Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(30 points) Dan is an old teacher and plans to invest for retirement. He is risk averse so does not want to invest on

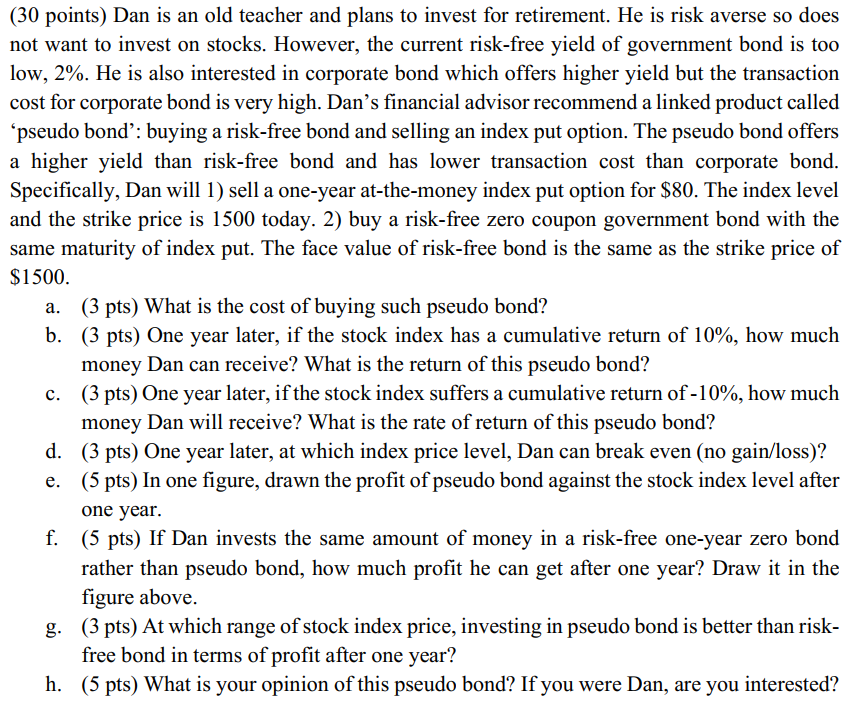

(30 points) Dan is an old teacher and plans to invest for retirement. He is risk averse so does not want to invest on stocks. However, the current risk-free yield of government bond is too low, 2%. He is also interested in corporate bond which offers higher yield but the transaction cost for corporate bond is very high. Dan's financial advisor recommend a linked product called 'pseudo bond': buying a risk-free bond and selling an index put option. The pseudo bond offers a higher yield than risk-free bond and has lower transaction cost than corporate bond. Specifically, Dan will 1) sell a one-year at-the-money index put option for $80. The index level and the strike price is 1500 today. 2) buy a risk-free zero coupon government bond with the same maturity of index put. The face value of risk-free bond is the same as the strike price of $1500. a. (3 pts) What is the cost of buying such pseudo bond? b. (3 pts) One year later, if the stock index has a cumulative return of 10%, how much money Dan can receive? What is the return of this pseudo bond? (3 pts) One year later, if the stock index suffers a cumulative return of -10%, how much money Dan will receive? What is the rate of return of this pseudo bond? d. (3 pts) One year later, at which index price level, Dan can break even (no gain/loss)? (5 pts) In one figure, drawn the profit of pseudo bond against the stock index level after one year. f. (5 pts) If Dan invests the same amount of money in a risk-free one-year zero bond rather than pseudo bond, how much profit he can get after one year? Draw it in the figure above. g. (3 pts) At which range of stock index price, investing in pseudo bond is better than risk- free bond in terms of profit after one year? h. (5 pts) What is your opinion of this pseudo bond? If you were Dan, are you interested?

Step by Step Solution

★★★★★

3.38 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Analyzing the Pseudo Bond for Dan a Cost of Pseudo Bond Price of Put Option 80 Face Value of RiskFree Bond 1500 Strike Price Therefore the cost of buy...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started