Answered step by step

Verified Expert Solution

Question

1 Approved Answer

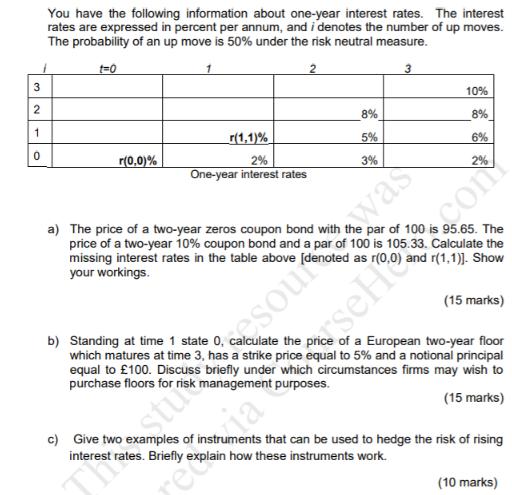

321 O 0 You have the following information about one-year interest rates. The interest rates are expressed in percent per annum, and i denotes

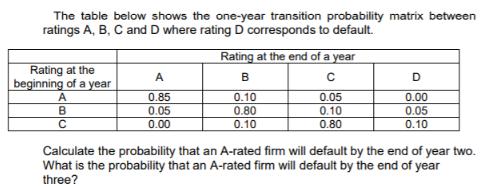

321 O 0 You have the following information about one-year interest rates. The interest rates are expressed in percent per annum, and i denotes the number of up moves. The probability of an up move is 50% under the risk neutral measure. t=0 2 3 r(0,0)% r(1.1)% 2% One-year interest rates 8% 5% 3% 10% 8% 6% a) The price of a two-year zeros coupon bond with the par of 100 is 95.65. The price of a two-year 10% coupon bond and a par of 100 is 105.33. Calculate the missing interest rates in the table above [denoted as r(0,0) and r(1,1)]. Show your workings. ecia (15 marks) seH com b) Standing at time 1 state 0, calculate the price of a European two-year floor which matures at time 3, has a strike price equal to 5% and a notional principal equal to 100. Discuss briefly under which circumstances firms may wish to purchase floors for risk management purposes. (15 marks) c) Give two examples of instruments that can be used to hedge the risk of rising how these instruments work. The stures sour was (10 marks) The table below shows the one-year transition probability matrix between ratings A, B, C and D where rating D corresponds to default. Rating at the beginning of a year A B C A 0.85 0.05 0.00 Rating at the end of a year B C 0.10 0.80 0.10 0.05 0.10 0.80 D 0.00 0.05 0.10 Calculate the probability that an A-rated firm will default by the end of year two. What is the probability that an A-rated firm will default by the end of year three?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started