Question

3. If you have a $10,000 loan with a 4 year (48 month) term and 10% interest rate, what is the total interest paid over

3. If you have a $10,000 loan with a 4 year (48 month) term and 10% interest rate, what is the total interest paid over the life of the loan? This information is provided in the book, so no calculations are needed. (a) $2,172 (b) $1,272. (c) $3,114. (d) $11,272. (e) $12,172.

4. Step one in reducing debt is to cut up our credit cards and start living on a cash-only basis. Step two requires that we perform four tasks (or exercises) for one week. The following are components of these four exercises except: (a) Keep a written record of everything you spend and total it at weeks end. (b) Avoid using cash to pay for gas for your car. (c) Take $100 out of the bank and dont spend a penny more. (d) Avoid gourmet coffee shops. (e) Keep all your ATM receipts and count up the fees.

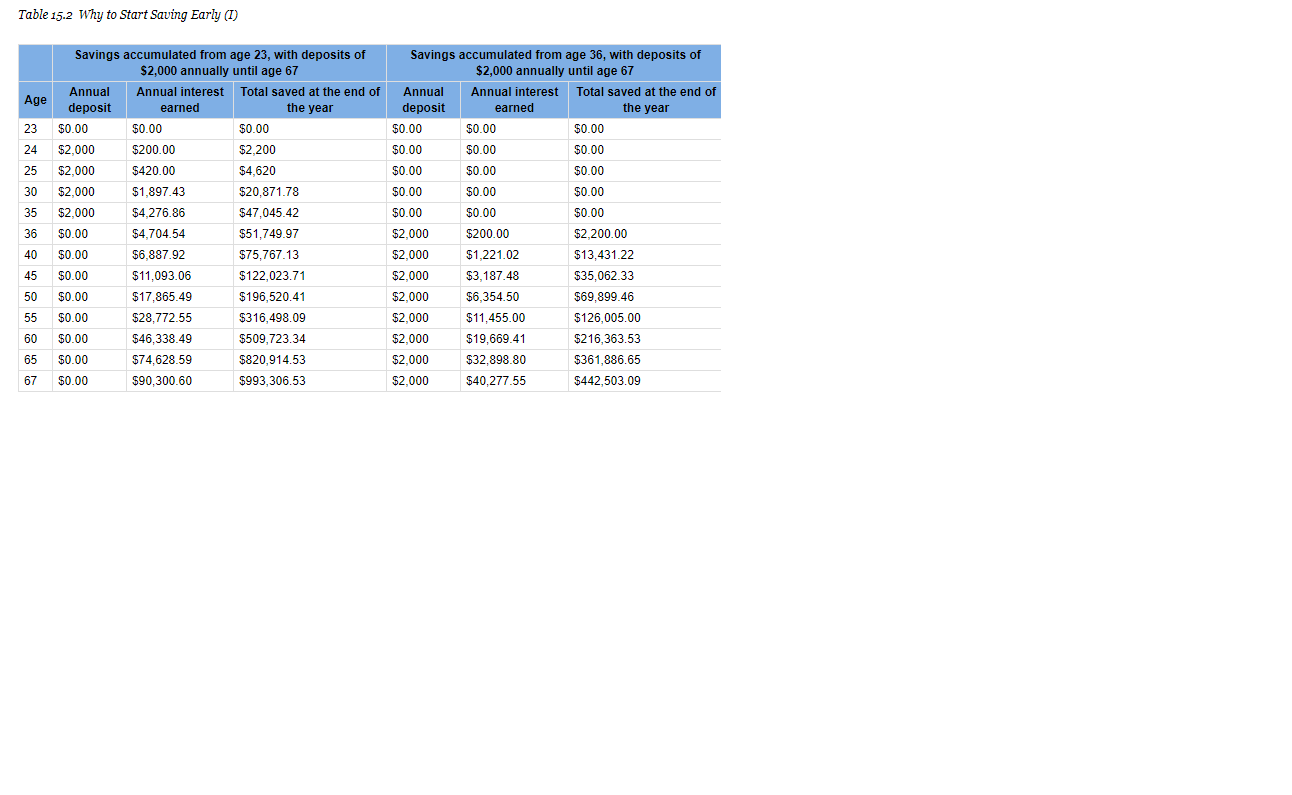

5. Financial planners recommend that we start saving as early as possible. According to Table 15.2 Why to Start Saving Early (I) dont confuse this with Figure 15.2), an annual investment of $2,000 starting at the age of 23 and ending at the age of 67 will result in total savings at age 67 of ________. (Note: The hard copy book shows Table 15.2 at the bottom of one page and the top of the next. Be sure to look at both pages to find the answer.) (a) $93,306.53 (b) $442,503.09. (c) $820,914.53. (d) $993,306.53. (e) None of the above answers are correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started