Answered step by step

Verified Expert Solution

Question

1 Approved Answer

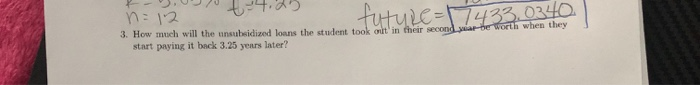

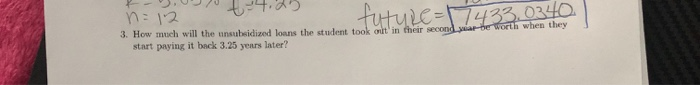

#3 please #3 says How much will the unsubsidized loans the student Took out in their second year be worse when they start paying it

#3 please

#3 says How much will the unsubsidized loans the student Took out in their second year be worse when they start paying it back in 3.25 years.

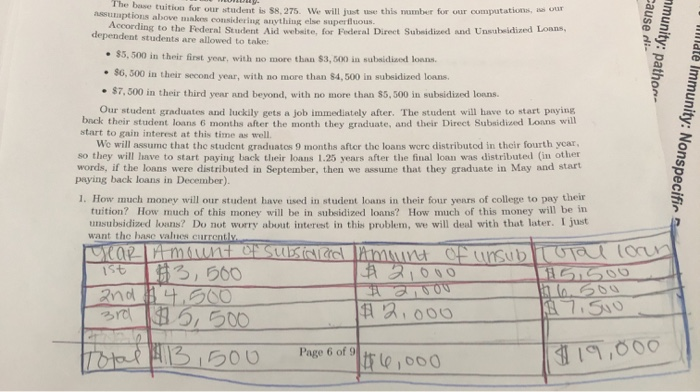

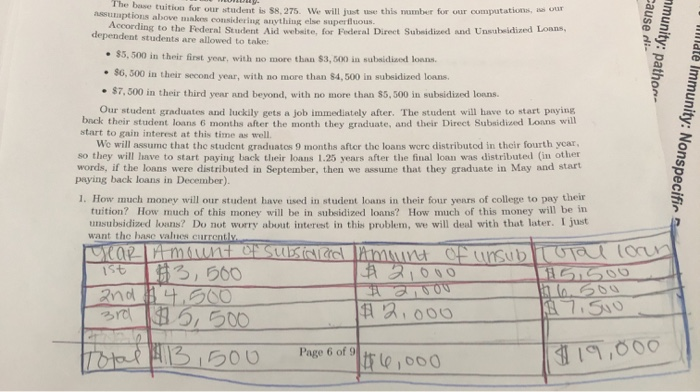

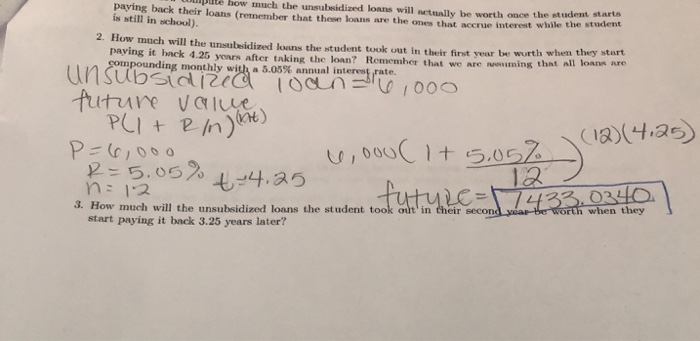

The base tuition for our student is 88,275. We will just this number for our computations, ww our assumptions above malors considering anything else superfluous. According to the Federal Student Aid website, for Federal Direct Subaidined and Unsubsidized Loans, dependent students are allowed to take $5,500 in their first year, with no more than $3,500 in subsidized loans. $6,500 in their second year, with no more than $4,500 in subsidized loans. $7,500 in their third year and beyond, with no more than $5,500 in subsidized loans. Our student graduates and luckily gets a job immediately after. The student will have to start paying back their student loans 6 months after the month they graduate, and their Direct Subsidieed Loans will start to gain interest at this time as well. We will assume that the student graduates 9 months after the loans were distributed in their fourth year, so they will have to start paying back their loans 1.25 years after the final loan was distributed (in other words, if the loans were distributed in September, then we assume that they graduate in May and start paying back loans in December). 1. How much money will our student have used in student loans in their four years of college to pay their tuition? How much of this money will be in subsidized loans? How much of this money will be in unsubsidized loans? Do not worry about interest in this problem, we will deal with that later. I just want the hand valies currently Year Amount of subsidized Amount of unsub total loan ist #3, 500 $21000 115,500 and $ 4.500 2,oou 3rd $5,500 $2,000 187.500 Total 13 1500 196,000 cause di- mmunity: pathor midte Immunity: Nonspecifir Page 6 of 9 119,000 paying back their loans (remember that these loans are the ones that accrue interest while the student how much the unsubsidized loans will actually be worth once the student starts is still in school). 2. How much will the unsubsidized loans the student took out in their first year be worth when they start paying it back 4.25 years after taking the loan? Remember that we are wiming that all loans are compounding monthly with a 5.05% annual interest rate. Unsubsidiua loan-16 1000 future value PLI+ P=66,000 R=5.05% n = 12 3. How much will the unsubsidized loans the student took out in their second year be worth when they start paying it back 3.25 years later? Rinnt) t-4.25 (12) (4:25) 4,000 1 + 5,05%) futute=12433,0340 . n=12 3. How much will the unsubsidized loans the student took out in their second ar be worth when they start paying it back 3.25 years later? future 74 7433,0340 The base tuition for our student is 88,275. We will just this number for our computations, ww our assumptions above malors considering anything else superfluous. According to the Federal Student Aid website, for Federal Direct Subaidined and Unsubsidized Loans, dependent students are allowed to take $5,500 in their first year, with no more than $3,500 in subsidized loans. $6,500 in their second year, with no more than $4,500 in subsidized loans. $7,500 in their third year and beyond, with no more than $5,500 in subsidized loans. Our student graduates and luckily gets a job immediately after. The student will have to start paying back their student loans 6 months after the month they graduate, and their Direct Subsidieed Loans will start to gain interest at this time as well. We will assume that the student graduates 9 months after the loans were distributed in their fourth year, so they will have to start paying back their loans 1.25 years after the final loan was distributed (in other words, if the loans were distributed in September, then we assume that they graduate in May and start paying back loans in December). 1. How much money will our student have used in student loans in their four years of college to pay their tuition? How much of this money will be in subsidized loans? How much of this money will be in unsubsidized loans? Do not worry about interest in this problem, we will deal with that later. I just want the hand valies currently Year Amount of subsidized Amount of unsub total loan ist #3, 500 $21000 115,500 and $ 4.500 2,oou 3rd $5,500 $2,000 187.500 Total 13 1500 196,000 cause di- mmunity: pathor midte Immunity: Nonspecifir Page 6 of 9 119,000 paying back their loans (remember that these loans are the ones that accrue interest while the student how much the unsubsidized loans will actually be worth once the student starts is still in school). 2. How much will the unsubsidized loans the student took out in their first year be worth when they start paying it back 4.25 years after taking the loan? Remember that we are wiming that all loans are compounding monthly with a 5.05% annual interest rate. Unsubsidiua loan-16 1000 future value PLI+ P=66,000 R=5.05% n = 12 3. How much will the unsubsidized loans the student took out in their second year be worth when they start paying it back 3.25 years later? Rinnt) t-4.25 (12) (4:25) 4,000 1 + 5,05%) futute=12433,0340 . n=12 3. How much will the unsubsidized loans the student took out in their second ar be worth when they start paying it back 3.25 years later? future 74 7433,0340 The column that says "unsub" means unsubsidized

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started