Question

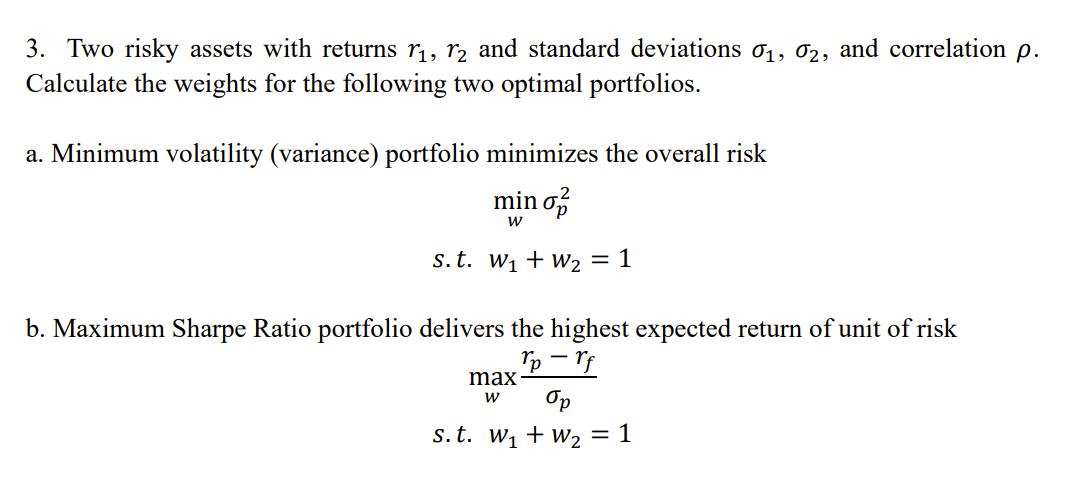

3. Two risky assets with returns 1, 2 and standard deviations 01, 02, and correlation p. Calculate the weights for the following two optimal

3. Two risky assets with returns 1, 2 and standard deviations 01, 02, and correlation p. Calculate the weights for the following two optimal portfolios. a. Minimum volatility (variance) portfolio minimizes the overall risk min o W s.t. W + W = 1 b. Maximum Sharpe Ratio portfolio delivers the highest expected return of unit of risk max W rp - rf S. t. W1 W2 = 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Heres how to calculate the weights for the two optimal portfolios given the information a Minimum Volatility Portfolio This portfolio minimizes the ov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Markets Theory Equilibrium Efficiency And Information

Authors: Emilio Barucci, Claudio Fontana

2nd Edition

1447174046, 978-1447174042

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App