs: (1) Variable costs always vary directly with the level of output. (1) Fixed costs always stay the same irrespective of the number of units produced and the time period involved. Which one of the following combinations (true/false) relating to the above statements is correct? Statement A True True B True False C False True D False False 10. Which of the following would not be a stakeholder for University of A Lenders B The community C Shareholders D Students