Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(3) Stupid Valley Bank (SVB) has reserves of $1,000, deposits of $22,000, debts of $19,000, loans of $21,000, and capital (owner's equity) of $1,000.

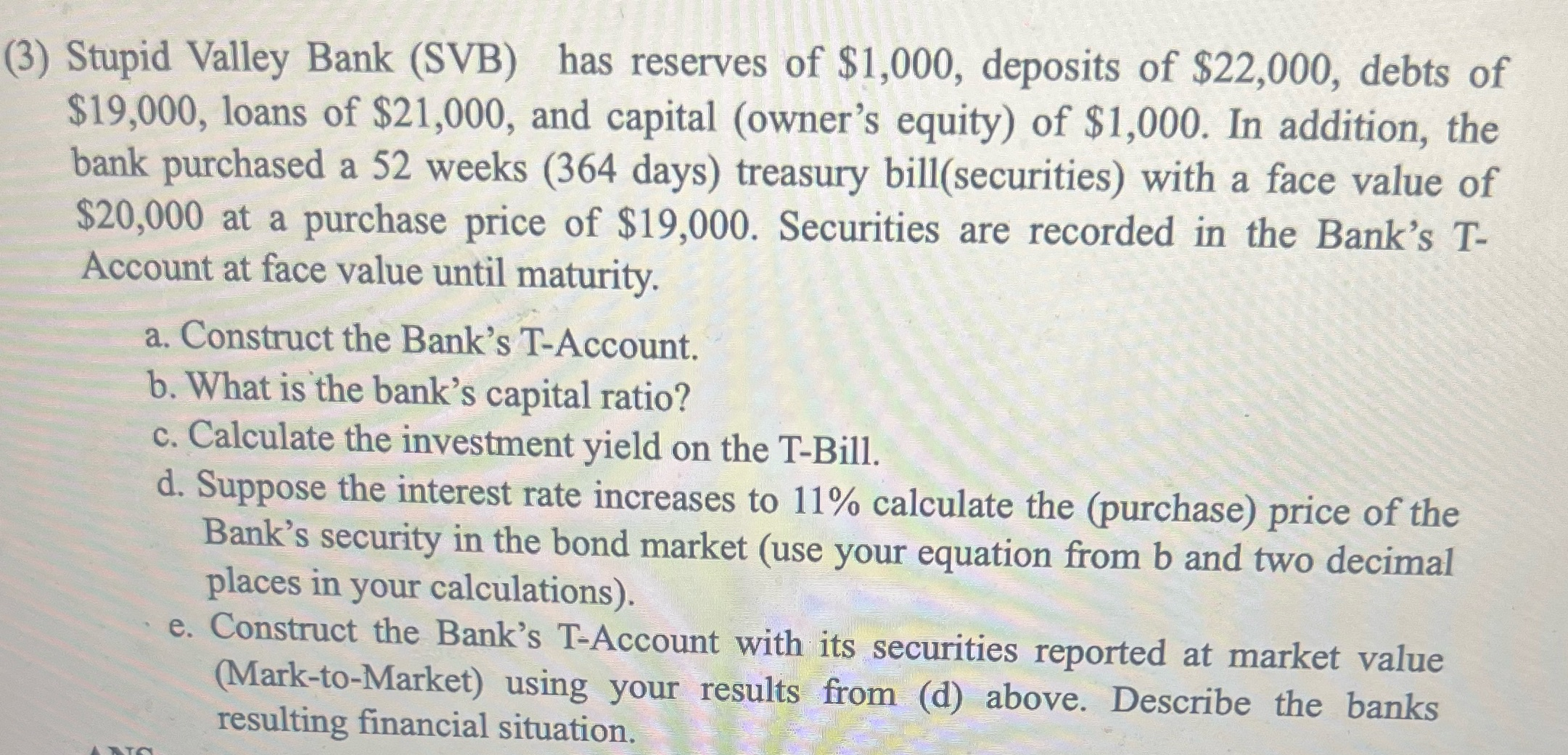

(3) Stupid Valley Bank (SVB) has reserves of $1,000, deposits of $22,000, debts of $19,000, loans of $21,000, and capital (owner's equity) of $1,000. In addition, the bank purchased a 52 weeks (364 days) treasury bill(securities) with a face value of $20,000 at a purchase price of $19,000. Securities are recorded in the Bank's T- Account at face value until maturity. a. Construct the Bank's T-Account. b. What is the bank's capital ratio? c. Calculate the investment yield on the T-Bill. d. Suppose the interest rate increases to 11% calculate the (purchase) price of the Bank's security in the bond market (use your equation from b and two decimal places in your calculations). e. Construct the Bank's T-Account with its securities reported at market value (Mark-to-Market) using your results from (d) above. Describe the banks resulting financial situation. ANO

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Banks TAccount Assets Liabilities and Equity Reserves 1000 Deposits 22000 Loans 21000 Debts 19000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started