Answered step by step

Verified Expert Solution

Question

1 Approved Answer

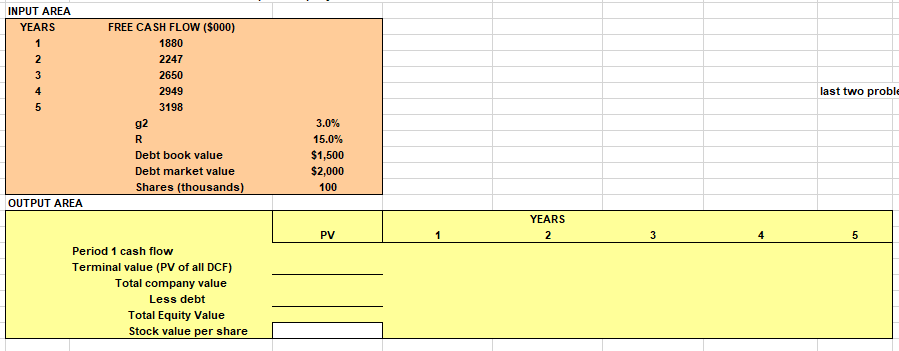

3. Super Company stock is selling for $200 per share which you believe is greatly undervalued. So you are considering making an offer for all

3. Super Company stock is selling for $200 per share which you believe is greatly undervalued. So you are considering making an offer for all of the Super stock. You have estimated Super's free cash flow for the next 5 years shown below, and you expect FCF to grow 3% per year beyond that 5 year horizon. You note that the company has $1,500,000 of outstanding debt and a required rate of return of 15%. A. Based on this information is Super Company's stock undervalued?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started