Answered step by step

Verified Expert Solution

Question

1 Approved Answer

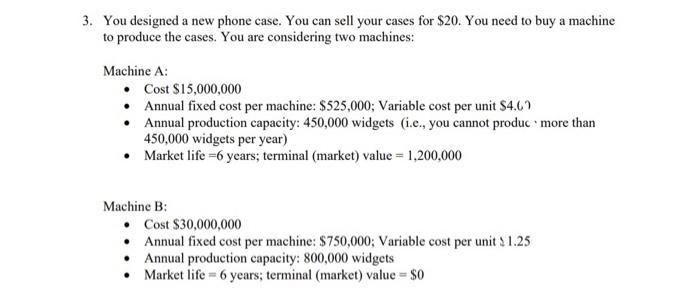

3. You designed a new phone case. You can sell your cases for $20. You need to buy a machine to produce the cases.

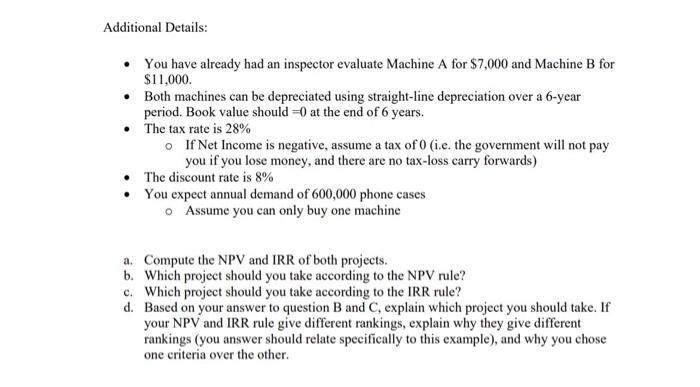

3. You designed a new phone case. You can sell your cases for $20. You need to buy a machine to produce the cases. You are considering two machines: Machine A: Cost $15,000,000 Annual fixed cost per machine: $525,000; Variable cost per unit $4.69 Annual production capacity: 450,000 widgets (i.e., you cannot produc more than 450,000 widgets per year) Market life =6 years; terminal (market) value = 1,200,000 Machine B: Cost $30,000,000 Annual fixed cost per machine: $750,000; Variable cost per unit $ 1.25 Annual production capacity: 800,000 widgets Market life = 6 years; terminal (market) value = $0 Additional Details: You have already had an inspector evaluate Machine A for $7,000 and Machine B for $11,000. Both machines can be depreciated using straight-line depreciation over a 6-year period. Book value should =0 at the end of 6 years. The tax rate is 28% o If Net Income is negative, assume a tax of 0 (i.e. the government will not pay you if you lose money, and there are no tax-loss carry forwards) The discount rate is 8% You expect annual demand of 600,000 phone cases o Assume you can only buy one machine a. Compute the NPV and IRR of both projects. b. Which project should you take according to the NPV rule? c. Which project should you take according to the IRR rule? d. Based on your answer to question B and C, explain which project you should take. If your NPV and IRR rule give different rankings, explain why they give different rankings (you answer should relate specifically to this example), and why you chose one criteria over the other.

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started