Question

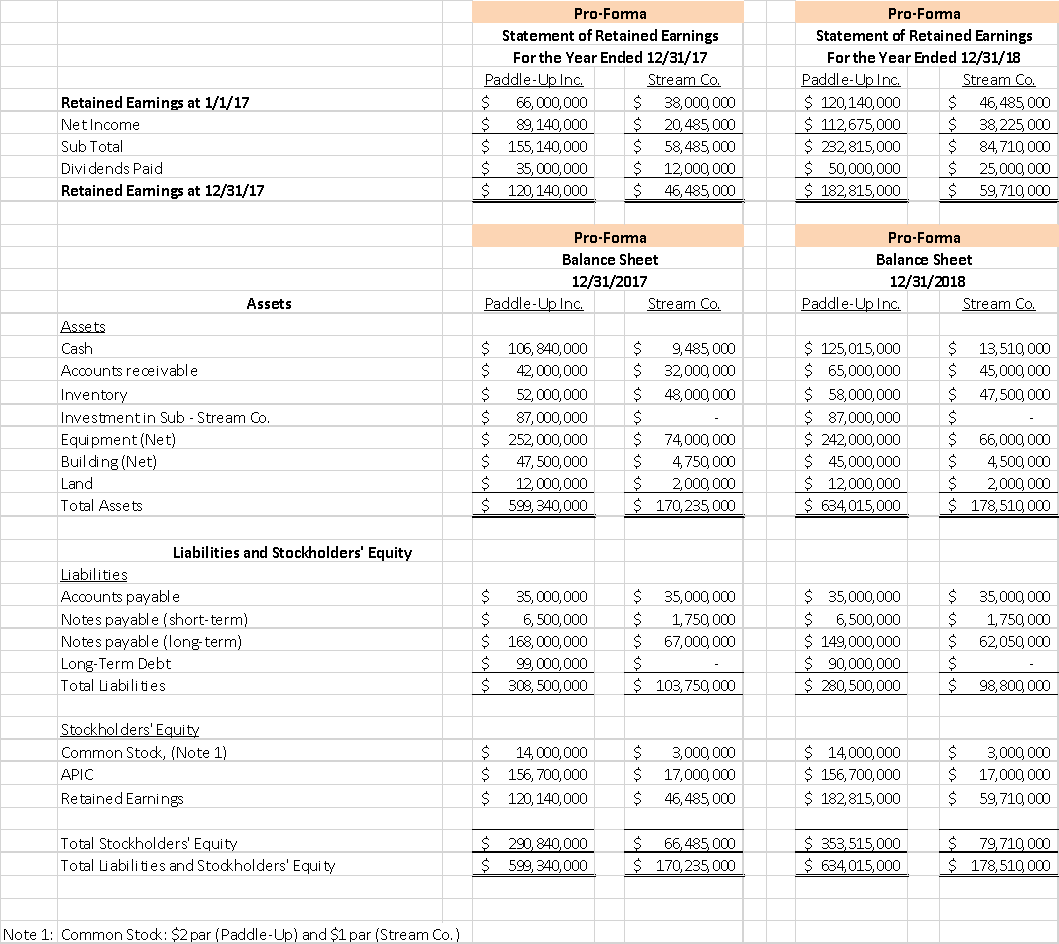

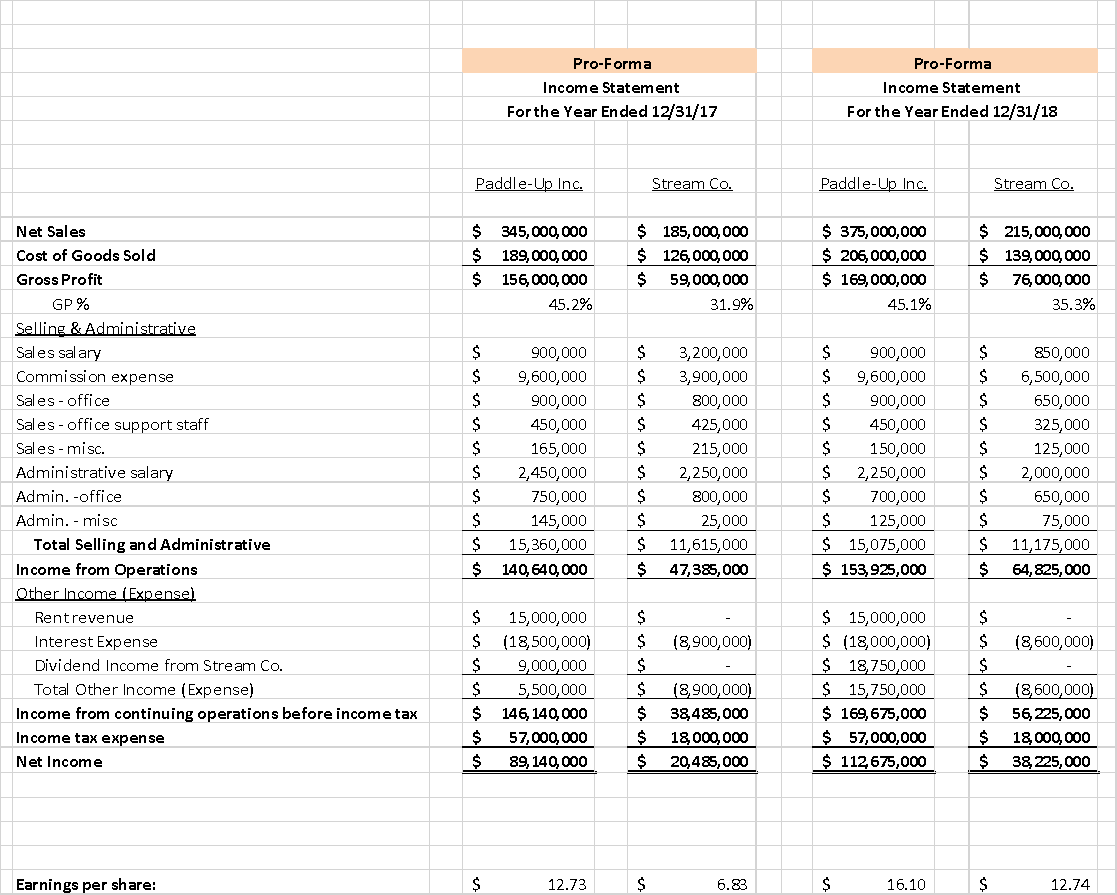

3. The Board has also requested that the accounting department provide pro-forma consolidated financial statements for the 75% stock acquisition scenario as of December 31,

3. The Board has also requested that the accounting department provide pro-forma consolidated financial statements for the 75% stock acquisition scenario as of December 31, 2017 and December 31, 2018 (using the cost method).

Income statement,

Statement of retained earnings,

Balance sheet

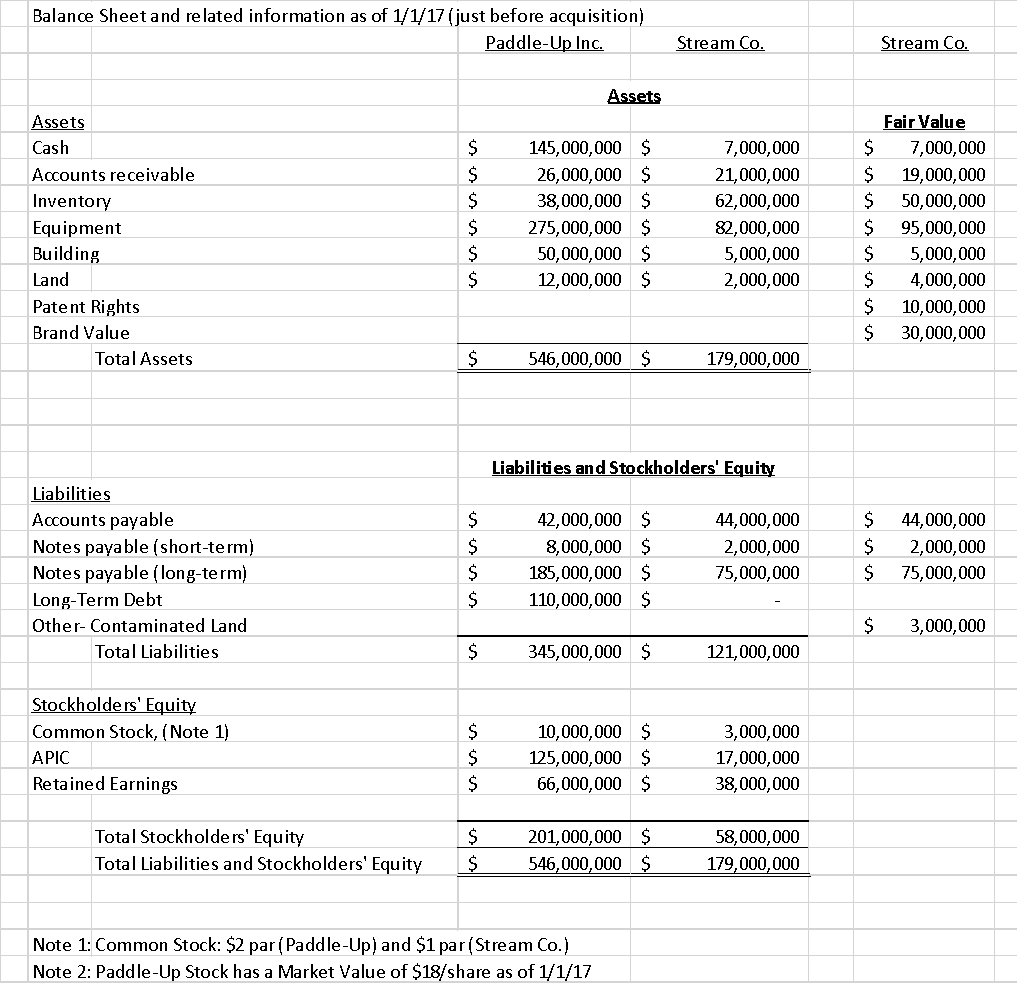

below is the balance sheet just before acquistion 1/1/17

Here is additional information:

Exhibit A The Paddle-Up acquisition team discovered during their due diligence that Stream Company did not realize the following key facts:

Stream Company management and board did not realize their patents and brands had significant value. Thus, they did not include these asset values in their own internal evaluation of the potential sale to Paddle-Up Inc.

Stream Company management and board does not fully understand that more than 25% of their employees will be let go (fired) within 6 months of the acquisition.

Stream Company management and board do not realize that their long-term customers will be faced with dramatic price increases to be implemented by Paddle-Up In

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started