Answered step by step

Verified Expert Solution

Question

1 Approved Answer

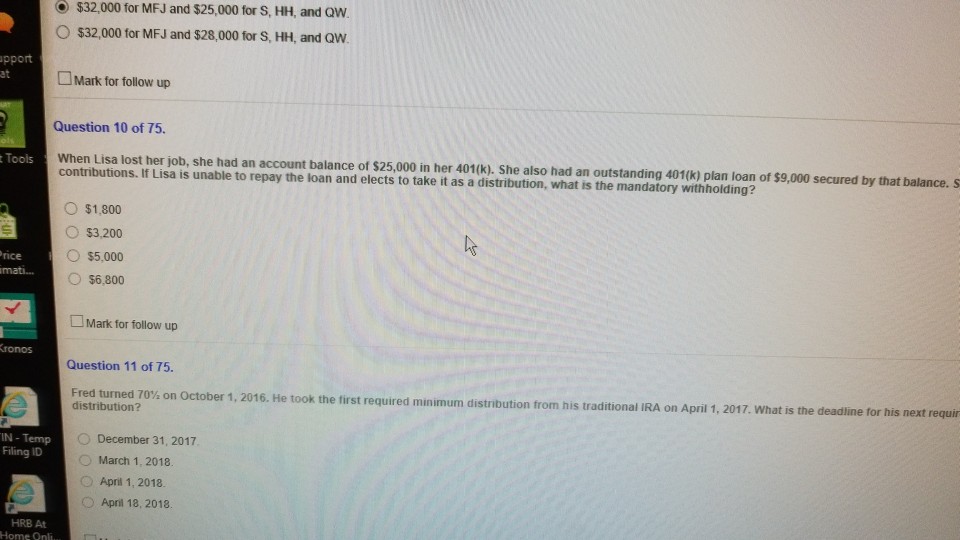

$32,000 for MFJ and $25,000 for S, HH, and Qw O $32,000 for MFJ and $28,000 for S, HH, and QW pport at Mark for

$32,000 for MFJ and $25,000 for S, HH, and Qw O $32,000 for MFJ and $28,000 for S, HH, and QW pport at Mark for follow up Question 10 of 75. Tools had an account balance of $25,000 in her 401(k). She also had an outstanding 401(k) plan loan of $9,000 secured by that balance. S contributions. If Lisa is unable to repay the loan and elects to take it as a distribution, what is the mandatory withholding? O$1,800 O $3.200 $5,000 O $6,800 rice mati... Mark for follow up ronos Question 11 of 75. distribution from his traditional IRA on April 1, 2017. What is the deadline for his next requir Fred turned70% on October 1, 2016. He took the first required min distribution? m IN Temp Filing ID O December 31, 2017. March 1, 2018. O April 1, 2018 April 18, 2018 HRB At $32,000 for MFJ and $25,000 for S, HH, and Qw O $32,000 for MFJ and $28,000 for S, HH, and QW pport at Mark for follow up Question 10 of 75. Tools had an account balance of $25,000 in her 401(k). She also had an outstanding 401(k) plan loan of $9,000 secured by that balance. S contributions. If Lisa is unable to repay the loan and elects to take it as a distribution, what is the mandatory withholding? O$1,800 O $3.200 $5,000 O $6,800 rice mati... Mark for follow up ronos Question 11 of 75. distribution from his traditional IRA on April 1, 2017. What is the deadline for his next requir Fred turned70% on October 1, 2016. He took the first required min distribution? m IN Temp Filing ID O December 31, 2017. March 1, 2018. O April 1, 2018 April 18, 2018 HRB At

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started