Answered step by step

Verified Expert Solution

Question

1 Approved Answer

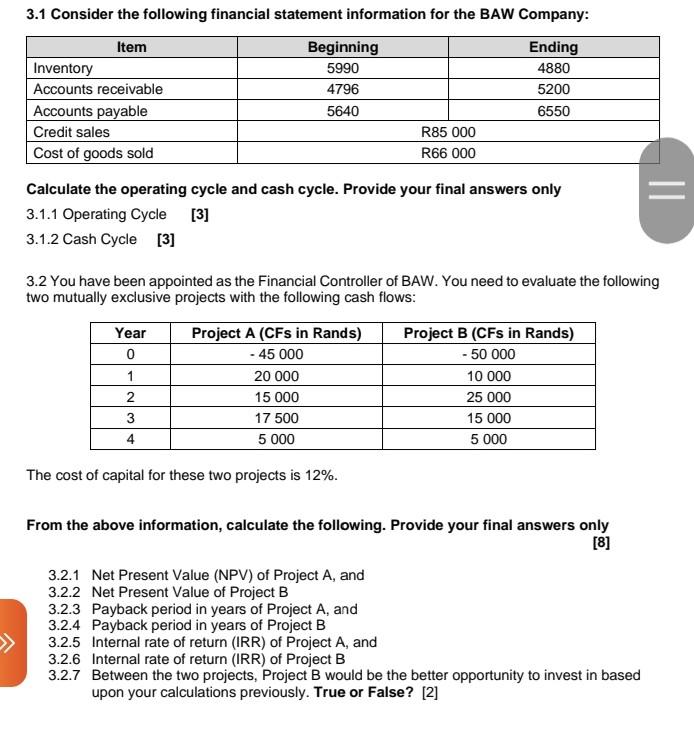

3.1 Consider the following financial statement information for the BAW Company: Item Beginning Ending Inventory 5990 4880 Accounts receivable 4796 5200 Accounts payable 5640 6550

3.1 Consider the following financial statement information for the BAW Company: Item Beginning Ending Inventory 5990 4880 Accounts receivable 4796 5200 Accounts payable 5640 6550 Credit sales R85 000 Cost of goods sold R66 000 Calculate the operating cycle and cash cycle. Provide your final answers only = 3.1.1 Operating Cycle [3] 3.1.2 Cash Cycle [3] 3.2 You have been appointed as the Financial Controller of BAW. You need to evaluate the following two mutually exclusive projects with the following cash flows: Year Project A (CFs in Rands) Project B (CFs in Rands) 0 - 45 000 - 50 000 1 20 000 10 000 2 15 000 25 000 3 17 500 15 000 4 5 000 5 000 The cost of capital for these two projects is 12%. From the above information, calculate the following. Provide your final answers only [8] 3.2.1 Net Present Value (NPV) of Project A, and 3.2.2 Net Present Value of Project B 3.2.3 Payback period in years of Project A, and 3.2.4 Payback period in years of Project B 3.2.5 Internal rate of return (IRR) of Project A, and 3.2.6 Internal rate of return (IRR) of Project B 3.2.7 Between the two projects, Project B would be the better opportunity to invest in based upon your calculations previously. True or False? [2]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started