Answered step by step

Verified Expert Solution

Question

1 Approved Answer

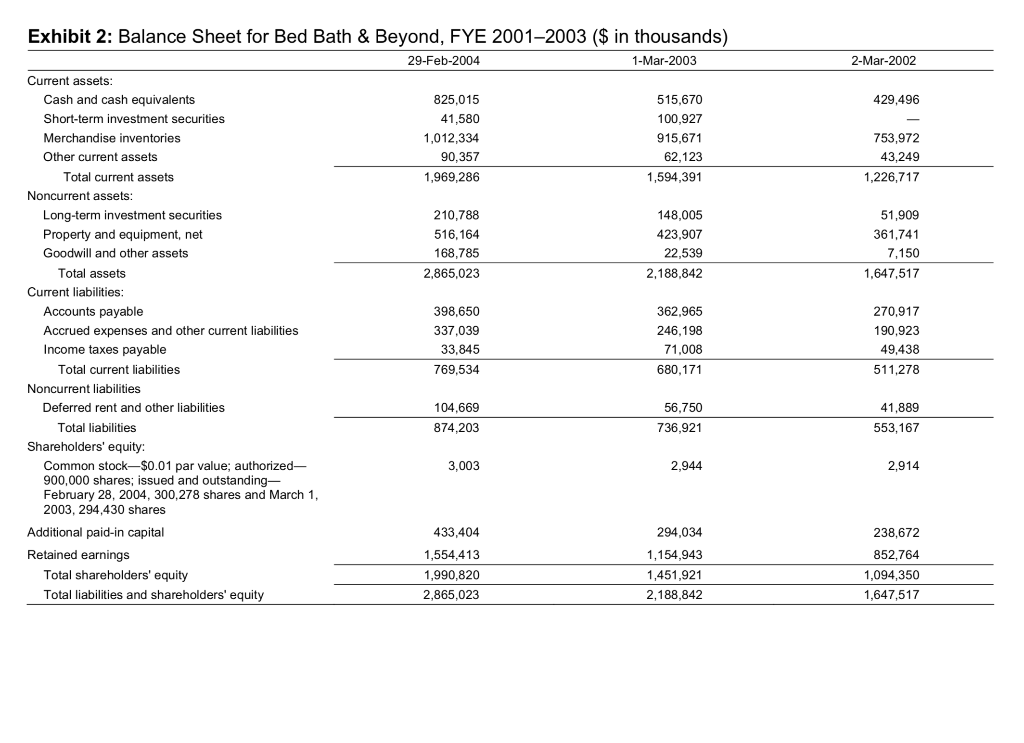

Please explain in details the calculations for the 40% and 20% debt!!! Exhibit 4: Statement of Cash Flows for Bed Bath & Beyond, FYE 2001-2003

Please explain in details the calculations for the 40% and 20% debt!!!

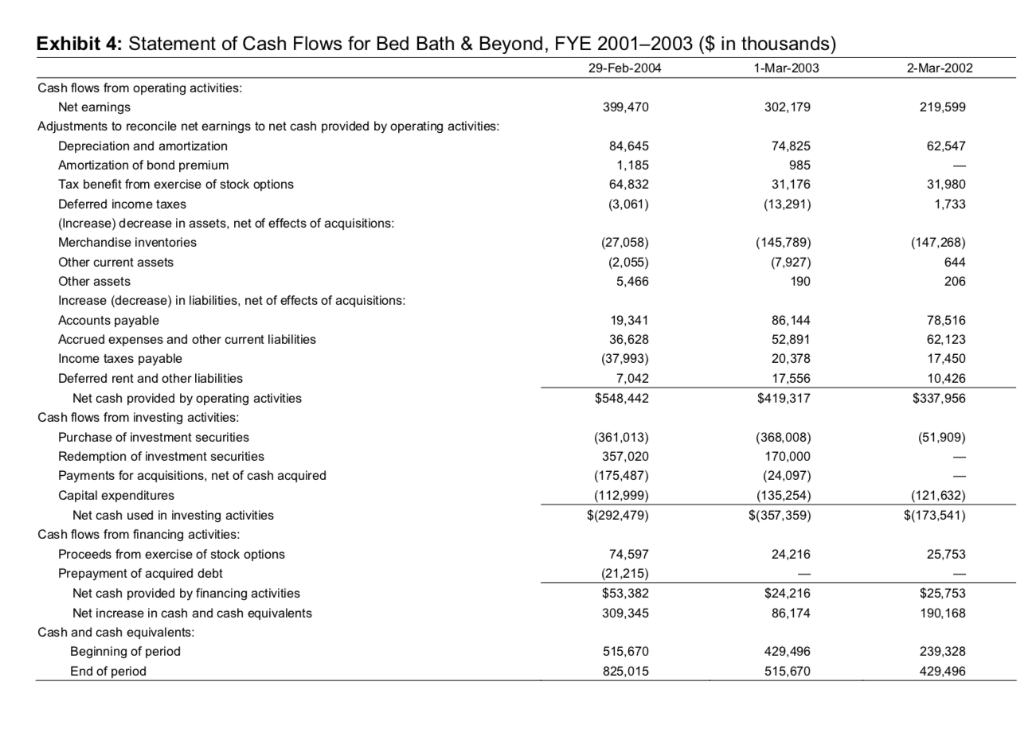

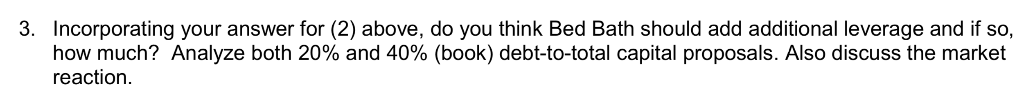

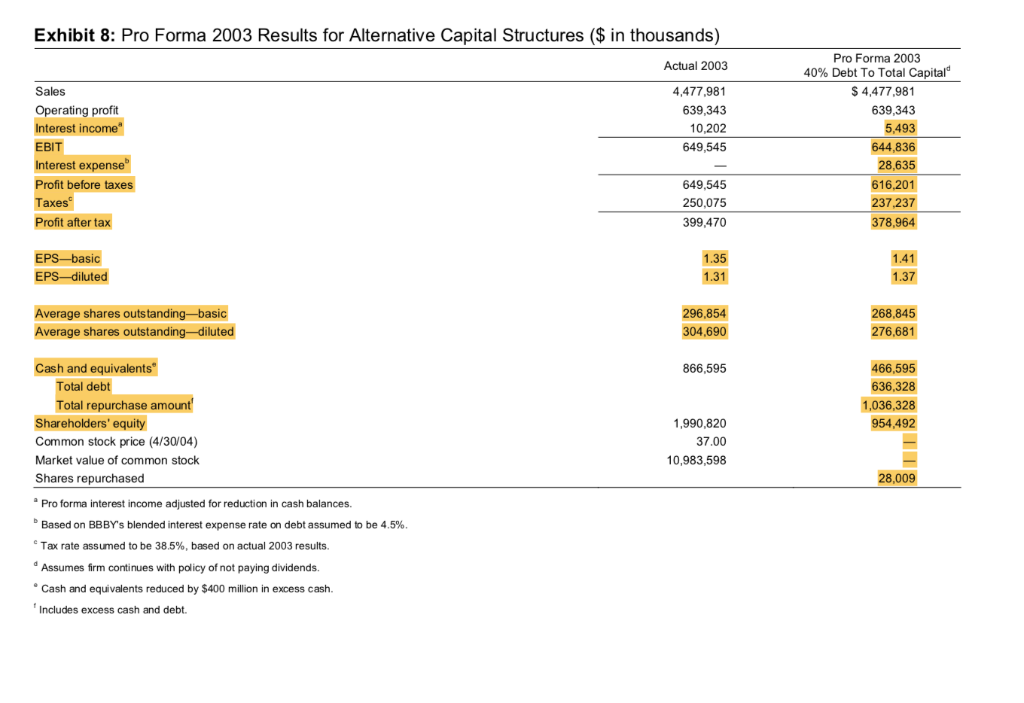

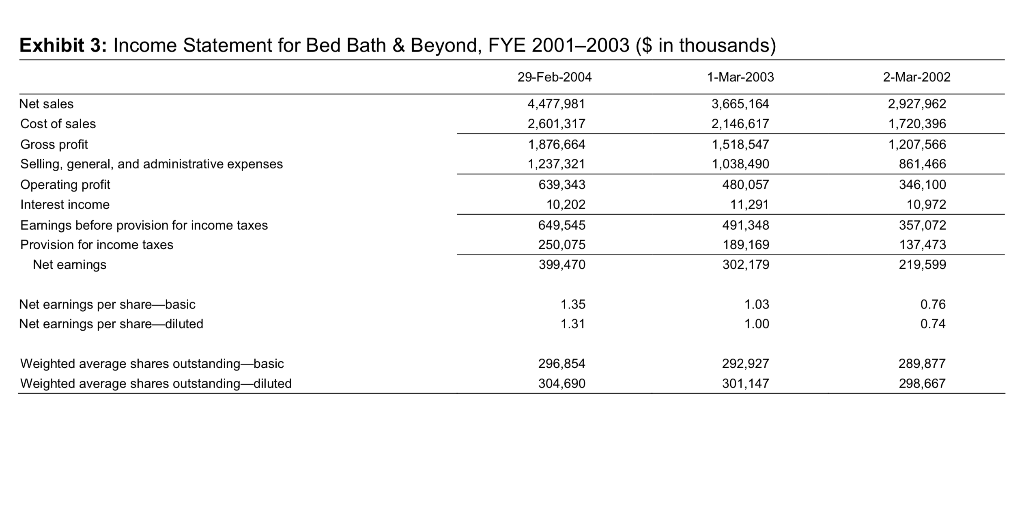

Exhibit 4: Statement of Cash Flows for Bed Bath & Beyond, FYE 2001-2003 ($ in thousands) 29-Feb-2004 1-Mar-2003 2-Mar-2002 Cash flows from operating activities: Net eamings 399,470 302,179 219,599 Adjustments to reconcile net earnings to net cash provided by operating activities 84,645 1,185 64,832 74,825 985 31,176 (13,291) Depreciation and amortization Amortization of bond premiunm Tax benefit from exercise of stock options Deferred income taxes (Increase) decrease in assets, net of effects of acquisitions Merchandise inventories Other current assets Other assets Increase (decrease) in liabilities, net of effects of acquisitions Accounts payable Accrued expenses and other current liabilities Income taxes payable Deferred rent and other liabilities 62,547 31,980 1,733 (27,058) (2,055) 5,466 (145,789) (7,927) 190 (147,268) 644 206 19,341 36,628 (37,993) 7,042 $548,442 86,144 52,891 20,378 17,556 S419,317 78,516 62,123 17,450 10,426 $337,956 Net cash provided by operating activities Cash flows from investing activities: Purchase of investment securities Redemption of investment securities Payments for acquisitions, net of cash acquired Capital expenditures (361,013) 357,020 (175,487) 112,999 $(292,479) (368,008) 170,000 (24,097) 135,254) (357,359) (51,909) (121,632) $(173,541) 25,753 $25,753 Net cash used in investing activities Cash flows from financing activities: 74,597 (21,215) $53,382 309,345 Proceeds from exercise of stock options Prepayment of acquired debt 24,216 Net cash provided by financing activities Net increase in cash and cash equivalents 24,216 86,174 190,168 Cash and cash equivalents Beginning of period End of period 429,496 515,670 239,328 515,670 825,015 429,496 Exhibit 8: Pro Forma 2003 Results for Alternative Capital Structures ( in thousands) Pro Forma 2003 Actual 2003 40% Debt To Total Capital" 4,477,981 639,343 10,202 649,545 Sales Operating profit Interest income EBIT Interest expense Profit before taxes Taxes Profit after tax S4,477,981 639,343 5,493 644,836 28,635 616,201 237,237 378,964 649,545 250,075 399.470 EPS-basic EPS-diluted 1.35 1.31 296,854 1.41 1.37 Average shares outstanding-basic Average shares outstanding-diluted 268,845 276,681 304,690 466,595 636,328 1,036,328 954,492 Cash and equivalents" 866,595 Total debt Total repurchase amount Shareholders' equity Common stock price (4/30/04) Market value of common stock Shares repurchased Pro forma interest income adjusted for reduction in cash balances. Based on BBBY's blended interest expense rate on debt assumed to be 4.5%. Tax rate assumed to be 38.5%, based on actual 2003 results. Assumes firm continues with policy of not paying dividends Cash and equivalents reduced by $400 million in excess cash. Includes excess cash and debt. 1,990,820 37.00 10,983,598 28,009 Exhibit 2: Balance Sheet for Bed Bath & Beyond, FYE 2001-2003 ($ in thousands) 29-Feb-2004 1-Mar-2003 2-Mar-2002 Current assets Cash and cash equivalents Short-term investment securities Merchandise inventories Other current assets 825,015 41,580 1,012,334 90,357 1,969,286 515,670 100,927 915,671 62,123 1,594,391 429,496 753,972 43,249 1,226,717 Total current assets Noncurrent assets: Long-term investment securities Property and equipment, net Goodwill and other assets 210,788 516,164 168,785 2,865,023 148,005 423,907 22,539 2,188,842 51,909 361,741 7,150 1,647,517 Total assets Current liabilities Accounts payable Accrued expenses and other current liabilities Income taxes payable 398,650 337,039 33,845 769,534 362,965 246,198 71,008 680,171 270,917 190,923 49,438 511,278 Total current liabilities Noncurrent liabilities 41,889 553,167 Deferred rent and other liabilities 104,669 56,750 Total liabilities 874,203 736,921 Shareholders' equity: Common stock-$0.01 par value; authorized 900,000 shares; issued and outstanding- February 28, 2004, 300,278 shares and March1 2003, 294,430 shares 3,003 2,944 2,914 Additional paid-in capital Retained earnings 433,404 1,554,413 1,990,820 2,865,023 294,034 1,154,943 1,451,921 2,188,84:2 238,672 852,764 1,094,350 1,647,517 Total shareholders' equity Total liabilities and shareholders' equity Exhibit 3: Income Statement for Bed Bath & Beyond, FYE 2001-2003 ($ in thousands) 29-Feb-2004 Net sales Cost of sales Gross profit Selling, general, and administrative expenses Operating profit Interest income Eamings before provision for income taxes Provision for income taxes 4,477,981 2,601,317 1,876,664 1,237,321 639,343 10,202 649,545 250,075 399,470 1-Mar-2003 3,665,164 2,146,617 1,518,547 1,038,490 480,057 11,291 491,348 189,169 302,179 2-Mar-2002 2,927,962 1,720,396 1,207,566 861,466 346,100 10,972 357,072 137,473 219,599 Net eamings Net earnings per share-basic Net earnings per share -diluted 1.35 1.31 1.03 1.00 0.76 0.74 Weighted average shares outstanding-basic Weighted average shares outstanding-diluted 296,854 304,690 292,927 301,147 289,877 298,667

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started